For 20 years, IBM was a global leader in hard disk Innovation. Similarly, for 15 years, Nokia was an apparently unsinkable ship in the mobile handset innovation ocean. However, their winning innovation record has been anything but history. Besides, there were 75 hard disk and 24 word processor innovators in the 1980s. Unfortunately, most of them are no longer in business.

Innovating is one challenge. Winning the innovation race is a more significant challenge. In real life, profiting from innovation demands winning the innovation race. As ideas are increasingly opening the window of improving the quality and reducing the cost simultaneously, the scope of co-existence of multiple innovators through cost-quality tradeoffs has been eroding. On the other hand, software-centric innovation allows bundling features without increasing cost. The scope of profiting from market segment-specific innovation has been deteriorating. For this reason, a single word processor serves the requirements of all kinds of users.

There appears to be a growing Natural tendency of monopoly in innovation. Notably, due to the increasing role of semiconductors, software, and connectivity in fueling innovation, the scope of getting better, bigger, and cheaper has been a growing force. Hence, acquiring the capability of innovating is no longer sufficient. The challenge is winning the innovation race to attain the price-setting ability to make a profit and compel followers to suffer from loss.

Examples of Winning Innovation Race

ASML in Lithography

In 1984, ASML was born as a spin-off of Dutch Philips’ R&D on high precision microscope and photolithography. It was a joint venture between Philips and ASM. Although it launched its maiden product before celebrating its first birthday, it became obsolete within a year. Hence, ASML got the urge to advance it to survive substantially. Upon crossing the struggle of survival during infancy, ASML released the lithography system PAS 5500 in 1991. It was highly successful. Thus, ASML succeeded in occupying a distant third position in the lithography innovation race.

However, ASML leadership was not happy with the 3rd position. It wanted to move ahead in the competition. However, being a late entrant, overtaking forerunners Canon and Nikon was a formidable task for ASML. Hence, it focused on the technology core, which had far greater potential than Canon and Nikon were leveraging. However, ASML’s preferred 13.5 nm EUV light source for producing silicon chips at sub-10nm had extremely faint latent potential. Already, several scientific investigations rejected the possibility of growing it to make it suitable for commercial production.

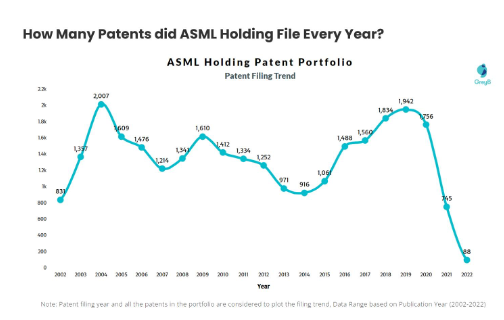

Source: https://insights.greyb.com/asml-holding-patents/

However, ASML focused on nurturing it. In addition to strengthening in-house R&D, ASML ventured into developing a global ecosystem of R&D partners for advancing each of the critical components like EUV generation, mirrors, lenses, and mechatronics it needed to reach the goal. This adventure in harnessing STEM to systematically create a flow of ideas led to ASML’s winning in the Photolithography market. Twenty years of relentless journey of refinement culminated in the release of the first commercial EUV lithography machine in 2019. Subsequently, ASML became the sole supplier of EUV lithography for producing microchips at sub-10nm node—for smartphones’ less energy-consuming powerful processors. However, the slowdown of patent filling is raising the question of sustaining the win.

TSMC in Foundry Services

As a spin-off of ITRI, in 1987, TSMC started offering foundry services to chip designing or fabless semiconductor companies. In process technology, TSMC was far behind Intel by several nodes. Besides, it did not have a steady flow of work. Instead, it was relying on the overflow of clients. Hence, its revenue and profitability were facing high uncertainty. Despite this, from the beginning, TSMC focused on R&D for systematic idea production for optimizing processes, resulting in increasing yield.

