In the 1970s, Malaysia was richer than Taiwan and South Korea. But South Korea and Taiwan have become more prosperous over the last four decades than Malaysia. Furthermore, while the per capita income of Taiwanese and South Koreans has been increasing, reaching a high-income level, Malaysia is caught in the middle income trap. Why could Malaysia not keep growing like those other two nations?

Every individual, firm, and nation aspire to keep increasing income levels. But only a few succeed, and the rest get caught in the growth trap. Unfortunately, the World Bank-financed growth commission could not develop a repeatable pattern for guiding a nation to keep increasing income levels. As many countries stop growing after reaching the middle-income level and have no remedy, the development community has identified it as a middle income trap.

Furthermore, upon reaching high-income status, why cannot all nations sustain their income level? For example, in the 1970s, Nauru’s (a small island nation) per capita gross domestic product (GDP) was second only to Saudi Arabia; but it has collapsed. On the other hand, upon reaching high-middle income status, why has Sri Lanka ended up in a high debt burden and financial disaster? Moreover, will countries like Bangladesh, India, Pakistan, and many other developing ones keep growing, reaching high income status? Let’s get to the basics of Wealth creation dynamics in a globally connected competitive market to shed light on these questions.

Wealth Creation Basics

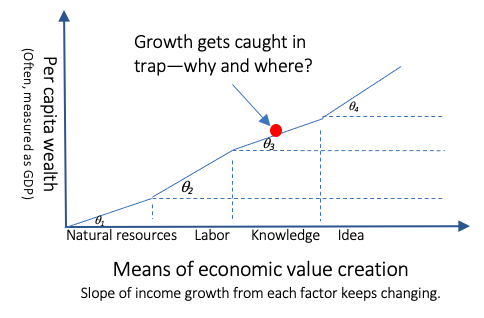

Let’s imagine the beginning of the human race’s existence on the planet. Those areas of the earth were wealthy that had readily consumable natural resources. Wealth creation begins with the extraction, trading, and consumption of natural resources. To increase the Utility and extraction of natural resources, human beings also started to gather knowledge and produce ideas creating the role of labor. Hence wealth creation depends on four major factors: (i) natural resource stock, (ii) labor, (iii) knowledge, and (iv) ideas.

Escaping middle income trap by exploiting natural resource stock is limited and transient

Creating wealth out of exploiting natural resources is the first step in increasing the income level. The per capita income through the exploitation of natural resource stock depends on (i) the number of citizens, (ii) types of stock and their volume, (iii) availabilities of technologies for extraction, (iv) barriers to reaching the market, and (v) ideas for refinement and utilization affecting the market value.

We all know countries like Saudi Arabia have reached high-income status because of natural resource exploitation. But despite possessing natural resource stock, many countries, like Saudi Arabia, were not rich 100 years ago. In the case of Saudi Arabia, despite the massive inventory of petroleum under the desert sand, there was neither market value nor the availability of technologies for discovering, developing, extracting, and refining. Furthermore, there was virtually no market for liquid petroleum products. The demand for petroleum has been growing due to the growth and diffusion of the internal combustion engine and Carl Benz’s automobile idea. Similarly, countries like Canada, Australia, and Congo have been experiencing exponential wealth extraction from their lithium and cobalt deposits. It has been due to the growth of the lithium-ion battery-based electric vehicle idea.

Transient prosperity

But income level due to natural resource extraction is transient. Along with population growth, the available stock has been depleting. Furthermore, the market value of the available stock depends on the idea of utilization. As existing dominant ideas run the risk of suffering from the Creative Destruction of Reinvention waves, the wealth creation of stock is vulnerable. For example, once the concept of renewable energy and electric vehicle reaches the inflection point, Saudi Arabia and many other nations will likely get hurt.

On the other hand, countries tend to borrow to finance infrastructure and public services based on the extrapolation of the past and current flow of wealth from natural resource stock. Sometimes, due to significant deviations in the future demand from the past, these countries get burdened with debt, weakening income status. One of the notable examples has been Nauru’s sorry economic status.

Labor exploitation is not sufficient to reach high-income status

Countries like Bangladesh do not have high per capita natural resources. Hence, these countries cannot become wealthy by exploiting natural resources. But they have a vast labor pool. Once that labor pool had very limited or no relevance to the wealth creation process. As a result, these countries were impoverished. In addition to basic amenities, they used to suffer from hunger and famine.

