With a $10 billion pot of money for giving subsidies, India has been struggling to allure global icons like Intel or TSMC to set up semiconductor plants in India. On the contrary, Japan started its semiconductor journey by paying only $25,000 in licensing fees to Bell Labs in 1952. On the other hand, Taiwan’s mega success in semiconductors began with a modest investment of $4 million, paid to RCA to set up a fab and train engineers. But why could India not follow in similar footsteps? Does it mean that India does not have qualified human resources? Or is India too late in the party, as they have recently learned about semiconductors? What’s missing in developing the semiconductor industry in India?

Ironically, in all major semiconductor companies worldwide, we see the brilliant presence of Indian science and engineering graduates. Some of them have been heading globally reputed semiconductor firms. The presence of Indian graduates in the semiconductor world is not recent. In the early days of semiconductors, Bengali scientists Sir Jagadish Chandra Bose contributed to semiconductors. Millimeter wave, crystal radio, and crystal detector are his notable contributions. He was the first to use semiconductor junctions to detect radio waves. Furthermore, as early as 1984, India set up a state-of-the-art semiconductor lab with a production-level foundry facility in Mohali. On the other hand, the import of semiconductors in India reached $54.87 billion in 2021.

Why is India’s local semiconductor production virtually zero despite all these bright sides? There could be an issue of lack of public investment to prime the pump. Does it mean that with this new pot of money, India will succeed in starting the chain reaction to meet its dream of graduating from Chip taker to giver?

Subsidy package for attracting investment for the semiconductor industry in India

According to Business Today, in September 2022, the cabinet approved 50% incentives for semiconductor manufacturing. Contrary to an earlier decision of the government to give 30-50 percent incentives for different categories, the current stimulus is flat at 50 percent for all types. In addition to fabrication plants across process nodes, this 50% subsidy is applicable for packaging, other chip facilities, and displays. As reported by the Reuter on September 21, 2022, this incentive package of $10 billion, subsidizing 50% plant cost, will likely court a total investment of at least $25 billion to boost local chip and display panels manufacturing.

The incentive package has already started to encourage private investment. Notable ones include the signing of Vedanta and Taiwan’s Foxconn India’s Gujarat to invest $19.5 billion in the western state to set up semiconductor and display production plants. Besides, the international consortium ISMC and Singapore-based IGSS Ventures plan to set up a chip plant in the southern states of Karnataka and Tamil Nadu, respectively. ISMC’s planned investment of $3 billion will manufacture 65nm analog semiconductors.

This recent announcement of the incentive package will likely speed up the implementation of Tata’s earlier announcement of semiconductor assembling, testing, and packaging investment. In 2021, The Economic Times reported Tata’s announcement of setting up an OSAT facility at $300 million for serving potential clients like Intel, AMD, and STMicroelectronics. Tata’s OSAT (outsourced semiconductor assembling and testing) facility will likely employ up to 4,000 workers.

Besides, Business Standard in January 2023 reported India’s deal with Belgium-based IMEC to get chip-making technology. According to this deal, the Belgium-based research and Innovation hub, Interuniversity Microelectronics Centre (IMEC), will provide the technology to manufacture chips of 28 nanometres and above. Of course, for accessing technologies, India will keep paying a royalty to IMEC.

Failure of Semiconductor lab in seeding semiconductor industry in India

In the early 1960s, semiconductor production activities such as testing, bonding, and assembling were highly labor-intensive. Hence, multinationals started to source low-cost for this value chain segment from South Asia. Through offshore facilities of multinationals (MNCs) for testing, bonding, and packaging service, South Korea, the Philippines, and Malaysia entered the global semiconductor value chain in the 1960s. But formidable Indian bureaucracy scared MNCs like Fairchild Semiconductor in setting up such facilities in India.

