Over the last 20 centuries, the population, per capita GDP, and average life expectancy have been growing simultaneously. How to explain such an apparent contradiction is a matter of concern. On the other hand, countries like Japan, having very little per capita natural resources, are very prosperous. But countries like India, Brazil, or China are not equally wealthy, despite having a large labor pool and rich natural resource stock. Furthermore, most countries stop growing after a certain growth period, while a few succeed in keep growing per capita income to reach high-income status. The underlying reason has been the idea economy.

We are all after Wealth, more wealth. But the natural resource stock of the planet is limited. On the other hand, the wealth creation process out of the extraction and transformation of natural resources causes harm to the environment. Hence, the human race has been facing the challenge of creating increasing wealth from depleting resources to meet growing consumption. Therefore, existing natural resource stock extraction and transformation methods are insufficient to meet this challenge. But fortunately, we can introduce new ideas to extract more wealth from the same resources while causing less environmental harm.

Ideas are vital for increasing our capacity to produce more wealth from the same amount of natural resources, labor, and other inputs. Hence, Paul Romer articulates economic value creation as a function of ideas and objects: O=f(A, X). But does it mean that Flow of Ideas is good enough? Furthermore, everybody has the capability of producing ideas. Despite it, why have we been observing growing inequality? Furthermore, will knowledge acquisition and sharpening of creativity keep increasing wealth creation out of ideas—strengthening the idea economy?

The genesis of the idea economy

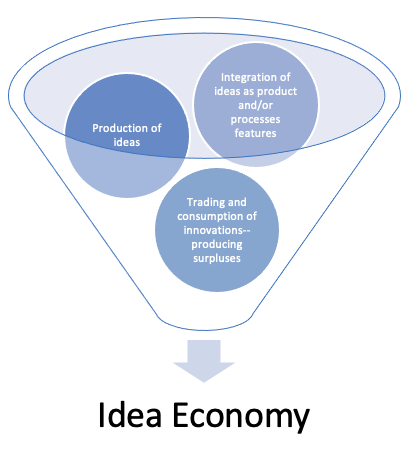

Idea economy pertains to idea production, trading, consumption, and benefit extraction—producing both consumer and producer surpluses. It happens that idea is the most powerful among the four primary sources of wealth creation, such as natural resources, labor, knowledge, and ideas. It has the capacity to open an endless frontier of wealth creation. In the report “Science the Endless Frontier,” Prof. Vannevar Bush underscored the power of ideas to the President of the United States.

Although knowing is useful. But knowledge alone does not create wealth. It must be fed to our creative process to produce ideas for improving products and/or processes in offering us better means of performing jobs. Hence, to increase the flow of ideas, there has been a necessity to increase the supply of knowledge.

It appears that knowledge gathering and idea production for finding better means of Getting jobs done is human beings’ inherent tendency. Hence, it’s not surprising that Carl Marks noticed repeated such observations recorded in ancient philosophical writings. Therefore, the idea economy is not new. It has been with us since our existence on this planet. Due to it, we have succeeded in extracting increasing wealth from the same resources.

For example, although we started using iron ore to produce paint, we have succeeded in developing magnetically levitated (Maglev) trains. For sure, we have been extracting far more wealth from Maglev than the use of iron for many other purposes. The underlying reason has been the production and deployment of ideas for improving the iron use to serve our purposes better. But due to ideas, why are not every human being, firm, industry, and country getting equally benefited? Furthermore, why can inventors not keep profitably producing their ideas?

Characteristics of ideas and scalability

Each of us produces ideas to deploy available tools to get jobs done. But those ideas are not sufficient to develop business. Even ideas that have succeeded in building large companies did not appear to be instant successes. For example, the computer emerged as a primitive big machine. Similarly, a 5MB hard drive weighing 1 ton hardly had any customers. Likewise, Carl Benz’s automobile did not initially find many customers.

At the core of the success of ideas in creating wealth, thereby idea economy depends on scalability. It refers to conceived ideas of products or processes that should be amenable to progression through a flow of ideas to improve quality and reduce cost. Hence, the production of ideas is not good enough. They should be grown with a flow of ideas, forming profitable businesses—thereby creating or expanding the idea economy.

Organized rise of idea economy—market economy and industrial revolutions

In the preindustrial age, our ancestors were as creative as we are. They also had the intense urgency of producing ideas for improving products and processes to perform their jobs better. But they used to rely on intuition to gather knowledge to create ideas and Craftsmanship for their implementation. As a result, their ideas were not scalable. Hence, their idea economy could not flourish. As a result, despite having a far less population, their quality of life was far poorer than ours.