In addition to systematically producing R&D outputs and converting them into better performance in wafer processing, TSMC’s timing was right. The rise of the mobile phone started asking for increasingly sophisticated processors. They were also asking for less energy-consuming processors to deal with the urgency of offering longer talk time with less heavy battery packs. Furthermore, the demand for increasing computational complexity was on the rise as mobile handset makers focused on software-centric innovations.

Besides, no leading-edge mobile handset makers, including Nokia, had in-house foundry and relied on fabless companies to offer them the processors. Hence, TSMC found a growing mobile handset processor wave offering profitable revenue for the capital and R&D investment needed to upgrade the process node. Therefore, TSMC unearthed a good match for scaling up its idea flow from R&D and turning it into increasing revenue and profit. This winning runway got a further boost with Apple’s iPhone, triggering a new wave of smartphones and subsequent switching of foundry service of Apple from Samsung to TSMC.

Hence, TSMC’s journey of winning the semiconductor innovation race teaches that there should be resonance between systematic idea production and long wave of profitable demand for it for winning the innovation race. The race to meet software-intensive consumer preferences with less energy-consuming processors created the need for higher nodes—a pathway for TSMC’s success.

Intel in Microprocessor and Microsoft in Word Processor

Shortly after its founding in 1968, Intel got the opportunity to develop microprocessor 4004 through a contract from Japan’s BusiCom. Intel’s success in the 1970s was not much. However, the adoption of Intel 8088, an upgraded version of 4004, by IBM PC led to the rise of the personal computer wave. Apart from Intel, tiny Microsoft also got to ride on this wave with software. Consumers’ preferences for doing more with increasingly complex software (like word processors) running on PCs created the demand for computationally complex processors. On the other hand, the progression of semiconductor technology kept offering a profitable option of packaging a growing number of smaller transistors on the same microchip. As a result, a resonance between consumer preferences and demand for the advancement of software and processors occurred.

Consequentially, both Intel and Microsoft started growing from the virtuous effect. They found a long-run way of profiting from a flow of ideas for advancing PC processors, semiconductor process nodes, and software. Thus, they kept rising along with the rise of the PC wave. However, the saturation of the PC wave has caused a dent in their growth. Although Microsoft diversified in other areas to compensate for it, Intel’s failure to ride on another wave of growth has pushed Intel into a loss.

How do you excel in winning Innovation?

Invariably, all great ideas begin the journey in primitive form. Besides, there are already some products in the market that customers are deploying to get their jobs done. Hence, innovation must cross the threshold limit set by the incumbents to establish acceptability. Upon doing so, it should keep growing to reach a more significant market. Furthermore, a competition race must be won to ferrate profit from the market. Besides, along the way, the urgency of crossing the threshold and reaching beyond run the risk of getting caught in the chasm by technology development hurdles. Furthermore, customers must prefer features that target innovation delivered as better alternatives.

As explained, innovations grow through a flow of ideas. Those ideas must distill from the resonance between consumer preferences and technology possibilities. Hence, winning innovation demands paying attention to consumer preferences for knowing the pain points to be addressed. However, the target technology core must offer economically viable options of ideas to address them profitably.

For gaining the scale advantage, idea flow must support the creation of increasing willingness to pay and reducing the cost of creating per unit value or willingness to pay. Such conditions must be met to increase unit sales, revenue, and profit simultaneously. Furthermore, despite patent barriers, followers will always keep catching up, resulting in erosion in the willingness to pay. Besides, both positive and negative externalizes will keep unfolding. Hence, innovators must successfully release successive better versions to respond to competition and externalities. To face the challenge, the technology core must be amenable to progression through adding new technologies and enhancing existing ones. Ultimately, ideas flowing through the resonance between consumer preferences and technology possibility must offer a long profitable runway.

Please Note:

This article is part of a book, Engineering Economics and Management–Modern Day Perspective.