Technology economics refers to the study of production, consumption, and transfer of Wealth due to the invention and evolution of technology. It explores how technology race drives and migrates prosperity, monopolizes the market, transforms jobs, and affects wealth distribution.

The role of technology is no longer limited to the economics of technology for improving production efficiency and offering better goods and services. Due to the expanding runway and scope of improving the quality and reducing the cost simultaneously, notably due to the increasing role of software and connectivity, the market is failing to function. Instead of invisible hands, growing market power due to the success of offering higher quality at less cost has been setting the price. Besides, disruptive consequences of Creative Destruction out of Reinvention waves have been migrating Innovation epicenter affecting the economy as a whole. Hence, technology economics encompasses far broader issues than ever before.

Technology economics refers to how technology has redefined basic economic principles, market functioning, competitiveness, jobs, and economic growth. Ever-expanding Economies of Scale, scope, and positive externalities due to technology have created a natural monopoly tendency. Hence, it’s far more than the conventional purpose of the economics of technology for establishing economic justification in favor of technology adoption and public policy. Technology economics attempts to go beyond the financial analysis of technological and economic changes due to technology. Instead, it raises the issue of the validity of basic assumptions of economic theories.

Notably, investigation of the power of ideas for improving the quality and reducing the cost simultaneously, zero cost of copying of software, creating Network effect out of software and connectivity, and ease of automation of Codified Knowledge and skills on the wealth creation and functioning of the market is the primary purpose of technology economics.

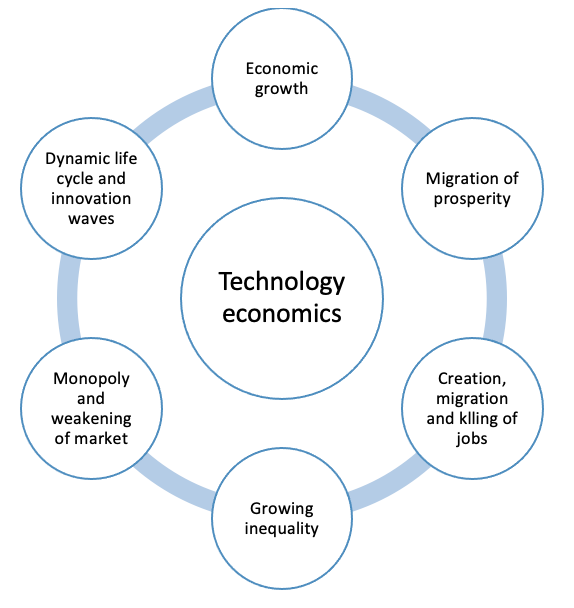

Focus areas of technology economics

- Technology and economic growth—technology increases economic value creation from natural resources and labor due to ideas. As there is no end to the Flow of Ideas, economic growth out of technology may be sustained endlessly. Due to this, both the per capita GDP and human population have been growing together.

- Technology life cycle and evolution dynamics—technology shows a human-like life cycle. They begin the journey in embryonic form and grow and reach saturation. However, there is an endless need for emerging next-generation technology to overcome low economic growth at saturation.

- Technology affects jobs and the market value of inputs—technology creates jobs due to the need to make copies of innovations. R&D needs for technology inventions and innovations also create jobs—high-paying jobs. However, automation technology reduces the human role in replicating and using technology products, killing jobs. Besides, technological advancement keeps changing the demand for inputs like natural resources, knowledge, and ideas.

- Role of the market in leveraging technology and market power accumulation out of technology—competition plays a vital role in growing technology from the embryonic beginning. However, the competition for advancing technology has a natural tendency to acquire market power, as ideas for technology advancement improve quality and reduce cost together.

- Public policy for leveraging technology possibilities—for increasing technology competence and creating the demand to leverage it, public policy matters. However, public policy for dealing with technology monopoly and fueling the next wave of growth out of creative destruction has been drawing growing interest.

