Startups beacon us in creating fortune out of ideas. But more than 90 percent of startups, upon getting funding, fail to reach profit and fold up within five years. The startup journey is marked by stress, anxiety, relationship break-up, and financial bankruptcy. Despite this, we are after startups, as startup success examples are too important to ignore. With the very high failure rate, someone may perceive startup success as winning the lottery. It appears to be a magical outcome. Does it mean it’s just a random process? Is success all about luck or the magical performance of a heroic character?

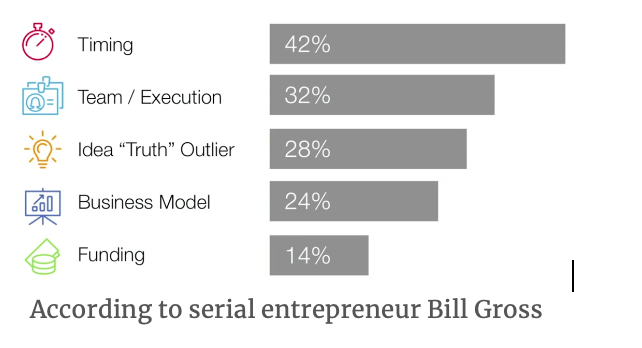

Some of the startup success factors are vision, assessment, planning, and execution. Popular tips for building successful startups are (i) start with a solid plan, (ii) network as much and as soon as possible, (iii) surround yourself with the right people, (iv) stay ahead of everyone else, and (v) maintain a balance between work and life. Besides, there are also well-publicized success factors such as (i) idea, (ii) plan—goals, KPI, strategy, and funding, (iii) team, (iv) timing, (v) market research, (vi) competition analysis, (vii) product development, (viii) business model, (ix) pricing, and (x) creating demand. Yes, they do make sense. But are they good enough to create startup success? It should have been a highly repeatable process of creating startup successes if it were the case. Unfortunately, the reality tells a different story.

A dissection of startup success stories indicates that there seem to be underlying reoccurring patterns. They give us a clue to determine startup success factors and make a prediction. Hence, it’s vital to draw a lesson from the dissection to improve our ability to manage and fund them. Let’s look into the dissection of a few startup success stories.

Dissection of startup success examples:

Tesla:

We are all surprised by the rise of Elon Musk as the world’s richest person due to the idea of an electric vehicle. In 2003, Martin Eberhard and Marc Tarpenning founded Tesla Motors in California, USA. After one year, in 2004, Elon Musk joined by investing $6.5 million. Is it due to the power of the idea alone, luck, or heroic act, Elon Musk has become the wealthiest person?

The electric vehicle idea has been to reinvent automobiles by changing the matured gasoline engine technology core with an electric battery. The value proposition has been to reduce emissions and make the air cleaner. By the way, Tesla is not the first company to pursue this idea. At the dawn of the 20th century, gasoline and electric vehicles competed. But gasoline vehicles outperformed their counterpart due to cost and performance. For example, Ford’s mass-produced Model T was a far better alternative to an electric vehicle. In 1912, the electric roadster sold for $1,750 was almost three times more expensive than the gasoline car, which cost only $650. On the other hand, gasoline engine performance kept improving faster than an electric battery, resulting in the dominance of gasoline vehicles.

During the last 100 years, innovators embarked on multiple attempts to pursue electric vehicles. Notable ones are General Motors’ electric vehicle demonstration in 1973, the test use of electric vehicles by the United States Postal Service in 1975, and defunct Israeli startup better place’s battery swap-based electric vehicle.

The electric vehicle idea is not new. Besides, from 2010 to 2019, Tesla’s stock price did not show any sign of success out of Elon Musk’s heroic act. The sudden rise in share price showing the Tesla startup success is due to the continued increase in battery performance, reaching a near inflection point.

Amazon online Bookstore:

In 1995, from the garage of Bezos’ rented home in Bellevue, Washington, Amazon rolled out the idea of an online bookseller, selling books over the world wide web. Upon looking at the online book catalog, customers used to place an order. Amazon used to pick, pack and mail those books, resulting in additional costs. But customers were not willing to pay an extra charge. Hence, Amazon’s online Bookstore was at a loss from day one. Yes, sales picked up to $20,000/week within two months, and so did the loss. Hence, Amazon exhausted Bezos’ parents’ investment of almost $250,000 in the start-up very quickly.

