ASML is a Dutch company headquartered in Veldhoven, Netherlands. Despite its birth in a wooden hut surrounded by 31 employees in 1984, ASML has risen as the most valued European technology star. ASML is the only company in the world to offer a $250 million photolithography machine that a semiconductor company needs to produce the latest generation chips. Hence, this costly machine is a must-have tool in the intense global competition of chip making. Consequentially, in the US-China chip war, the US is after constraining access to ASML’s extreme ultraviolet (EUV) lithography machine to prevent China’s rise as a high-end chip maker. Therefore, the ASML EUV machine has been caught in the USA’s trade restriction radar.

Instead of rushing to help highly valued customers, ASML was recently found scrambling to pull American engineers out of the operations of its Chinese clients. In the unfolding chip war between the USA and China, ASML’s success has become a significant victim. To comply with the US restrictions, ASML cannot export its highly acclaimed achievement—the EUV lithography machine—to its lucrative Chinese clients.

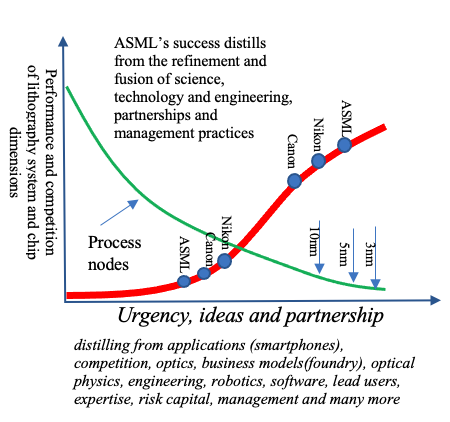

In semiconductor production, lithography is a critical step in determining the dimensions of devices. As the dimension keeps shrinking, the performance of silicon chips keeps rising, and energy dissipation and cost keep falling. Hence, there is an intense race among semiconductor firms to access the latest lithography machines. Similarly, there has been competition among the semiconductor process equipment makers to develop lithography machines to produce the next node of smaller dimensions. Through an intense and costly R&D program, ASML has succeeded in capitalizing 13.5 nm EUV to project possible smallest dimension chip features on silicon wafers. Hence, for the sub-10 nm dimension, ASML’s EUV lithography machine is the only option for global chip makers. But this magical success is no Eureka moment.

Birth of ASML—a joint venture in a wooden hut.

The parents of ASML are Dutch Philips and ASM International (ASMI). Due to persistent insistence, ASMI founder Arthur del Prado succeeded in involving Philips to give birth to ASML as a joint venture–Advanced Semiconductor Materials Lithography. The sole purpose of ASML has been to develop and commercialize lithography machines for semiconductor manufacturing.

In semiconductor success stories, the personality of individuals has played a vital role. For example, in the rise of Silicon Valley, the “traitorous eight” played a decisive role. Similarly, Dr. Morris Chang has been the underpinning for the growth of TSMC as the global best foundry service provider. Such reality raises the question, which personalities played a role in building a strong cultural foundation of ASML?

At birth, Arthur del Prado seeded the culture of pursuing missions with deep passion. In the 1950s, Prado got first-hand experience in the formation of the semiconductor industry, turning the farming land of California into Silicon Valley. He gained exposure to the infant semiconductor industry as early as 1957. He associated with a Silicon Valley merchant manufacturer of silicon crystals, Knapic Electro-Physics, in 1957. Subsequently, in 1958, he returned to Europe with a firm conviction that Transistor would keep replacing vacuumed tubes in electronics products. Hence, he inspired European electronics firms to get involved with using and producing semiconductor devices like Diode, Transistors, etc. Mr. Prado got involved in the semiconductor business with an initial offering of Knapic Electro-Physics crystals to European customers.

Subsequently, Mr. Prado established ASMI and got involved in the development of an array of semiconductor processing equipment. He also became aware of the growing role of lithography and the pertinent expertise of Philips. To leverage the synergy, in 1984, Mr. Prado convinced Philips’ board to form a joint venture, ASML, to exploit a lithography machine opportunity.

Turning childhood struggle for survival into incredible success—personalities matter

Based on the earlier work of Philips that had been in the works since the early 1970s, ASML released its first product before celebrating its first birthday. It was PAS 2000 stepper. Unfortunately, within one year of launching, the product became obsolete. Hence, ASML got into a survival struggle. Among others, three executives played a pivotal role in winning this struggle. They are (i) Steef Wittekoek, (ii) Willem Maris, and (iii) Hank Bodt.

With experience on the early wafer steppers in Philips Research, Steef Wittekoek was the first chief scientist of ASML back in 1984. In addition to upgrading PAS 2000 to PAS 2500, he was instrumental in developing a partnership with German optics company Zeiss. Subsequently, in creating ASML’s success in EUV, Zeiss’s optics and mirrors played a vital role.