- Distribution of technology benefits—technology has been increasing the wealth supply. However, the distribution of wealth is not uniform, resulting in growing inequality between nations, firms, and individuals.

Key takeaways of technology economics

- Technology opens an endless frontier—due to no limit to the flow of knowledge and infinite urgency of Getting jobs done better, wealth creation out of technology faces no end.

- Episodic and migratory nature of wealth creation out of technology —as technologies grow as the S curve and mature technologies are taken over by emerging ones, wealth creation out of technology is episodic. Besides, due to the unleashing of Creative waves of destruction, wealth creation epicenters out of technology keep migrating across the boundaries of firms and nations.

- Winning the global race matters highly—as technology advancement increases the quality and reduces the cost, winning the global race to profit from technology possibilities.

- Natural tendency of monopolization—the race of advancing technology through the cumulative effect of the flow of ideas leads to offering the highest quality at the least cost, resulting in a Natural tendency of monopoly.

- Negative consequences of Economic value creation from technology—the increasing role of technology has been accelerating the consumption of natural resources, resulting in resource depletion, environmental pollution, and emissions. Besides, the evolution of technology and the race to win cause stress in the job market and the life of entrepreneurs.

Research questions of technology economics

- Linking technology competence and ideas to economic growth—due to the technology life cycle and global race, there has been no natural correlation between technology competence, wealth creation, and economic development, raising the question of how to establish this link.

- Winning and sustaining economic success from technology—how to win the global race of profiting from technology possibilities and sustain it through market power and reinvention has been a daunting challenge.

- Dealing with technology monopoly and fueling subsequent waves of creative destruction —technology monopoly is an inevitable outcome in the race to leverage technology possibilities. As monopoly is reluctant to drive the next wave of growth through self-destruction, how to fuel the next wave of creative destruction has been drawing paramount importance.

- Predicting job loss and sustaining and creating jobs—job creation and loss due to technology are natural outcomes. Due to a lack of linearity and discontinuity, the challenge is to predict and respond accordingly.

- Scaling up grassroots innovations and upgrading replication, imitation, and repair ability into innovation—many success stories of economic value creation out of technology started the journey as grassroots innovations. Although less developed countries are blessed with millions of grassroots innovations, none of them has been scaled up at the global level. Of course, not all grassroots innovations are equally scalable. Hence, how to identify candidate grassroots innovations and scale them up is a severe research question. Besides, how to upgrade the capability of assembling, manufacturing, imitating, reverse engineering, and repairing into the power of creating wealth out of innovation poses a research question.

- Creating idea economy—although Paul Romer got the Nobel Prize for articulating ideas as an endogenous factor of economic output, there has been no natural correlation between idea supply and economic prosperity. Hence, such an economic theory risks misguiding policy decisions of increasing the supply capacity of education, R&D, publications, and patents. Therefore, how to create a market of ideas to drive economic growth is an important research question.

Unfolding reality of technology economics

Let’s review a few examples to comprehend economic issues addressed and created by technology:

- Migration of inventions affecting economic prosperity—the rise of Japan has been a miracle. It happened due to the migration of the innovation epicenter of a few significant products. Similarly, South Korea and Taiwan rose due to the semiconductor Process innovation epicenter migration. However, it reduced the competitiveness of the USA’s tech industry, creating a policy crisis and triggering the chip war.

- Attaining price-setting capability through leveraging technology—Microsoft, Apple, Intel, and Amazon, among others, created success stories by offering cheaper and better alternatives. However, due to prolonged success, they outperformed the competition, resulting in price-setting capability. More importantly, antitrust or competition laws are inappropriate to deal with because of technology’s unique role—making things better and cheaper.

- Creating, migrating, and killing jobs—inventions and innovations out of technology form the root of creating jobs—notably manufacturing jobs. For example, the invention of automobiles created high-paying manufacturing jobs. However, further technological progress migrates and eventually kills those jobs.

- Making prosperity out of natural resources transient—economic value from possession of natural resources depends on technology. Technology creates and destroys the importance of it. For example, the automobile made the petroleum market, but its further progress as electric vehicles will likely kill it.