Unlike other south Asian countries, Taiwan took a different approach. This island economy started the journey by mastering wafer processing technologies. Taiwan’s pursued the entry route through semiconductor process technology assimilation. Hence, it got into an agreement with American RCA at a cost of $4 million in 1974 for 7.0μm CMOS process technology transfer. Interestingly, in the 1980s, India followed the footstep of Taiwan to enter the semiconductor industry. As early as 1984, the Indian government founded a 100% state-owned enterprise–integrated device manufacturer, SCL. By the way, the SCL was proposed in 1972 in the report “Planning for the Semiconductor Industry in India.” Unfortunately, India took long 12 years to move to its implementation.

The Government of India invested around $40-$70 million USD into the venture—far more than Taiwan’s $4 million. SCL began the journey in 1984 by licensing a 5-micron process technology from American Microsystems Inc. The facility established in the planned city of Mohali in the state of Punjab hired top graduates from the Indian Institute of Technology (IIT) and the Indian Institute of Science in Bangalore.

Soon after, SCL licensed process technologies from the American industrial automation company Rockwell and Japanese firm Hitachi. The former licensed technology for enabling SCL to produce its 2560G microprocessor. And for making components for their electronic wristwatch, Hitachi licensed the needed technology. Hence, SCL got equipped with technology, talent, and Government by in and foreign clients to proceed with its mission of developing the semiconductor industry in India. Unfortunately, unlike Taiwan’s ITRI, SCL failed to start the chain reaction. So, the obvious question is: what went wrong?

Fire devasted early progress, and Indian bureaucracy took too long to rebuild

Although SCL started the journey with the old 5-micron technology node, due to additional technology transfer from Rockwell and Hitachi, SCL upgraded it to 0.8 microns by the late 1980s. As a result, SCL was just one node behind NTT, Toshiba, and Intel. But an unfortunate fire devasted the facility in 1989. Due to highly flammable chemicals, fire incidence is not uncommon in semiconductor plants. Insurance records indicate that fires are one of the industry’s most common causes of operational losses. Unfortunately, in this rapidly changing industry, the Indian bureaucracy took 08 years to rebuild it in 1997—at the cost of $50 million.

Lack of strategic focus on the role of state-owned SCL

Taiwan’s ITRI aimed to assimilate imported technologies, keep improving them, and converting acquired competence into globally competitive production process capability. To derive commercial benefit from such a strategy, SCL incubated UMC in 1980, followed by TSMC in 1987. But unlike ITRI’s focused role, SCL suffered from lacking in its strategic role. Unfortunately, while TSMC started gaining momentum into 3rd party foundry model, the Government of India was searching for buyers to sell the fab. Subsequently, they retooled the SCL to make chips for telephone exchanges and smart cards. In 2005, SCL experienced another significant change of direction by becoming the R&D center for the space department (ISRO).

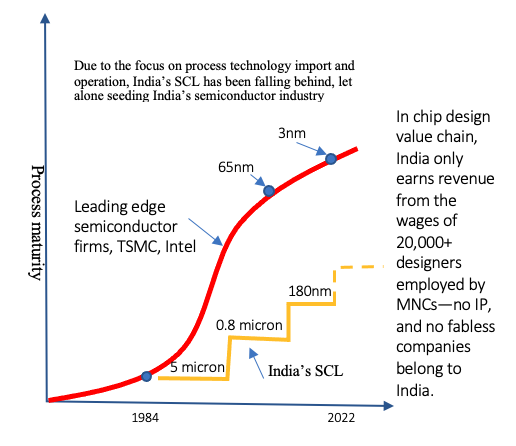

By being Government’s captive chip production plant, SCL is not even competitive in the domestic Indian market, let alone abroad. Contrary to TSMC’s exponential growth, SCL’s revenue kept falling from $14 million in 1999-2000 to $3.5 million in 2005-2006. During the same period, $400,000 in profit turned into $5.6 million in a loss. Furthermore, unlike global semiconductor firms, SCL has been very slow in upgrading its technology,. For example, it took SCL nearly a decade to reach that 180nm node.

As of today (2023), SCL is busy with R&D work for the Space and military programs with its 180nm process nodes, while TSMC has been operating its 3nm process node for the Apple A14 chip. Besides, due to a lack of focus and the absence of a strategic high-growth path, since inception, SCL has been suffering from high human resource turnover.