Upon accepting the offer of Philips to become ASML’s CEO, Willem Maris embarked on the challenge to keep ASML afloat during the downturn of the early ’90s. With his sports background, he maintained the right balance in his management style. In addition to keeping ASML afloat during a tough time, Mr. Maris’s leadership succeeded in onboarding two important clients—Intel and IBM.

During extreme financial difficulties in the 1990s, Henk Bodt, Philips’ board member, made a last appeal to Philips CEO Jan Timmer to make one final investment in ASML. The financial lifeline of 30 million guilders led to finalize the PAS 5500. Consequentially, this product became wildly successful and launched ASML from the struggle for survival to reach the industry’s top.

The emergence of ASML as a strong lithography player

To overcome the short life span of PAS 2000, in 1986, ASML brought the PAS 2500 stepper to market. Its new alignment technology formed the foundation for many future innovations in its machines. Besides, the release of PASS 5500 in 1991 turned out to be a Breakthrough platform for ASML. On the other hand, American lithography companies could not sustain the competition, leading to their disappearance in the 1980s. As a result, the global lithography market found ASML competing with market leaders Nikon and Canon in the 1990s.

The market share of ASML in 1985 was just 15% in terms of units shipped, while Nikon and Canon had 60% and 25% shares, respectively. One reason for Nikon’s and Canon’s dominance was the high dominance of Japanese firms in the global semiconductor business. However, the situation started changing in favor of ASML the in the second half of the 1990s; during this period, ASML’s American, Korean, and Taiwanese customers like AMD, Intel, Micron, Samsung, TSMC, UMC, etc. started rapidly growing. ASML also became very responsive in increasing the shipment and enhancing lithography machines for smaller feature dimensions and higher wafer throughput. As a result, demand for their requirements for production equipment also kept accelerating, resulting in the rapid growth of ASML. Consequentially, the market share of ASML kept increasing, leading to outsold both Nikon and Canon in the number of units in 2002.

ASML’s long R&D journey to exploit EUV possibilities to emerge as global monopoly

To reach the unreachable height for all others, in 1997, ASML embarked on developing lithography machines using a 13.5nm EUV light source. In the 1960s, lithography machines used visible light sources, with wavelengths as small as 435 nm (mercury “g line”), for IC production. To reduce the feature dimension further, lithography machine innovators move to a UV light source, with a wavelength of at first 365nm (mercury “i line”), then excimer wavelengths first of 248 nm (krypton fluoride laser). Subsequently, 193 nm (argon fluoride laser), called deep UV came into use. The light source became a target. However, in the 1990s, having further chip density improvement, pressure on using smaller wavelengths started growing. Hence, the exploration of extreme ultraviolet (EUV) light sources having 13.5nm became the target for producing sub-10nm dimension chips.

Russian scientists in the early 1970s demonstrated a EUV light source. But unlike all previous light sources, EUV is extremely difficult to handle. Starting from lenses to air, everything else absorbs it. Hence, Japanese and American scientists expressed extreme pessimism about the prospect of using it for developing lithography machines. But unlike many others, ASML management took the confidence of their scientists and engineers in cognizance and decided to pursue it in 1997. This decision pushed ASML into a long, uncertain, and expensive journey, reaching the Eureka moment of releasing the first commercial EUV machine in 2019.

During the two-decade-long journey, among others, physicist Vadim Banine and engineer Erik Loopstra played a vital role in consistently building an intellectual asset base for turning faint EUV possibility into miracle success. For making radical improvements in areas such as control stability, microscopic debris mitigation, power scaling, conversion efficiency, and more, they consistently led R&D. Their team effort in continuously pushing the boundaries of technology has enabled ASML to register thousands of patents; more than 1,000 of which were attributed to Erik and Vadim.

EUV light source—reaching the limit of science, technology, and engineering

Among many other challenges, creating a light source with a wavelength of 13.5 nanometers is formidable. Although EUV light occurs naturally in outer space, to make EUV lithography possible, ASML had to develop a radical technique to generate EUV light for lithography.

In the vacuumed chamber, at 70 meters per second, a generator ejects molten tin droplets of around 25 microns in diameter. On the journey to the bottom, they are first hit by a low-intensity laser pulse, flattening them into a pancake shape. Subsequently, they are hit by a more powerful laser pulse. As a result, those pancake-shaped droplets vaporize to create a plasma that emits EUV light. To produce enough light t support commercial-grade machines, this process keeps repeating 50,000 times every second.