- Winning the global race matters—inventions and innovations are not good enough to profit from technology. Winning the global race to gain market power is at the core of creating economic value from technology. For example, India has been learning semiconductor production process over the last four decades. Despite it, India’s success in driving economic growth out of it is limited, as India could not win the global race of fine-tuning the process.

Impact of technology on the economy

Economy refers to the production, distribution, trade, and consumption of goods and services. To maximize wealth creation, the economy emphasizes the practices, discourses, and material expressions affecting scarce resources’ production, use, and management.

As technology increasingly affects all aspects of the economy, its importance in managing it has grown. For example, ChatGPT, like machine learning applications, has shown the possibility of automating knowledge-intensive jobs, unleashing economy-wide implications. On the other hand, due to the success of pursuing the next wave of semiconductors, Taiwan has grown as a high-income economy. Due to Taiwan’s success in becoming the semiconductor epicenter, the USA’s economy has suffered from damage. Similarly, due to the technology race, Japan succeeded in becoming a high-income country through the migration of innovation epicenter of multiple products such as consumer electronics.

- The positive impact of technology on the economy—technology allows to extract growing economic value from labor, knowledge, and natural resources. Due to higher efficiency, wealth creation goes up, and wastage comes down.

- Negative impact of technology on the economy—conventional negative impacts of technology are emission, pollution, and safety. Besides, technology makes prosperity unstable. Due to technology, inequality has been growing, and job security has been suffering.

Examples of the impact of technology on the economy

Here are notable implications of technology on the economy:

- Creating, killing, and migrating of jobs—inventions and innovations create jobs requiring R&D and replication; automation kills and migrates jobs due to the changing role of humans.

- Migration of innovation epicenters affecting the rise and weakening of economies—the rise of reinvention waves out of emerging technology core tends to migrate innovation epicenters of all products.

- Industrial revolutions shaping economies—due to the creation of the scale effect and the unleashing of creative destruction force, economies have grown and weakened during the first three industrial revolutions. The 4th industrial revolution is expected to reshape the global economy further due to energy and machine intelligence technologies.

- Changing the market value of natural resources—technology creates and destroys the market value of natural resources, unleashing economy-wide implications. For example, automobile technology created the demand for liquid fuel, creating oil-rich economies. However, the rise of renewable energy and electric vehicles threatens to weaken them.

- Creating an imperfect market—collusion, vertical forecloser strategy, and preferential policies are conventional sources of price fixing in creating an imperfect market. However, the long runway of increasing the quality and reducing the cost has been contributing to market power accumulation, creating an imperfect market.

Challenges for leveraging technology for economic growth

Economic growth, job creation, and equality are three primary goals of economic growth theories. However, technology has been affecting all of them. Besides, the relationship is not linear, sustainable and predictable. Economic value creation from natural resources, labor, and human capital keeps changing due to technology. For example, technology created high-skilled manufacturing jobs in the Western world. However, the progression of automation enabled the low-skilled workforce of less developed countries to be eligible for those manufacturing jobs, resulting in migration. Unfortunately, further advancement of automation will kill all those migrated jobs.

Although Paul Romer’s recent growth theory has given greater importance to technology by terming ideas as endogenous factors, there has not been a linear correlation between idea supply and economic growth. In many cases, by increasing R&D funding for increasing the flow of ideas, firms and nations may suffer from financial loss. Similarly, human capital-centric growth theories also do not offer a leaner path of growth out of enhancing the quality and quantity of graduates. Due to the ease of automation of knowledge, unlike the past, college graduates are suffering growing employment and job loss. Hence, technology economics demands reviewing economic growth theories.

Growing issues about technology economics

- Productivity and technology economics–Cobb Douglas’s production function identifies the role of technology as the advancement of capital and total factor productivity (TFP). However, continued productivity enhancement through improving capital and TFP leads to human-free production. Such a reality raises the question about income growth out of productivity advancement.

