Idea is about opinion or expression in organizing inputs to get jobs done. Due to ideas, population and per capita gross domestic product (GDP) have been growing rapidly and simultaneously over the last 300 years. As we get our jobs done increasingly better, our living standard has been increasing. The role of ideas in Wealth creation is paramount. Despite this, there has been a growing dissatisfaction with pursuing ideas. Hence, the importance of how ideas are being formed, grown, and diffused has been growing. Here is a snapshot of 12 dimensions of idea formation, evolution, and diffusion–transforming products, jobs, businesses, and prosperity.

1. Idea and wealth creation:

Except air, rainwater, and fruits, more or less, nothing on this planet in raw form is consumable by human beings. Despite this reality, we have been deriving increasing benefits from natural resources. At the root of it is the idea. Due to the growing Flow of Ideas, we have been deriving increasing benefits or creating growing wealth from the same units of natural resources. Hence, wealth creation out of idea flow for mixing inputs in a better way is at the root of the growing quality of living standard. Besides, although labor is an essential input, in the absence of an idea, mere labor in mixing inputs is useless—let alone creating additional value, Utility, or wealth. To articulate this wealth creation phenomenon, Paul Romer has developed a Nobel Prize-winning theory: ideas (A) and objects (X): (Y=F(A, X).

However, considering idea as an endogenous factor, one tends to believe there has been a natural correlation between idea production and economic growth. Hence, there could be a temptation to increase the R&D budget, thinking that it will drive economic growth. Unfortunately, reality offers different lessons. It’s worth mentioning that 94 percent of patents are never used.

Economic output depends on mixing inputs like materials, energy, and labor according to ideas. The difference between the cost of inputs and the perceived value of the output is the wealth created by ideas, offering the recipe for mixing those inputs. We can derive more economic value from all other inputs by improving ideas. Hence, despite the limited reserve of natural resources and labor supply, our wealth creation capability is limitless due to the possibility of creating endless ideas from boundless knowledge flow, creativity, and urgency of Getting jobs done better. Despite this, the human race has been suffering from basic necessities, sustainability, and growing inequality. The underlying cause has been the failure to produce and leverage ideas and democratize idea-based wealth creation capability across individuals, firms, and nations.

2. Genesis of idea creation:

Like all other living creatures, humans must get numerous Jobs done. Some of them are to meet hunger, quench thirst, get a place to reside, feel comfortable during winter, summer, and rainy days, communicate with others, and move from one place to another. However, unlike other living creatures, humans have an inherent urgency to get jobs done better. Besides, such an urgency is endless. They do not remain content with getting jobs done in a certain way for long. Hence, they have been after new ideas—an endless flow of ideas.

Carl Marx noticed this inherent urgency of human beings in ancient philosophical writings, known as praxis. To meet this urgency, human beings have been blessed with the ability to gather knowledge about the surroundings and the nature of jobs and create ideas by feeding that knowledge to innate creative capability. Besides, humans have been blessed with numerous natural abilities to apply better ideas in mixing inputs.

3. Idea diffusion:

Despite the importance of ideas in getting jobs done better and, consequently, creating more wealth, ideas do not instantly diffuse in society. Some people are more receptive to new ideas than others. There appear to be three critical factors affecting idea diffusion—(i) non-consumption, (ii) risk management, absorption ability, and communication barrier, and (iii) customer groups’ specific varying economic benefits. Some people face jobs that they cannot perform with existing ideas. Hence, their desperation makes them respond to new ideas far earlier than others. Professor Clayton Christenson termed them as a non-consumption segment. The next attribute is risk management and absorption capability.

Often, ideas emerge with an inherent risk of failure in getting jobs done. Not every group of customers has the same capability to manage risk and absorb the loss caused by the failure of ideas. In articulating Innovation diffusion theory, Prof. Rogers identified target users as the innovator segment with the highest risk management and absorption capacity. Communication channels and barriers changing perceptions about risk and reward derived by the previous adopters about new ideas also play an essential role in idea diffusion.

As not all adopters enjoy the same economic benefit from the deployment of new ideas in getting similar jobs done, not all users performing the same job will absorb a proven idea instantly. Besides, the situation of getting jobs done varies, raising the issue of suitability. However, due to incremental progression making them more suitable and costing increasingly less, a growing number of customers keep adopting new ideas. In the end, cost-benefit analysis determines the adoption decision for innovation. Besides, policies and regulations also affect idea diffusion.