ASML’s emergence as the most expensive European technology company

As of November 2022, ASML’s market cap reached $241.60 Billion. In EUV segment, ASML has 100% market share. And DUP, ASML competes with Nikon and Canon. Consequentially, ASML became the world’s 35th most valuable company by market cap. It made ASML the 4th most valued European company. And among Europe’s technology companies, ASML attained the highest market capitalization.

ASML’s such attainment did not appear as a diamond-like discovery through filtering tons of ores. Instead, it grew like a pearl. Since its inception, ASML’s R&D team kept adding ideas like nanoscopic layers around a sand particle to grow a pearl. The irritation of growing means in producing lithography machines for helping chip makers to create features with decreasing dimensions has been the cause of secreting ideas and adding them layer after layer. Consequentially, 29,436 patents globally (with 15,911 active patents as of Oct 2022), numerous trade secrets, and implicit capability have produced a cumulative effect reaching the miracle performance.

Upon materializing EUV, ASML does not appear to have much room to pursue lower optical wavelengths. But there is an option of further reducing chip dimension by increasing the optical system’s numerical aperture (NA). Hence, ASML and its partners have been working on a brand-new EUV tool — the Twins can EXE:5000-series—for post-3nm nodes. It features a 0.55 NA (High-NA) lens capable of an 8nm resolution, which is projected to avoid multi-patterning at 3 nm and beyond. These High-NA scanners are still in development and are expected to be highly complex, large, and expensive. Each of them will cost over $400 million. Hence, despite reaching the wavelength limit, ASML’s journey of exploiting higher NA will keep enabling it to release successive versions of lithography machines for decreasing chip dimensions—keep making Moore’s law alive.

ASML’s global partnership in growing EUV pearl

Scientific, engineering, management, and financial complexity in realizing EUV lithography was formidable. It was beyond the reach of the in-house capacity of ASML. Hence, ASML had to form partnerships with diverse stakeholders.

In the science and engineering front, two partnerships played a vital role. For the light source, it has been American Cymer. Due to its critical importance, ASML acquired Cymer in 2012 by paying $2.5 billion. For handling the EUV light source, there was a need for highly specialized optics. ASML’s partnership with Carl Zeiss developed a particular type of highly polished mirror. In 2020, ASML bought 24.9% of ZEISS subsidiary Carl Zeiss SMT for EUR 1 billion in cash to solidify the relationship.

In addition to Cymer and Carl Zeiss, ASML’s success depends on the components and expertise of more than 5,000 suppliers (Source: Economist). For example, a Dutch company VDL makes robotic arms that feed wafers into the machine. Among them,1,200 partners as of 2020 were in a development alliance.

Furthermore, ASML needed cash to finance a long R&D journey and ensure that its journey would end in delivering the solution its key customers would be asking for. Hence, ASML management pursued the lead user customers Intel, Samsung, and Tsmc to chip in to finance its research and development in return for stakes in the firm. Back in 2012, Intel, TSMC, and Samsung each invested substantial sums resulting owning 15%, 5%, and 3% stakes in ASML, respectively. Involving lead users in EUV’s risky and costly adventure was vital in propelling ASML from a distant third against Nikon and Canon to a monopolistic technology leader & powerhouse. In the semiconductor industry. The relationships are complex and multifaceted between chip makers & customers, and tool makers. But due to interdependency, the reality is that it is vital for success.

Partnership with Zeiss—A European Joint Project for EUV

In creating the EUV success story, the Dutch company ASML is primarily responsible for the overall system design, assembling, and integration of the world’s most complex production facility. In addition to Dutch and German Governments, European funding has also flowed in as part of so-called “Joint Undertakings.” With the help of this project, ASML partner ZEISS developed the world’s most advanced fab for EUV lithography optics—playing a critical role in ASML’s success. The foundations for EUV lithography in the mid-1995s by the researchers and visionaries at ZEISS formed the basis of ASML’s launching of the EUV journey.

Because air and glass absorb EUV light, the exposure needs to occur in a vacuum; only high-precision mirrors may be used instead of optical lenses. For this job, the indispensable role is played by Zeiss’s EUV mirrors, the most accurate mirrors in the world today. The mirror is so smooth that if it’s scaled up to the size of Germany, the largest unevenness would be just a tenth of a millimeter. The preciseness of the sensors and actuators in a ZEISS projection optics work is so accurate that a reflected laser beam could hit a golf ball on the moon with pinpoint accuracy. And such success came from a systematic investigation creating a Flow of Ideas leading to more than 2,000 patents. Hence, ASML-led EUV lithography is a European success story—an example of a successful transfer between science and industry.