- Global economy and technology—the global economy has been showing increasing monopoly. The underlying cause has been the technology. Besides, as technology tends to migrate to the innovation epicenter, the global economy constantly changes.

- Industrial economics and technology management—the success of industrial economics depends on improving the quality and reducing the cost through technology. However, technology management plays a vital role as technology has an S-curve life cycle and evolves episodic.

- Economics of technology and management—management decisions for pursuing technology relies on three vital aspects of economies of technology—(i) customer preferences, (ii) technology feasibility, and (iii) economic viability.

- Technology monopoly—how to attain and sustain technology monopoly is a management challenge. On the other hand, how to deal with it is a regulatory and public policy issue.

Economies of scale, scope, and network effect demand redefinition due to technology

- Scale—as volume increases, the cost decreases due to the division of capital expenditure on growing units, creating the scale effect. However, creating scale effects out of technology is not limited to this conventional definition. Instead, technological economies of scale refer to increasing the willingness to pay, raising the minimum efficient scale (MES) point, and decreasing the cost at MES due to ideas for both products and processes.

- Scope— the cost reduction due to sharing a production facility with multiple products refers to conventional Economies of Scope. However, economies of scope out of technology refers to cost reduction due to sharing of common intellectual assets, design elements, or components among multiple products, resulting in a family of products.

- Network Externality Effect—Once a telecommunication network is used to be state monopoly, it has a network effect as perceived value increases with the growth of subscribers. However, software and connectivity-centric technologies are enabling the development of positive network externality effects in a growing number of products.

Technology economics power natural tendency of monopoly—weakening the power of the market

Economies of scale, scope, and network effects have been expanding the range of being bigger, better, and cheaper. Once, among technologies, only the Telecommunication industry used to have such an effect. Hence, telecom used to be a public monopoly for a long time. However, the growing role of software, connectivity, and profound science-based ideas has been expanding economies of scale, scope, and network effects in various products. Consequentially, the natural tendency of monopoly has been emerging across industries. It has been happening due to the race to make innovations better and cheaper, leading to a private monopoly. Hence, the market economy has been suffering from the eroding ability of invisible hands to govern the competition.

Economic principles in perspective of technology economics

- People face trade-offs—due to the ability of technology to make products better and cheaper, this basic proposition does not appear to be universally valid.

- The cost of something is what you give up getting it—the main challenge of technology economics has been assessing the Opportunity cost of not pursuing emerging technology, notably for reinvention. Mistakes of reinvention decisions may lead to business loss and startup rise.

- Rational people think at the marginal cost and marginal revenue—thinking at the margin suffers from the risk of avoiding creative destruction as new waves begin the journey at a loss.

- People respond to incentives—as technology economics offers the option of providing incentives to all, conventional tools of redistributing incentives of social welfare maximization suffer from limitations.

- Trade can make everyone better off—technology expands trade at the cost of creating inequality and creative destruction. Hence, not everyone is better off due to the expansion of business.

- Markets are usually a good way to organize economic activity—the market is good for intensifying competition for nurturing technological possibilities. However, competition in leveraging technology creates an imperfect market, weakening its power.

- Governments can sometimes improve market outcomes—by addressing technology monopolies and opening a new wave of creative destruction, the government has a vital role to play in a technology-led economy. The challenge is to have an optimum balance between the role of the Government and the competition.

- A country’s standard of living depends on its ability to produce goods and services–in a connected market economy, the standard of living depends on economic value creation instead of just producing goods and services.

- Growth of money leads to inflation—if the money supply grows more than the growth of economic value, inflation takes place. However, the Government can print more money without causing inflation, provided it succeeds in creating proportionate additional wealth by leveraging technology possibilities.

- Society faces a short-run tradeoff between inflation and unemployment—such trade-offs could be avoided by intelligently leveraging technology possibilities.

It seems that technology economics has a bearing on all these economic principles. Hence, from the perspective of technology economics, all those principles should be adapted to derive better justification for expanding wealth production, consumption, and transfer out of technology possibilities.