Dutch ASML’s extreme ultraviolet ray lithography machine is a critical building block in the unfolding US-triggered Chip War. It’s perceived that without this ASML machine, China cannot manufacture sub-10nm microchips. Surprisingly, ASML’s magical EUV lithography machine faces a Canon nanoimprint lithography disruption threat.

Over 20 years, ASML invested over $10 billion to release the first EUV lithography machine in 2019. Subsequently, ASML got ahead of industry leaders Japanese Canon and Nikon. Surprisingly, within four years, ASML’s twenty-year-long R&D success of emerging as the monopoly in the sub-10nm segment of semiconductors faces nanoimprint lithography disruption. Should we be surprised?

According to Innovation Principle number six, the emergence of successive Reinvention waves is an integral behavior of innovation dynamics. Hence, launching Canon’s FPA-1200NZ2C nanoimprint semiconductor manufacturing equipment is a natural outcome. It’s a reinvention of lithography machines because Canon has replaced the technology core of printing microchip design on the wafer.

Conventional lithography machines, including ASML’s EUV one, optically project circuit patterns onto the photoresist-coated wafer. In reinventing the lithography machine, Canon has changed this 70-year-old optical projection technology core. Instead of projection, Canon has developed a stamping-like technology core. This alternative technology imprints the circuit pattern on the resist on the wafer by pressing a mask, like a stamp. Due to the removal of optical projection, Canon claims that this imprint technique more faithfully reproduces the circuit pattern on the wafer. It also claims it can form complex two- or three-dimensional circuit patterns in a single imprint. Besides, it does not require a highly complex, power-hungry light source and optical assembly. Hence, Canon nanoimprint lithography machine’s upfront price and operating cost will be far less than ASML’s EUV machine. Does it mean the nanoimprint lithography (NIL) disruption threat is real?

Key Takeaways

- Japanese companies Canon and Nikon used to have a duopoly in the semiconductor lithography market in the late 1990s. However, due to EUV lithography, ASML emerged as the monopoly in the high-end chip-making lithography market.

- Canon is seeking to capture market share in high-end chip making by positioning the NIL as a simpler and more attainable alternative to the leading-edge ASML’s EUV tools of today.

- With a claim that NIL can imprint 5nm and 2nm chips at far less cost, Canon has challenged ASML’s monopoly in high-end chip making by releasing NIL machine.

- Canon’s unfolding attack of breaking ASML’s grip on chipmaking tools, leading to the supply chain disruption for cutting-edge chips, is intriguing.

Review of lithography evolution

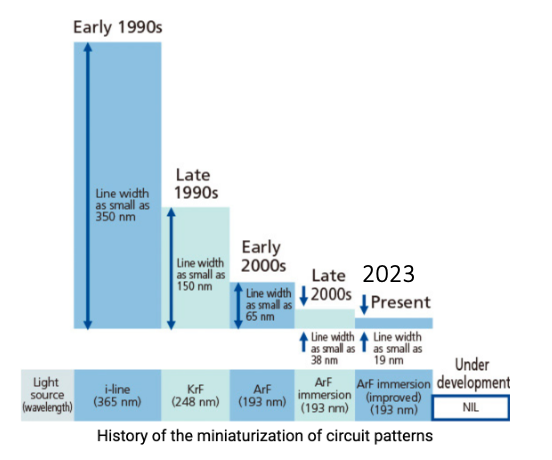

Lithography refers to transferring highly complex circuit patterns of microchips onto a silicon substrate known as a wafer. Upon the invention of the integrated circuit in 1959, it started as an optical procedure. To begin with, circuit patterns are printed on a transparent thin film known as a photomask. Light is guided through the photomask for projecting the printed circuit patterns on a photo-resist coated wafer. How small the feature could be printed depends on two major factors: (i) the wavelength of the light source and (ii) the numeric aperture of the optical system, comprising of lenses and mirrors, for guidance and projection. According to Rayleigh’s equation, the third factor is the quality of the photoresist. Hence, to improve the resolution, the focus has been on changing the light source towards decreasing wavelength, increasing the optical system’s numerical aperture, and improving the photoresist quality.

In the 1960s, American companies were leading the development of photolithography machines. However, by the late 1960s and the early 1970s, Japanese companies, notably Nikon and Canon, with expertise in optics, entered the photolithography market. While American companies were dying in the 1980s, Dutch ASML entered the race in 1984. However, ASML was an insignificant player compared to Nikon and Canon. Hence, by the early 1990s, Canon and Nikon became a duopoly in the photolithography semiconductor equipment market.