4. Growing inequality due to idea diffusion:

Ideas are at the core of wealth creation. Unfortunately, ideas have been driving inequality. As ideas improve the quality and reduce the cost simultaneously, the race of idea advancement and diffusion leads to attaining market power accumulation, resulting in equality between firms. Furthermore, as ideas migrate across the boundaries of nations, despite an initial gain in labor and natural resource market value, idea-receiving or importing countries find a decreasing scope of creating profitable opportunities for their local idea production.

Besides, in the long run, scaling up imported ideas reduces local labor’s market value and the loss of grassroots innovations. In many cases, due to the flow of alternative ideas, natural source exporting countries also find the value of their commodities decreasing. On the other hand, due to endless scalability and nonrivalry nature, idea-exporting firms and nations find endless growth and per-capita income. Consequentially, there has been a growing concentration of wealth and rising inequality between nations.

5. Idea import dependence creates a growth trap:

There is a saying that does not reinvent the wheel. Ironically, wheels have been evolving. Including Nobel Laureate Paul Romer, high-profile economists are after advising less developed countries to import ideas. Ironically, Governments of less developed countries are also after importing proven ideas. The objective is to create a market for their labor and natural resources by replicating foreign products with imported capital machinery, whether for export-oriented manufacturing or import substitution purposes. To implement such advice, less developed countries borrow from foreign sources to advance infrastructure by importing ideas.

Despite initial progress, due to the growing role of labor-saving ideas and the decreasing role of local natural resources, economic value creation from local labor and raw materials reaches saturation. Besides, investment in education fails to create economic value as imported ideas keep automating knowledge and eroding the market of local ideas. Hence, after showing initial lucrative GDP or economic growth, less developed countries suffer from drying up value creation–ending up in debt, unemployed growing graduate population, and eroding labor income. Development lenders like Word Bank have termed it a growth trap. Unfortunately, these lenders are not after finding solutions and helping these less developed countries to keep growing by tapping into local idea production, consumption, and export.

6. Idea waves make prosperity transient:

Regardless of greatness, no idea sustains the creation of economic value for a never-ending period. The underlying cause has been human beings’ inherent urgency to find alternative ideas to improve the means of performing jobs. Consequentially, new ideas take over the market of existing proven and matured ideas—causing destruction to employment and firms. Prof. Schumpeter termed it as Creative Destruction. If new entrants pursue those new ideas, prosperity will migrate from incumbent firms, resulting in the growth of new entrants or Startups. Due to loss-making beginnings and uncertain futures, incumbent firms profiting from matured existing waves often shy away from pursuing new waves, ending up suffering from disruption. This disruptive effect of the new wave on high-performing incumbent firms due to creative destruction was termed Disruptive innovation by Prof. Clayton Christenson.

Besides, if those new entrants pursuing creative destruction are from matured idea-importing countries, prosperity will migrate across the boundaries of nations. Such reality of idea growth and diffusion and migration of innovation epicenter due to successive creative waves underscores Carl Marx’s observation—the accumulation and annihilation of wealth under Capitalism.

7. Sustaining ideas in a Market Economy:

Unlike in the past, radical ideas do not emerge as better alternatives to existing means of getting jobs done. Hence, patent protection and seed capital for rolling out are insufficient to profit from great ideas. They must evolve through the cumulative effect of a flow of complementary ideas to cross the threshold. Although public investment in R&D is crucial for giving birth to ideas, profit-making competition plays a vital role in evolving them through a flow of ideas. Hence, the market economy plays an essential role in growing and diffusing ideas. However, the freedom to evolve leads to sustaining innovation diffusion challenges, as competition brings replication, imitation, and substitution.

Besides, the race of idea flow of making innovations better and cheaper leads to monopolization, slowing down evolution and diffusion. Furthermore, there has been an increasing R&D investment need, reaching billions, in inventing and evolving ideas before profit shows up. Hence, despite the positive role of the market economy, solely relying on the market is insufficient to give birth to evolving ideas.

8. Hype cycle:

Notably, High-tech ideas show an initial demonstration of fueling Reinvention waves of significant products. Hence, expectation scales up and inflates. However, upon showing initial demonstrations and grabbing a few customers, technology fails to keep up the past success, resulting in far slower progress than expected. Consequentially, expectation collapses. Such an effect is known as the hype cycle. There have been three underlying causes: (i) misleading early progress of the technology core, (ii) the possibility of fueling creative destruction waves, (iii) high profit-making chance by riding the next wave, (iv) fear of missing out on the next wave, and (v) expectation manipulation by big players for grabbing investment dollars.

