In 2022, while mighty Intel was reporting eroding revenue, loss, and laying off experienced engineers, TSMC did report the opposite. Does it mean that Intel recruited poorer-quality engineers than TSMC did? Does it mean that MIT, Standford, and many other top-ranking American Universities all of a sudden became poor performers?

Although there has been a positive correlation between the prosperity of advanced countries and STEM indicators, will less developed countries succeed in repeating it? Are graduates, publications, and patents good enough? If that were the case, why are more than 85 percent of engineering graduates in India failing to get engineering jobs? Of course, quality is an issue. But if that is addressed by enabling Indian universities to rank well in the global indices, will all the graduates get high-paying jobs?

Why do firms rise and fail to sustain their success? Is it just luck? Or is it due to poor-quality engineering work? If that were the case, why do well-engineered products like A380 and more than 75 percent of innovative products fail to produce profitable revenue? On the other hand, why are off-the-shelf innovations gaining market shares among technological solutions?

Why are not inventing and innovating good enough? In many cases, inventors have lost their inventions to followers and become importers. Is it due to intellectual property infringement, low-cost labor, and public subsidies? If that were the case, upon losing so many inventions to Japan, why does the USA maintain strong economic and political partnerships with Japan or Taiwan?

Competition is good for fostering Innovation. But why does the race end up with the winner taking all the market–turning invisible hands ineffective? To counter it, are US-style antitrust laws of breaking monopolies or preventing mergers good enough? What is a remedy of rising technology monopoly?

Unfolding reality challenges conventional engineering economics and management

Modern day perspective of engineering economics and management goes far beyond the application of economic principles in the analysis of engineering decisions. Over the last half a century, the role of engineers has exponentially grown from the engineering of cost-effective, customized technical solutions to economic problems. Engineering graduates are facing increasing opportunities and challenges in innovating solutions to meet latent demand and profiting from them in a competitive market. Therefore, conventional engineering economics or engineering economy is no longer sufficient to empower them.

We are all overwhelmed by the spectacular rise of Startups and surprised by the sudden fall of technological behemoths. The success of STEM, creativity, and entrepreneurship is no longer limited by the quality of engineering design, initiative, and out-of-the-box thinking. If that were the case, why have high-performing technological firms been failing? Besides, why are most startups stumbling? On the other hand, why are some firms managing stable growth by leveraging technology possibilities? Does it just happen out of luck? Perhaps the truth lies far beyond the surface. It demands a managed journey for winning the competition in incremental advancement and Reinvention waves meeting unfolding consumer preferences.

How ideas in leveraging technology possibilities for Getting jobs done better are being formed and shaped in a competitive market into economic value or waste, causing the rise and fall of products, firms, and economies, is the primary focus of Modern Day Engineering Economics and Management.

Defining Engineering Economics and Management

Engineering Economics and Management refers to managing Wealth creation dynamics out of technology possibilities in a globally connected competitive market. It attempts to replace the heroic art of innovators with reoccurring patterns underlying the success and failures of technology ideas. Besides, modern day engineering perspective of Engineering Economics and Management spells out why cannot market and STEM indicators alone drive wealth creation from STEM.

It explains why the prosperity of firms and nations rises and falls due to Creative waves of destruction caused by scientific discoveries, inventions, and innovations. Hence, it goes beyond the basics of microeconomics and engineering in explaining the role of competition, empathy, Passion for Perfection, culture, and national policies in creating economic value from STEM competence.

Engineering economic analysis has stretched far beyond the exercise of breaking down the various options for an engineering project based on its overall costs. In pursuing unproven technology possibilities, economic analysis demands clarity about pervasive uncertainties in producing returns. It asks about the implications of pursuing technology possibilities on firms’ market value or stock price.