But the advancement of production ideas has created a demand for that unskilled labor force. It has happened due to the automation of Codified Knowledge and skill, leaving only innate abilities for humans to supply. As a result, the exploitation of labor to create wealth has opened up. Hence, these countries have been witnessing income growth by exporting unskilled labor pools and supplying work to manufacturing for export. These countries have been importing capital machinery, intermediary products, and product design to add value from local low-skilled, low-cost labor for export-oriented manufacturing.

Due to foreign currency earning from the commercialization of low-cost labor, these countries have been experiencing income growth. Furthermore, they are using it to import industrial products for consumption. As a result, their quality of living has been growing. Moreover, they have been borrowing and developing infrastructure upon showing the history and predicted future income from labor trade. Consequently, these countries have been graduating to higher income levels. Does it mean that they will keep growing, reaching high-income status?

How far these countries can reach through labor trade and borrowing for infrastructure development depends on several factors. Some of them are (i) technology affecting the market value of labor, (ii) utilization of imported infrastructure through borrowing in producing foreign currency, and (iii) the labor pool. Through this approach, they will not grow much—let alone reach high-income status.

Knowledge economy is weakening due to software-centric automation

So far, a positive correlation between education indicators and economic prosperity has been found in a few nations. Such a reality gives the impression that governments could keep increasing per capita income by investing in education. But creating economic value from knowledge demands the capacity of the economy. It does not naturally exist. Hence, countries like India and Bangladesh have been suffering from the growing unemployment of college graduates. For example, more than 80 percent of engineering graduates in India are not finding engineering jobs. Well, quality could be an issue. But quality advancement alone does not solve the problem of wealth creation out of education.

Furthermore, due to software-centric automation, creating economic value from knowledge on the production floor has been rapidly diminishing. Therefore, despite the success of the knowledge economy in a few countries, the scope of creating wealth out of knowledge has been shrinking. Hence, aspiring developing countries will not likely escape the middle income trap by investing in education.

Idea economy offers scalable growth path—offering sustainable escaping middle income trap

The idea has been at the center of creating and destroying the market value of natural resources, labor, and knowledge. For example, the concept of internal combustion engines, skyscrapers, automobiles, and many others created the demand for knowledge in designing them. But the further progression of ideas has led to software for design automation, weakening the demand for knowledge. Similarly, the idea of job division, automation, and robotics has created a demand for a low-skilled workforce. But ideas of further automation will kill that demand, making the same labor pool irrelevant. Similarly, ideas are behind the rise and fall of the market value of natural resources like petroleum, jute, and renewable energy.

Idea offers the opportunity of increasing the perceived value and reduce the cost of the products we have been producing. Ideas have been substituting the role of materials, energy, and labor in making and using many products. For example, mobile handsets are far lighter and cheaper than before because of ideas. Similarly, microwave ovens weigh far less than 750 lbs and cost far less than $5000 because of ideas. Ideas have been at the core of creating increasing wealth from the same ingredients without the facing limit. Hence, an idea economy offers a scalable and sustainable means of reaching high-income status. But the idea economy itself is dynamic due to Creative waves of destruction causing wealth accumulation and annihilation.

Furthermore, although we need knowledge and creativity to develop ideas, that is not sufficient. We need to succeed in profitably trading them as product and process features. The latter part seems to be getting increasingly complex due to the exponential growth of R&D needs and monopolization.

Develop local solid thinking, predicting, and ideating capacity

The market value of natural resources, labor, and knowledge has been continuously changing due to ideas. And those ideas are external factors, as developing countries’ economies depend on the ideas of wealthy nations. Hence, the income growth out of these three factors faces a volatile reality. Therefore, developing countries should develop the capacity to predict the future, as opposed to following the past of advanced ones. Furthermore, natural resources, labor, and knowledge-based economic value creation are limited in taking developing countries to high-income states. Hence, these countries should focus on an idea economy to escape the middle income trap. In retrospect, Taiwan, Japan, Germany, and a few others have escaped the middle income trap because of pursuing an idea economy through their own thinking, predicting, targeting, planning, and executing.

...welcome to join us. We are on a mission to develop an enlightened community for making the world a better place. If you like the article, you may encourage us by sharing it through social media to enlighten others.