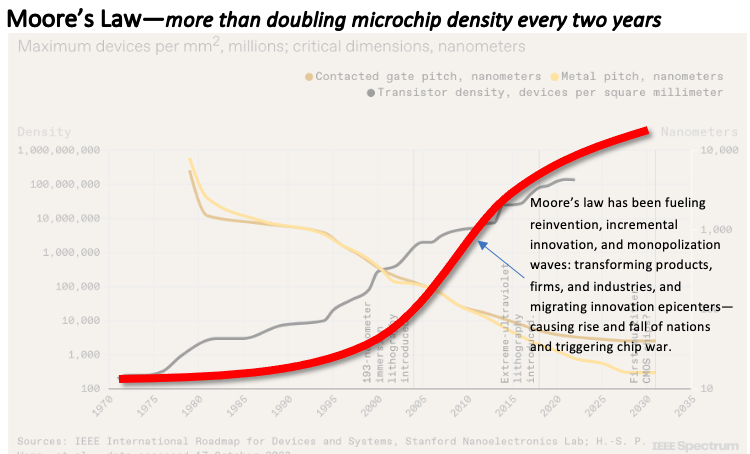

More than Moore refers to the implication of Moore’s law on fueling competition in the evolution and monopolization of Innovation. Moore’s law states that the number of transistors in a dense integrated circuit (IC) doubles every two years. Consequentially, chip density has increased from 1 before 1959 to 135.6 million per mm2. Due to the success of keeping Moore’s alive for over 60 years, the semiconductor industry made tremendous progress, reaching $600 billion in revenue in 2022. To benefit from the underlying science and technology to keep increasing chip density, as Moore’s law predicted, a race of innovation was sustained. Consequently, due to the growing specialization, the semiconductor industry started vertically disintegrating, forming the value chain.

Furthermore, the scope of increasing specialization through a Flow of Ideas led to winners, resulting in monopolization in each layer. The long journey of making transistors smaller and better has been the underlying cause of the growing semiconductor industry. Due to it, a series of Reinvention waves of major products kept unfolding. Consequently, several industries, such as consumer electronics, cameras, computers, and telephones, have undergone a transformation.

But there has been an unfolding reality that Moore’s law is on its path of getting dead. The underlying reason has been that the scope of improving the quality and reducing the cost through chip density increase has been shrinking. High-end process nodes are showing signs of increasing per-component cost. Growing capital expenditure and falling defect size, contributing to decreasing yield, have been the underlying cause. Hence, an unpleasant reality is gradually unfolding—Moore’s law is on its way to get dead. As a result, the semiconductor industry has been reluctantly embracing the quality-cost trade-off reality—fueling the chiplet era. It’s widely anticipated that the chipset-based design approach of a complex system in a package (SiP) will keep transforming the semiconductor industry. Instead of specialization, commoditization may start surfacing, weakening the monopoly edge.

Genesis of Moore’s Law

In 1947, three scientists at Bell laboratories invented the first Transistor. It is a three-legged solid-state device having amplification and switching behavior. Due to its smaller size and higher reliability, it emerged as a candidate of alternative to vacuum tubes and electromagnetic relays in making computers, consumer electronics, and telephone switches—among others. But its fabrication cost, as high as $100 apiece in 1957, was a barrier to its diffusion. But the invention of a technique of producing multiple discrete components with interconnections on the same silicon substrate (known as a wafer) led to the invention of integrated circuits (IC). The evolution of IC-powering semiconductor economics is the genesis of the formation of Moore’s Law in 1965.

Since the invention of integrated circuit technology in 1959, the number of transistors on the same die or chip has kept increasing due to semiconductor economics. The primary reason was that as engineers succeeded in producing smaller transistors and placing them closer on the same chip, the cost per component kept falling. Besides, the quality attributes like per component size, power consumption, and noise kept falling; the switching speed also kept rising. Hence, process engineers kept generating ideas to improve wafer quality, lithography techniques, chemicals like photoresist, vapor deposition, and etching techniques to increase microchips’ transistor density. Furthermore, chip designers kept focusing on designing major circuit building blocks and integrating them as a single IC.

In an article in 1965, Dr. Moore summarized the trend of the growth of transistor density and cost reduction. He found that the success of IC in reducing the component cost due to growing density already led to doubling chip density every year. He later updated it to 18 months, followed by 24 months.