Yes, Amazon has turned that loss-making online Bookstore into profit. But is it due to keep giving subsidies for picking, packing, and mailing? For sure, NO. To turn the loss into profit through cost reduction and quality improvement, Amazon embarked on R&D of digitizing books and innovating the book reader Kindle. As a result, Amazon got rid of the cost of printing, paper, ink, binding, warehousing, picking, packing, and mailing. Such advancement led to significant cost reduction, making eBooks a cheaper alternative.

On the other hand, customers found it a better alternative for getting instant access to books instead of waiting for days to get the delivery over the mail. Furthermore, the availability of smartphones and tablets with large high-resolution screens also made access easier. Hence, neither the idea nor the luck created a profitable online Book retailing business. In the absence of an additional Flow of Ideas out of R&D, the initial online book retailing idea could have ended the journey by burning the money and time of Mr. Bezos.

Microsoft:

We all hail the idea of Microsoft as a great startup success. But, in 1975, it did not emerge like this. For sure, the programming skills of Bill Gates and Paul Allen and the idea of writing an interpreter of BASIC programming language for the Altair 8800 microcomputer were not sufficient for turning that little startup into a mega success story. Its success is rooted in the mistake made by IBM managers in selecting an outsourced operating system for its newly designed personal computer.

Interestingly, Microsoft did not develop it. Upon getting a royalty contract from IBM in 1980, Microsoft sourced a CP/M clone called 86-DOS from Seattle Computer Products, repackaged it, and gave it the name of Microsoft Disk Operating System (MS-DOS). With the rise of the sale of IBM PC, Microsoft’s royalty from the MS-DOS kept linearly growing. Furthermore, due to the amenability of the progression of underlying Intel’s Microprocessor, the performance and popularity of IBM PC kept increasing. On the other hand, the migration of text-based user interface to graphical user interface-based Windows led to the exponential growth of applications and acceptability, and so did the royalty revenue from the OS.

To accentuate the scale advantage of OS revenue, Microsoft embarked on deriving scope and externality advantages through the development of applications like Word Processor and Spreadsheets. Subsequently, Microsoft became a success story. Hence, the amenability of technology progression and innovations for leveraging it out of Economies of Scale, scope, and externalities have been at the root of turning an embryonic idea into a mega-success story. By the way, we should not underestimate the decision-making failure of IBM managers. If IBM had not taken the decision to outsource OS for PCs, the success pathway of Microsoft could have been quite different. Similarly, the rise of Intel appears due to IBM’s decision to use Intel’s processor instead of designing and making it by itself.

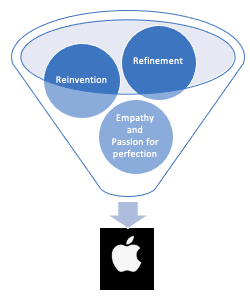

Apple:

Apple’s success is attributed to Steve Jobs’ magical character. But Apple I in a wooden box released in 1976 did not show up with many supernatural powers. Indeed, by selling 175 of the 200 units for $666.66 apiece and destroying the rest, Apple did not show the magical performance of Steve Jobs. Hence, the idea and supernatural character did not mark the journey of the astronomical rise of Apple from the Garage.

The path-breaking success for Apple came from Xerox’s decision not to pursue GUI-based Xerox Alto and to give away the technology to anybody interested. For sure, Steve deserves credit for picking it up and reinventing the personal computer with GUI GUI-based user interface. But the debut of Apple’s Macintosh with GUI in 1984 was not a magical success either; it was too slow. The solution came from Motorola, not from Apple, though. Continued progression of the underlying microprocessor kept unveiling the latent potential of GUI, making Macintosh a big success. Along with the rise in the sale of Macintosh, Apple found an astronomical growth path. But that success kept declining, reaching almost an end by 1997.

Apple found its 2nd life due to the reinvention of the portable music player as the iPod and the smartphone as the iPhone. None of these devices Apple invented. These successes were created by the reinvention of existing products. Hence, to be a magical performer, startups should not always look for Breakthrough ideas. Even ideas thrown out by others could be refined and repackaged to create mega-startup success. It does not also demand inventions. Like Apple, most startup successes are the outcome of the reinvention of existing products.