SCL kept focusing on technology transfer and operating imported machinery

From the beginning, SCL has been relying on transferring process technologies from foreign firms and operating. Hence, SCL’s R&D appears to focus on knowing foreign technologies instead of advancing them. For example, its upgradation from 5 microns in 1984 to 0.8 microns happened due to the technology provided by Rockwell and Hitachi. Similarly, it relied on Israel’s TowerJazz Semiconductor for uplifting its fabrication unit to 180nm in 2011. It has been now expecting another round of funding from the newly allocated $10 billion semiconductor fund for improving the process technology through import.

From such a reality, it’s not unfair to summarize that SCL has failed to develop self-innovation capability. Unfortunately, it’s vital for being globally competitive. In retrospect, SCL’s focus on operating imported technologies and failure to establish self-innovation capacity are the underlying reasons for the failure of SCL to seed the semiconductor industry’s growth in India. Besides, the lack of strategic focus is another core area of weakness.

Citing billions of dollar funding of TSMC or Samsung, some people may argue that SCL did not succeed due to a lack of funding. But the core weakness of SCL has been the weakness of creating a virtuous effect in transferring Government seed funding into profitable cashflow from commercial activities. In retrospect, the Government of India gave far more money to SCL than the Government of Taiwan made to ITRI to spin off UMC and TSMC—creating a virtuous cycle. Unless India solves this core weakness, no amount of funding will likely turn SCL or similar facilities into a seedbed for developing the semiconductor industry in India. Furthermore, SCL’s core weakness is not an exception in India. Many other state-led initiatives for pursuing import substitutions met a similar fate. One notable example is Hindustan Motors making cars through the technology transfer from the UK’s Morris Motors.

India’s Human resources fueling global semiconductor industry—but failed to develop SCL

From Google to Microsoft, Indian students are Silicon Valley superstars. We all know the reputation of Indian Science and Engineering graduates worldwide. Alongside Pichai, the current CEOs of Microsoft (Satya Nadella), Adobe (Shantanu Narayen), and IBM (Arvind Krishna), most of the Indian technology superstars did graduate studies in the USA. So did Taiwan’s Dr. Morris Chang. But why could none of them play the role the way Dr. Morris Chang did in creating Taiwan’s success? Despite hiring graduates from IIT, ISC, and many other institutions, why could SCL not grow as a seedbed as ITRI has in developing India’s semiconductor industry?

Let’s look into India’s science and engineering strengths further. In the USA, Indian students account for 18% of all international students, second only to China (35%) in the student country of origin. Furthermore, as high as 78% of Indian students in the US study Science, Technology, Engineering, and Math (STEM). According to some studies, India contributes 31.7 percent of the total STEM graduates in the world; it has one of the world’s largest STEM job markets. In addition to 23 total IITs, more than as high as 4423 Engineering Colleges in India offer B. Tech degrees; the number has been growing. According to Statista, in 2016, India alone produced 2.6m STEM graduates.

Semiconductor design services—failure to develop fabless companies

After starting the journey in 1984, SCL and other Government institutions set up dozens of training centers to meet its demand for future chip designers. But a fire incident in 1989 devasted the plan of engaging the outputs of those centers. Leading foreign chip manufacturers and design houses took advantage of the availability of such quality chip designers. Hence, they opened their chip design centers in Bangalore, Pune, Chennai, and Hyderabad. Consequentially, chip design service export started to grow in India.

According to some estimates, as high as 20 percent of global chip designers are from India—working inside and outside of India. Among them, more than 20,000 chip designers have been working in almost 250 chip centers in India. Most of these centers are captive development centers of multinational corporations like IBM, Intel, Philips, Texas Instruments, and Qualcomm.

But through this route, India could not develop a strong foothold in the chip design segment of the semiconductor value chain. There appears to be not a single home-grown IP-based fabless company, like Taiwan’s MediaTek, in India. Multinationals have been sourcing low-wage advantages by recruiting chip designers in India. It’s worth mentioning that establishing a solid footprint in the chip design segment demands not only technical competence. There has been a strong demand for conceiving chips supporting product and Process innovation.