Underlying Science and Technology

Semiconductors are called materials like silicon, germanium, gallium arsenide, and elements near the “metalloid staircase” on the periodic table. They are neither insulators nor conductors. The experimental study of the electrical properties of semiconductor materials started in the early 19th century. Scientists observed the change in conductivity of semiconductor materials due to heat and light. However, clarifications of experimental observations had to wait until the development of quantum mechanics in the early part of the 20th century.

The development of quantum mechanics helped scientists to invent techniques for adding impurities such as boron or arsenic into intrinsic semiconductor materials. As a result, they succeeded in predictably increasing the density of electrons or placeholders of electrons (holes) forming n-type and p-type extrinsic semiconductor materials. They also succeeded in adding different types of impurities in two different sections of the same semiconductor substrate, forming a p-n junction diode. Subsequently, they invented a transistor with two junctions in 1947. Due to the knowledge of quantum mechanics, they could figure out our rationales for changing junction formation, leading to an array of semiconductor device refinement and invention. Furthermore, quantum mechanics enabled in fine-tuning doping, etching, cleaning, and many other wafer processing techniques. Consequentially, such advancement kept increasing chip density—giving birth to Moore’s law and keeping it alive for 60 years.

Technology

There have been three significant technological developments in favor of keeping Moore’s law alive. Of course, the first one is the invention of IC. The other two are lithography and the invention of an array of transistor designs. For example, the bipolar transistor took over the initial invention of the point-contact transistor. Subsequently, the invention of MOSFET opened a better option for increasing chip density. Although lithography has a long history, its continued advancement leading to Deep UV (DUV) and Extreme UV (EUV) lithography steppers has been playing a vital role in reducing transistor size. Consequentially, its role in keeping Moore’s law alive has been pivotal.

More than Moore

Rise of Monopoly

As chip density growth kept reducing per component cost and increasing the quality, the race to produce ideas in all areas of chip production started and sustained. Hence, specialization started to grow, leading to vertical segmentation. It began with the growth of the silicon crystal with increasing purity. Consequentially, a monopoly in the wafer segment surfaced due to specialization and patent barriers. In the race, Japan succeeded in attaining a monopoly in the wafer.

To project the decreasing size of devices, the race to improve lithography started. The invention of semiconductor lithography by Bell Labs started to form lithography machine makers like GCA in America. GCA pioneered photolithography, a vital technology for benefiting from Moore’s law. Subsequently, a few other American companies entered the lithography market, followed by Japanese companies Canon, Nikon, and Hitachi. But in the race to offer lithography machines for increasing chip density, American companies failed; subsequently, Japanese companies established a near monopoly situation in the 1990s.

But the decision of late-entrant ASML to pursue extreme UV light sources for reducing component dimension to the sub-10nm range so that 10s of billions of transistors could be produced on the same chip changed the competition scenario. After 20+ years of R&D, ASML succeeded in offering a EUV lithography machine for packaging transistors of sub-10nm dimension. ASML’s success has not only made it a monopoly in semiconductor lithography but also it helped TSMC to grow as a monopoly in high-end chip making.

To support chip density, monopolies have grown in electronic design automation (EDA) software. American companies such as Mentor Graphics, Synopsis, and Cadence are dominant players. Furthermore, specialized equipment manufacturers have emerged from the USA and Japan. In Chemicals and Gases, Japanese and German companies have a monopoly position. And British ARM has a monopoly in the processor core.

Moore’s law powered reinvention waves and incremental innovations transforming products and industries—migrating innovation epicenters

In the beginning, semiconductors like transistors could not make products better and cheaper by replacing vacuum tubes or electromagnetic relays. Compared to RCA’s vacuum tubes, priced at $1 apiece, Fairchild’s $150 apiece transistor was way too expensive. Hence, companies like RCA or Texas instruments making vacuum tube Radios and Televisions did not pursue it. Due to its smaller size, it found the market in tiny devices like hearing air or highly weight-sensitive applications like fighter jects and space vehicles.

But finding ways like lithography and integrated circuit to increase chip density, consequentially giving the birth of Moore’s law, started to fuel the reinvention power of semiconductors. Hence, Sony’s humble beginning of reinventing Radio, Television, and other consumer electronics products began getting better and cheaper. The continuation of this trend led to the rise of Creative Destruction, unleashing Disruptive innovation effects on American and European firms. As a result, the epicenter of America’s billion-dollar radio equipment industry migrated to Japan. The same fate unfolded for Television receiver makers, forcing more than American firms to lose their TV set-making business. And it kept happening in many other products like VCRs, Displays, and Camera, raising a vital question: America cannot competitively manufacture its inventions.