9. Chasm in idea diffusion:

Chasm is a phenomenon of pause or discontinuity in the diffusion of ideas. It happens for two crucial reasons. Although the first group of customers (the innovator segment) adopts new ideas for the unique role of getting jobs done, the mainstream customers demand the new idea to be a better substitute for the existing matured predecessor. Hence, there is a noticeable gap in idea maturity for meeting the requirements of innovators and mainstream segments. As a result, idea diffusion faces a pause or chasm after the adoption by the first, nonconsumption, or innovator group. There is another reason for the chasm. However, the technology life cycle is considered an S-curve-like continuous variable. In reality, technology growth may experience discontinuity, showing intermediary pauses or pauses before reaching the maturity state. As a result, multiple chasms in idea diffusion may take place.

10. Scalability:

Irrespective of latent potential, all great ideas are invariably born in primitive form. Hence, they do not start diffusing. To qualify to be economically better alternatives, they need complementary ideas. A flow of ideas is required to make them increasingly attractive to a growing number of customers. Hence, the scalability of ideas depends on the flow of ideas in improving the suitability of getting jobs done better at a decreasing cost. Notably, due to the lack of scale effect, countless grassroots ideas have little implications, let alone create high-paying jobs and large firms. In addition to scalability, leveraging Economies of Scope and positive externality also contribute to idea diffusion, creating jobs and driving the growth of firms and the economy.

11. Idea lifecycle and externalities:

Ideas are like living creatures, having dynamic lifecycle. They begin the journey in an embryonic form. They need a flow of ideas to grow through infancy and start to diffuse. Ideas become economically viable or attractive for diffusion during the growth and maturity stages. Once the next reinvention wave becomes a better alternative, the diffusion of matured ideas declines. Besides, idea diffusion also depends on externalities like infrastructure, 3rd party components, and consumers’ preferences. Hence, timing plays a vital role in the diffusion of ideas.

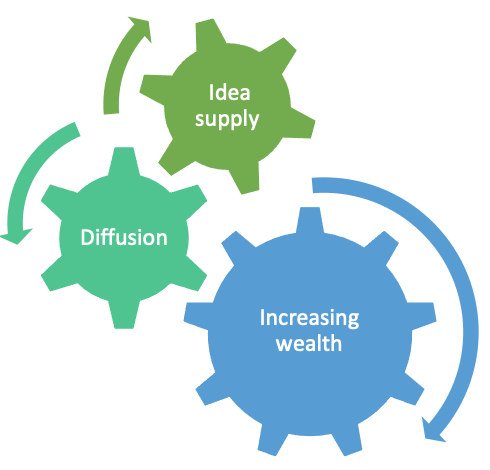

12. No natural correlation between idea flow, diffusion, and prosperity:

Although ideas are at the core of wealth creation, idea flow is insufficient to create wealth. First, they need to scale up through cumulative effect to be a better alternative to a growing number of customers. Due to a lack of scalability, numerous ideas are failing to diffuse. The next challenge is sustaining itself in the competition space by releasing better versions. Otherwise, great ideas would prematurely retire upon showing initial success, ceasing their diffusion. The next one is about their ability to evolve episodically, leading to recreation through self-destruction. Hence, there has not been a natural correlation between idea flow, diffusion, and prosperity.

To sum up:

Yes, ideas are at the core of growing quality of living standards and wealth creation. However, there is no natural correlation between idea supply and economic prosperity. On the other hand, idea diffusion is mainly caused by additional economic benefits. However, social and communication factors also play a role in adopting new ideas. As alternative ideas of getting jobs done tend to be better and cheaper due to the progression of the technology core, idea diffusion tends to synchronize with the technology lifecycle. Besides, as externalities play an essential role, timing influences innovation diffusion.

Furthermore, the chasm in innovation diffusion may be created due to the difference in the purposes of adopting innovation and the pause in the progression of technology. Moreover, although Paul Romer’s theory suggests that idea flow tends to offer a sustained growth path to less developed countries, the reality significantly differs. There is no denying that due to the idea of import, less developed countries will initially gain by opening the window of commercialization of their labor and natural resources. However, continued reliance will slow down their progress and prematurely saturate due to blocking local idea production and commercialization capability. To sum up, driving wealth creation from production and diffusion of ideas demands drawing lessons from these twelve dimensions.