Global monopoly gets caught in Chip War

Due to the rising import of semiconductor devices reaching $350 billion in 2020, China has taken an aggressive plan for boosting production capacity. Furthermore, due to the growing importance of semiconductors in the modern economy, China would like to attain chip independence. On the other hand, the USA increasingly finds itself dependent on foreign suppliers, such as TSMC, for high-end chips. Hence, America considers such dependence as a national security threat. On the other hand, China’s ability to attain semiconductor self-sufficiency also poses a security and economic threat to the USA. Hence, the US congress has come up with Chips and Science acts, triggering a Chip war between the USA and China.

ASML is the sole supplier of the critical building block of producing chips using the latest nodes, such as 5nm and 3nm, so ASML’s EUV lithography machine is at the top of the US’s restriction list. To prevent China from making advanced chips using sub-10 nm dimensions, the USA has pursued Dutch Government to stop selling its lucrative machine to Chinese clients such as SMIC. However, Chinese chip makers such as SMIC (logic devices) and YMTC (memory) are presently ASML’s customers for DUV lithography machines.

But they are prospective large future customers for its most expensive EUV lithography tools. Hence, in the Chip War, ASML has become a victim of its globally acclaimed success in EUV. But ASML has also been gaining out of it as the USA, Europe, and Japan have been aggressively increasing their semiconductor production capacity. Hence, in the short run, the net befits from the chip war may turn out to be positive for ASML.

ASML faces long run imitation and Innovation challenges–risking RoI

There has not been much room for pursuing smaller wavelengths to increase chip density. Through NA enhancement, ASML has been making progress in reducing the semiconductor feature dimension using the same light source. But the R&D cost has been exponentially growing, slowing down further progression. Furthermore, due to the bar on accessing the Chinese market, the scale benefit for recovering growing R&D costs will be getting smaller than it could have been. On the other hand, China has no option other than finding an alternative to ASML’s EUV photolithography machine to meet its chip independence mission.

The likely slowdown of ASML’s progress due to exponentially growing R&D cost and technology limits, China will find longer catch-up time. On the other hand, ASML’s EUV patent portfolio will likely be eroding due to expire rate higher than that of new filling. Hence, in the long run, ASML faces a serious imitation threat. China may also succeed in developing better lithography machines using alternative technology cores like electron or ion beam scanning. Therefore, in the long run, due to US-Chia Chip War, ASML runs the risk of losing its monopoly edge in high-end lithography machines. Due to such a reality, long-term holding of ASML stock runs the risk of facing disappointing dividends and price appreciation.

Will nationalism in semiconductors produce ASML like success stories down the road?

To attain an edge in the semiconductor industry, the USA, China, India, and European Union have developed aggressive programs, including subsidies, regulations, and protection. For example, the US congress did not take much time to come up with The Chips and Science Acts, citing national security issues. The program has a massive financial outlay, reaching more than $70 billion ($52 billion + tax incentives) to subsidize capital expenditure in setting up fabs on the US soil and provide additional funding for R&D. Similar to the USA, the EU has launched Chip Act for boosting Europe’s share of global chip production capacity to 20% from its current level of about 10%. In addition EU’s $48.8 billion, individual member countries have come up with their own subsidies. Furthermore, the USA has been working with its allies to prevent China from accessing the latest chip design and making technologies, triggering a chip war.

Besides, China has been implementing a program with an investment of almost $150 billion to attain chip independence. Similarly, due to growing chip imports, India has been getting desperate to allure foreign companies to set up fabs so that India can graduate from chip taker to export. For this purpose, India has set a $10 billion subsidy pot.

Historically, success in the semiconductor industry has arrived from aggressive investment in R&D in improving processes, equipment, and chip design. Consequentially, innovation epicenters got migrated as waves. Among many others, ASML is notable. In creating such success stories, including ASML, government funding played a strong complementary role to private investment. Hence in this highly charged Geopolitical conflict, what is the possibility that massive public investment will lead to creating ASML-like pathbreaking innovations in major segments of the semiconductor industry value chain?

...welcome to join us. We are on a mission to develop an enlightened community for making the world a better place. If you like the article, you may encourage us by sharing it through social media to enlighten others.

Related articles:

- Chip War

- China’s Semiconductor Independence–prematurely caught?

- India’s Semiconductor Dream–pushed in the slow lane?

- Semiconductor Value Chain–globally distributed ecosystem

- Semiconductor IndustryWaves

- Intel Falling Due to PC and Mobile Waves

- ASML Lithography Monopoly from Sustaining Innovation

- Taiwan’s Semiconductor Monopoly – How did it arise?

- ASML TSMC Nexus Fuels Semiconductor Monopoly

- ASML Monopoly in Semiconductor — where is magic?

- SEMICONDUCTOR MONOPOLY DUE TO WINNING RACE OF IDEAS

- Semiconductor Industry Growth–personalities, new waves, and specialization underpin