ASML EUV machine

In the early 1990s, scientists and engineers started looking for extremely low wavelength sources to give a big resolution jump. Hence, 13.5nm extreme ultraviolet (EUV) light source became the target. However, due to the extreme complexity of developing a sufficient power EUV light source and the needed optical system to guide it, most experts and companies doubted its feasibility for commercial exploitation. However, Dutch ASML was an exception. Despite many unsolved technology challenges, in 1999, ASML management, scientists, and Engineers embarked on this daunting journey. Through the relentless R&D effort of the internal team and ecosystem partners like Cymer and Zeiss, ASML succeeded in releasing the first EUV photolithography machine in 2019. As no one else, including Nikon and Canon, did not pursue it, ASML became the only EUV lithography machine supplier. Hence, for sub-10nm microchip production, ASML emerged as the monopoly in supplying the EUV photolithography equipment.

Of course, the performance has a high cost bearing. The price of each unit of ASML’s complex machine varies from $150 million to $400 million. Highly complex light sources and optical systems were major cost escalation factors. Besides, the cost accelerates for improving the resolution by increasing the numerical aperture. Hence, there was an opportunity and urgency to find an alternative technology core.

Emergence of Canon nanoimprint lithography technology core

In response to the high cost of EUV, Canon pursued an alternative technology core. Instead of chasing lower wavelengths to project higher-resolution images, Canon opted to eliminate it. Hence, it focused on fine-tuning its inkjet printing technology so that far less costly alternatives could emerge—giving birth to Canon nanoimprint.

In Canon’s nanoimprint lithography technology, a master stamp of circuits patterned by an e-beam system is developed. Like an inkjet printer works, jets deposit low-viscosity resist on a substrate wafer. Then, pressing patterned stamps (masks) into the surface of the resist transfers the pattern on the substrate. However, despite simplicity, this process has multiple limitations, including alignment on metal layers. Its adoption suffers from (i) overlay alignment, (ii) throughput, and (iii) effectivity. Besides, the requirement of cleaning templates after a certain number of impressions is also a performance issue.

However, here are a few significant benefits:

- According to Canon, its NIL FPA-1200NZ2C enables patterning with a minimum linewidth (critical dimensions, CD) of 14 nm, which is suitable for 5 nm-class process technologies.

- Possibility of producing feature sizes below 5nm and lower line-edge roughness (LER).

- Due to the absence of an expensive light source and optical system, Canon’s nanoimprint lithography (NIL) cost could be one-tenth of ASML’s EUV machine.

- Compared to EUV lithography machines, NIL requires fewer steps and less power to operate, and NIL machine is far more compact.

Nanoimprint lithography disruption possibility

It appears that ASML has little option to reduce the cost and the size of the EUV machines. Hence, Canon’s nanoimprint lithography machine will have a high-cost advantage—by a factor of 10x or more. Besides, the operating cost will be lower due to compact size and lower energy needs. Through incremental advancement, Canon will likely fine-tune the machine, resulting in higher alignment accuracy greater throughput, and lower effectivity. However, so far, attactve performance demonstration has been mainly in memory chip-making experiments of Toshiba, SK Hynix and Kioxia. Therefore, it may be fair to state that in the sub-10nm zone, ASML’s EUV machine will face competition from Canon’s nanoimprint lithography. Due to the very high-cost advantage, the threat of nanoimprint disruption may be high. Or, at least, ASML’s monopoly in sub 10-nm nodes will likely be challenged. Hence, Canon will likely regain its position in the high-end semiconductor lithography race. However, to what extent Canon will regain is not clear yet.

2 comments

It would be useful to see a full, independent cost analysis of the various NGL equipment sets. There hasn’t been a real analysis since one was chartered by a major equipment supplier and investor over a decade ago (imprint, EUV, multi-beam eBeam, multiple exposure DUV). At that time, imprint was hindered by the requirements to clean templates every 1,000 imprints.

A year later: Canon has already shipped the first machines and this will be a serious headache for ASML sooner than later. They will still be there, but probably in a bit different shape. Canon will definitely become a very long-term monopoly, and will probably be like that forever. I’m a bit more concerned about Nikon: unless they manage to compete at the lower end against the response from ASML, not sure how they will manage.

David Jiménez, siento mucho haberte despertado del sueño húmedo 🙃 Japón ha vuelto.