Apart from reinventions, by leveraging smaller, better, and cheaper semiconductor devices, a growing number of products started to gain an edge through Incremental innovation. In this race, once dominant firms started losing the edge. In some cases, the innovation epicenter of certain products also migrated across the boundaries of firms and nations. Furthermore, in the race to pursue Moore’s law, the USA’s Silicon Valley lost the edge in silicon processing to Taiwan’s TSMC.

More than Moore is far more than doubling chip density

In retrospect, Moore’s law does not only tell us about the history of doubling chip density every 24 months. The implication of this achievement on transforming products, industries, innovation epicenters, and nations is quite formidable. Notably, the rise of Japan, Taiwan, and South Korea to the status of the high-income country could not have been possible without the continuation of Moore’s law. Furthermore, Moore’s law has been at the root of offering increasingly better alternatives to existing products. Besides, it kept fueling monopoly in each layer of the semiconductor industry. Once Moore’s law is dead, which technology core will be helping transform products and helping aspiring developing nations to reach high-income status?

Moore’s law is dead—chiplet era redefines semiconductor industry

Due to growing monopolization out of smart leveraging of Moore’s law, the semiconductor industry’s edge has been migrating. For example, Silicon Valley can no longer make the best chips. America’s semiconductor icons like Intel have lost their glory. Despite inventing transistors and many other critical technologies for designing and making chips, America relies on Taiwan’s TSMC to supply more than 90% of high-end chips. Hence, America’s innovation icon Apple solely relies on TSMC.

On the other hand, China has been aggressively progressing towards acquiring high-end chip-making capability. Such development has led to terming semiconductor edge a national security concern by the US government—triggering the chip war. But there has been a growing sign of making Moore’s law dead. Its implications on the semiconductor industry could be transformative—making the chip war irrelevant.

Upon losing the process node battle to TSMC, integrated device makers (IDMs) like Intel have been after chiplet. Furthermore, rising capital costs and falling yield due to decreasing size of tolerable defects have increased the importance of chiplet. Instead of making a microsystem on a huge monolithic chip, the option of designing and fabricating it as a group of chiplets. Subsequently, these chiplets are packaged as a system in package or SiP. In the chiplet era, monopoly will likely diffuse and fade the importance of chip war, among many other implications.

The continuation of Moore’s law through advancing device, design, and process technologies has played a critical role in shaping the semiconductor value chain. Its transformative effects on products, firms, industries, and nations have been formidable. Its growing importance and monopoly status have triggered a chip war. But the technology limitation underpinning semiconductor economics has been making a case that Moore’s law is dead. Consequentially, the rise of chiplet ear will likely have profound implications—redefining the semiconductor industry.

...welcome to join us. We are on a mission to develop an enlightened community for making the world a better place. If you like the article, you may encourage us by sharing it through social media to enlighten others.

Related Articles:

- Chip War

- Moore’s Law is Dead–Chiplet redefines semiconductor industry

- Semiconductor–illusive technology core changing world order

- Winning Chip War–fuelling reinvention waves for changing world order

- Chiplet Technology — a weak reinvention core?

- Semiconductor Economics–will Chiplet era slow down the growth?

- ASML–growing pearl gets caught in Chip War

- China’s Semiconductor Independence–prematurely caught?

- India’s Semiconductor Dream–pushed in the slow lane?

- Semiconductor Value Chain–globally distributed ecosystem

- Semiconductor IndustryWaves

- Intel Falling Due to PC and Mobile Waves

- ASML Lithography Monopoly from Sustaining Innovation

- Taiwan’s Semiconductor Monopoly – How did it arise?

- ASML TSMC Nexus Fuels Semiconductor Monopoly

- ASML Monopoly in Semiconductor — where is magic?

- SEMICONDUCTOR MONOPOLY DUE TO WINNING RACE OF IDEAS

- Semiconductor Industry Growth–personalities, new waves, and specialization underpin

- Transistor–technology core shaping global trade and power

- Loss of America’s Inventions–blame semiconductor economics?