Netflix:

Netflix is a success story in video streaming. But Netflix was not a pioneer in pursuing this idea. Its precursor is a video on demand, which came into existence before the birth of Netflix in 1997. In fact, many of the startups pursuing video on demand during the .com era got bankrupt, turning it into a bad idea. But how did it bring fortune to Netflix? The success of Netflix’s streaming success came from changing video viewing habits, the availability of smartphones and smart TVs, and broadband internet penetration. Hence, externalities and timing highly matter to the success of startups. Therefore, the timing for synchronization for leveraging externalities matters to startup successes.

Sony:

Sony’s idea of repairing radios did not create today’s Sony. Soon after the invention of the Transistor by American Bell labs, Sony management realized its latent potential. Their background in science and solid-state physics created an x-ray vision to see through the fog. Sony’s management detected the latent potential of the transistor to support the reinvention of radio, television, and many other consumer electronics products. Hence, although American electronics giants like RCA showed a lukewarm response, Sony became desperate to take the license of the transistor. Instead of just producing it, Sony embarked on R&D for its refinement, making it increasingly suitable for reinventing Radio and TV, by making them cheaper and better. This journey of reinvention of existing products out of replacement of mature technology core with emerging one has turned a 10-people radio repairing shop, operating in a war-ravaged shopping place, into a mega success story.

The amenability of the progression of transistor technology core and Sony’s decision to keep improving through R&D played a vital role in making Sony a success. Hence, access to technology and a great idea is not enough.

Google:

Larry Page and Sergey Brin are not the first to come up with the idea of a search engine. Instead, Yahoo was the first to offer popular search engines on the web. Soon after its founding in 1994, to allow users to search Yahoo! Directory, a search function came into existence in 1995. A number of search engines such as Magellan, Excite, Infoseek, Inktomi, Northern Light, and AltaVista quickly followed. Google’s idea of a subscription model for search engines did not create success. Instead, a three-party business model out of digital ads opened an exponential growth path for Google out of search engine. Hence, business model Innovation also matters in creating startup successes out of technology possibilities.

Infosys:

For sure, Infosys is a big startup success. Its 276,000+ employees, $13 billion revenue, and $2.3 billion net profit are encouraging enough for Indian youths to jump into the mission of a startup. However, Infosys did not show up as a great idea. In 1981, Infosys came into existence to offer customized software applications. Despite its ability to develop software, the company was struggling to survive, leading to searching for options to close down. The underlying cause of poor health was high cost, poor quality, low profit, and diseconomy of scale.

The scalable growth path of Infosys came out not due to the magical idea of innovating software. Instead, success came due to the fact of not making software. Due to the growth of telecommunication and the rapid proliferation of PC and Y2K issues, there was a surge in demand for computer programmers in corporate America. It opened the business model of training fresh graduates with technology skills and placing them to do programming work for American clients. Once Infosys focused on leveraging this model, a scalable growth path opened up. As a result, both the headcount and revenue of Infosys kept growing linearly.

Underlying patterns of startup success:

A dissection of the above examples reveals that many of them did not have great ideas. For example, ideas of Apple I or Infosys’ customized application development did not bring fortune. Similarly, many of the commonly cited factors did not create dissected startup successes. Instead, this exercise reveals the following insights of startup successes:

- The underlying technology core should be scalable to keep increasing the quality and reducing the cost–not always scalable enough

- Irrespective of the greatness of ideas, startups should pursue R&D to create a flow of ideas—including business model innovation–for taking economic advantage of scale and scope.

- Externality factors matter—hence, timing and synchronization deserve attention.

- Decision-making failures of incumbent firms open the startup success doors.

- As opposed to the invention, reinvention of existing products, often from borrowed ideas, creates startup success.

- Speed and persistence in the race of refinement of technology and product features are at the core of startup success.

- Startup success emerges from winning the race to make products better and cheaper, leading to price-setting capability and monopolization.

In all these seven areas, there is a high degree of uncertainty. Hence, the textbook approach to entrepreneurship and doing well in conventional success factors do not suceed in creating startup successes. As a result, the startup journey suffers from high-level uncertainty.