Sources of Wealth– ideas play a vital role

However, the further progression of ideas such as electric vehicles, renewable energy, and cloud-based IT service automation have been destroying such markets. Hence, ideas are at the core of creating wealth and shaping the market of other factors. Therefore, the development pathway should focus on getting into the orbit of creating wealth from ideas.

But despite the strength of ideas in driving wealth creation, there is no natural correlation between idea density like patent filling and wealth creation. For example, more than 75% of innovative products retire without producing profitable revenue. Similarly, as high as 94% of patents are never used in improving products or processes. Furthermore, incumbent ideas producing profitable revenue run the risk of losing the market due to the rise of the next wave of ideas. For example, the LED light bulb has taken over the incandescent light bulb market, invented by Edison. Hence, one of the core challenges of Engineering Economics and Management is to make decisions and manage programs to understand wealth creation dynamics out if ideas as reoccurring patterns.

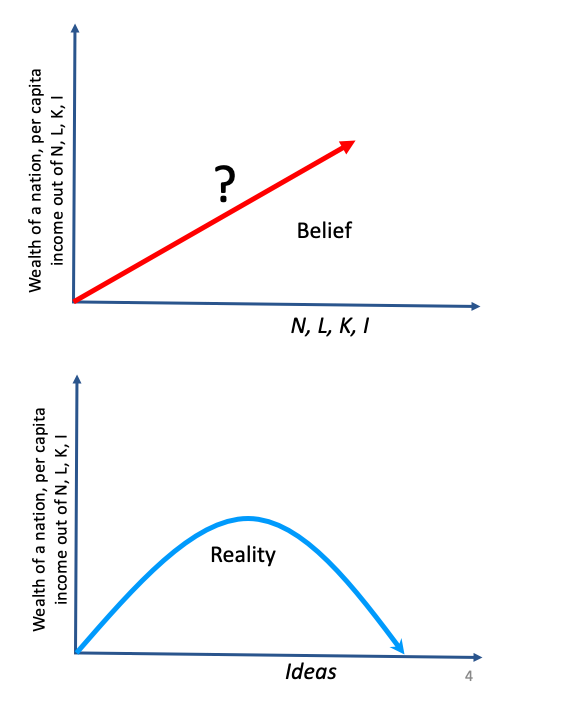

Natural resources (N), labor (L), knowledge(K), and ideas (A) are our tools for creating wealth by getting our jobs done. But is there a natural, scalable correlation between wealth and these input factors? Unfortunately, the answer is no. The wealth creation capacity of natural resources, labor, and ideas depends on ideas. Ideas create and destroy their wealth creation capacity. For example, the idea of internal combustion engine-based automobiles has created the market for liquid fuel. Similarly, the idea of automating knowledge and skill, leaving only innate abilities to humans, has made low-skill labor of Bangladesh eligible for manufacturing jobs. Besides, the idea of remote service delivery over a communication network has created a market for IT services market. Hence, how to leverage the non-linear relation of ideas with economic value creation is an issue, as shown in Fig. 1.

Science, Technology, Engineering, and Mathematics (STEM)–why are we after it?

As explained in the previous section, ideas are at the core of creating economic value. Does it mean that Engineering Economics and Management suggest encouraging more idea creation? For this reason, should the focus be on STEM indicators like the number and quality of graduates, publications, and patents? It appears that conventional wisdom suggests it. For example, in assessing innovation and competitiveness capability, such indicators play a pivotal role in the Global Innovation Index (prepared by INSEAD, WIPO, and Cornel) and the Global Competitiveness Report (prepared by WEF).

As less developed countries are at the bottom of such indicator-based ranking, there has been advice for these countries to improve these indicators by accelerating investment, often through borrowing from foreign sources.