Besides, there has been an enormous challenge in selling millions of pieces of those chips in the global market for leveraging the Economies of Scale advantage. Hence, through the growth of MNC’s design centers on Indian soil, India’s success has been in creating employment and earning tax revenue only. So far, India has not acquired the skill set for designing its chips and getting these manufactured in Indian or foreign foundries and commercializing them in a competitive market.

India’s failure in chip innovation

For developing a solid chip design cluster, India suffers from weakness in its ability to innovate, cost-effective manufacturing, develop software intellectual property, build effective supply-chain management, excellent customer service network, rich working culture, and substantial brand value. Usually, it takes decades of dedication with the support of strong engineering, technology and innovation management, and risk capital. Unfortunately, India suffers from a high attrition rate as experienced professionals prefer to immigrate. Hence, India could not turn its technical chip design competence to develop a snowball effect in creating a semiconductor cluster comprising both down and upstream segments.

Growing semiconductor consumption for foreign innovations

It’s estimated that between 2021-2026, India’s semiconductor component market will see its cumulative revenues climb to $300 billion. It has been picking up due to India’s incentive to assemble electronic products like Mobile handsets locally. But almost all the chips used in locally assembled products are designed and manufactured outside India. Even though a few are designed in India, intellectual properties (IPs) belong to MNCs. As explained, India has not succeeded in developing fabless companies with the ownership of microchip IPs. Hence, by manufacturing them locally, India will not get much economic benefit.

Subsidies for setting up production capacity through imported technology are not good enough

Recently, news of billions of dollar subsidy programs has been surfacing in support of India’s vision of graduating from chip importer to exporter. India has offered 50 percent subsidies to capital expenditure. By the way, the recent development of providing a 50% subsidy has doubled from its earlier announced 25%. Prior to it, India offered only import tax waivers for establishing such a facility in India, it seems that India has been in a race to increase incentives to allure MNCs to set up mega chip production facilities in India.

But there has been no visible improvement in SCL’s capability as an innovation engine. In retrospect, it resembles Soviet computer history. Besides, despite growing employment in the chip design service sector in captive MNCs’ design centers, there has been no growth in domestic fabless companies. Furthermore, import substitution in electronics products is limited to assembling and manufacturing. There has been no visible progress in Product innovation, giving birth to new chips which could be locally designed and manufactured. Hence, if Indian companies do not innovate and have intellectual properties in electronic products, microchips, production processes, and other equipment, what will India gain by alluring foreign microchip production through massive subsidies?

Related Articles

- Chip War

- Semiconductor Lithography Economics–fuelling Moore’s law and market power

- Microchips–invention, evolution, transformation and chip war

- Moore’s Law–fuelling monopolization, Reinvention, and migration

- Moore’s Law is Dead–Chiplet redefines semiconductor industry

- Semiconductor–illusive technology core changing world order

- Winning Chip War–fuelling reinvention waves for changing world order

- Chiplet Technology — a weak reinvention core?

- Semiconductor Economics–will Chiplet era slow down the growth?

- ASML–growing pearl gets caught in Chip War

- China’s Semiconductor Independence–prematurely caught?

- India’s Semiconductor Dream–pushed in the slow lane?

- Semiconductor Value Chain–globally distributed ecosystem

- Semiconductor IndustryWaves

- Intel Falling Due to PC and Mobile Waves

- ASML Lithography Monopoly from Sustaining Innovation

- Taiwan’s Semiconductor Monopoly – How did it arise?

- ASML TSMC Nexus Fuels Semiconductor Monopoly

- ASML Monopoly in Semiconductor — where is magic?

- SEMICONDUCTOR MONOPOLY DUE TO WINNING RACE OF IDEAS

- Semiconductor Industry Growth–personalities, new waves, and specialization underpin

- Transistor–technology core shaping global trade and power

- Loss of America’s Inventions–blame semiconductor economics?

- Soviet Computer Failure—reasons and lessons?