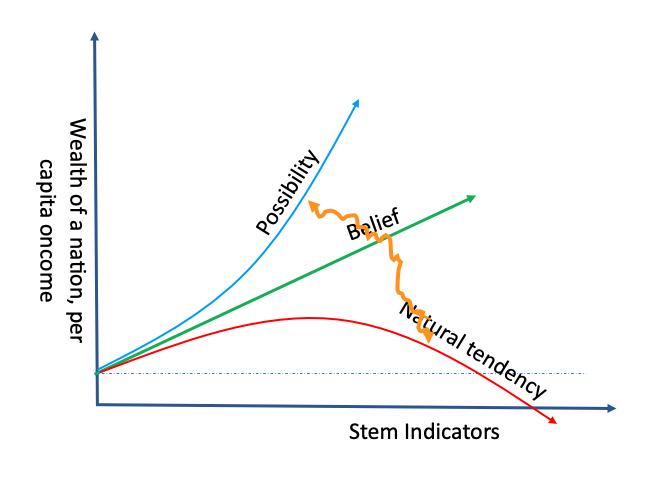

Unfortunately, there has not been a natural linear correlation between STEM indicators and economic prosperity. Often, less-developed countries suffer from declining returns on their STEM indicator advancement. But in some cases, mostly in advanced economies, there has been an exponentially growing relationship. Hence, Engineering Economics and Management face the challenge of establishing a positive, scalable correlation between STEM indicators and economic growth. Unfortunately, most less developed countries have been increasing STEM investment without paying much attention to this vital issue (as shown in Fig. 2) of driving prosperity out of it.

Genesis of Modern Day Engineering Economics and Management

Economics deals with the science of the optimum allocation of scarce resources—for maximizing welfare.

And innovation is the heroic art of Genius—a magical act. It is about getting jobs done better out of ideas, generating a highly scaleable, profitable revenue stream, and accumulating Monopolistic market power.

Science is about identifying variables and establishing quantitative (or at least logically very strong) relations among them to interpret and scale up art. Technology is about the intentional manipulation of those variables to invent or advance means for getting jobs done better.

Innovation success —the heroic act of magical personalities in making an enormous amount of money (wealth) out of ideas, often causing destruction to incumbent products and firms and monopolizing a new wave of wealth creation.

Engineering is the use of scientific principles to design and build machines through the optimum allocation of resources–cost-effective technology solution to an economic problem (how to make the best use of limited or scarce resources).

Economics is the branch of knowledge concerned with producing, consuming, and transferring wealth.

Scarcity as an economic concept “… refers to the basic fact of life that there exists only a finite amount of human and nonhuman resources which the best technical knowledge is capable of using to produce only limited maximum amounts of each economic good. ”

Urgence: to replace the allocation of scarce goods among competing demands and the heroic art of innovation with the science of infinite wealth creation out of scarce resources—so that we keep producing more with less.

Engineering Economics and Management is a discipline of interpreting technology-led wealth creation dynamics as reoccurring patterns for scaling up invention & innovation art of economic value creation out of ideas with science, engineering, and management practices—for endlessly expanding reservoir of wealth from scarce resources.

Key Topics of Engineering Economics and Management

- 1. Importance of Science, Technology, Engineering, and Mathematics–driving prosperity from knowledge and ideas

- 2. Basics of Wealth Creation through Getting Jobs Done

- 3. Economics of Value Creation by Leveraging Technology

- 4. Engineering (H) and Rational Decision (D) Making in Taking Ideas (A) to Market

- 5. Basics of Economics within the Context of Creating Wealth from Science, Technology, and Engineering

- 6. Technology Progression and Transformation of Human Role (future of work)

- 7. Technology Lifecycle, Diffusion Patterns and Principles of Innovation

- 8. Managing Technology Uncertainties and Portfolio in Creating Economic Value

- 9. Economics of Reinvention, Redesign, and Design for Manufacturing

- 10. Attaining Market Power and Creating an Imperfect Market by Exploiting Technology Possibilities

- 11. Managing Communication, Coalition, Programs, and Projects and Financing the Journey

- 12. National Strategies and Policies and Programs for Leveraging STEM in Driving Economic Growth