During the 16th and 17th centuries, British-led Western Europe focused on developing scientific methods for expanding our knowledge acquisition capacity. Furthermore, they also adopted a few essential principles in organizing economic activities to encourage wealth creation out of ideas. These principles are (i) possession of private capital, (ii) ownership of ideas, (iii) profit-making fair competition in generating and exploiting ideas in offering us better means, and (iv) investment in knowledge acquisition and production. Consequentially, rapid economic growth started in the UK, followed by Western Europe, forming the first industrial revolution.

Subsequently, the 2nd industrial revolution started due to the production and deployment of ideas, exploiting electrical science. Unlike the first one, the USA led the 2nd, leading to the rise of the USA. As the USA led the 3rd industrial revolution by exploiting semiconductor science and software, the USA still has a robust idea economy.

Creative Destruction and Disruptive Innovation make the Idea economy transitory

Irrespective of the greatness of ideas, and the strength of the flow of the complementary ideas, every great idea saturates, forming an S-curve-like lifecycle. At maturity, further growth slows down, limiting our progress in getting jobs done better. As it slows down the scope of profiting from ideas, the competition force encourages reinventing matured ideas by changing the technology core. For example, due to its maturity, the light bulb has been reinvented as CFL, followed by LED ones. As a result, new waves out of Reinvention grow and cause creative destruction to the matured waves. Sometimes, new entrants, instead of incumbent ones producing matured products, pursue those reinvention adventures and incumbents fail to make timely switching. Consequentially, incumbent firms suffer from disruptive innovation effects due to the rising creative force of destruction.

Migration of idea epicenter across the boundary of firms and nations

As explained, sometimes, new entrants pursue reinvention to form a new wave of growth of existing matured products. And incumbent firms fail to switch. Those new entrants could be from within the same country or anywhere in the world. As a result, due to the suffering from disruptive innovation effects, the idea epicenter migrates across the boundaries of firms and nations.

For example, Thomas Alva Edison came up with the light bulb idea. He also succeeded in developing a business, GE, out of it. But, the epicenter of the light bulb idea has migrated from the USA to Japan due to the reinvention success of Nichia as LED. Similarly, epicenters of ideas of cameras, TV, hard disk storage, solid state memory, and many more have migrated from the USA to Japan and a few other countries. Due to this reality, the prosperity of the idea economy keeps migrating, making wealth creation success out of ideas transitory.

Ideas make the market value of labor and natural resources transient

In addition to creating new wealth, ideas also make the market value of labor and natural resources transient. For example, silicon did not have much market value 70 years ago. But pure silicon is now highly expensive due to the growth of semiconductor ideas. Similarly, the market value of petroleum products has grown due to the growing diffusion of automobile ideas. But the market value of petroleum runs the risk of falling due to the growth of electric vehicles and renewable energy.

Similarly, due to the growth of the idea of automation, low skilled labor force of less developed countries has qualified for factory jobs. But the further development of automation ideas will likely make the same labor force irrelevant to the production.

Winner takes all in idea economy—increasing inequality

Although idea creation is the by-birth gift of every human being, its’ exploitation has been benefitting decreasing number of individuals, firms, and nations. This is due to competition in profit from ideas, in making products better and cheaper. As a result, the winner succeeds in attaining price-setting capability. Consequentially, the winner monopolizes the market, leaving nothing for others. Hence, an idea economy tends to increase wealth accumulation and expand inequality.

Idea economy tends to facilitate wealth accumulation and annihilation in Capitalism

During the rising phase of the invention or reinvention waves, better-performing firms keep gaining market power to set the price to make a profit while compelling weaker firms to keep losing. This race of advancement through incremental advancement leads to a winner, monopolizing the market. As a result, the share prices of winning firms keep appreciating. Furthermore, winning firms also succeed in declaring lucrative dividends to shareholders. Employees also start getting an increase in salary and bonuses. As a result, individuals associated with winning firms, whether employees or shareholders, keep accumulating wealth. But if new entrants pursue reinvention waves, and incumbent monopolies fail to make timely switching, high-performing firms busy producing matured products suffer from disruption. Consequentially, share price and profitability start falling sharply, resulting in wealth annihilation. Hence, idea economy tends to wealth accumulation and annihilation in capitalism. But smart firms can avoid it through self-reinvention.

Idea economy is at the core of opening endless capacity of creating wealth while causing less harm to the environment. But it requires a smart strategy for creating a systematic flow of ideas to outperform the competition. Moreover, the idea economy keeps migrating due to creative destruction and disruptive innovation. Furthermore, idea competition has a natural tendency to monopoly. Hence, we need an intelligent strategy and governance framework to build and profit from an idea economy.

...welcome to join us. We are on a mission to develop an enlightened community for making the world a better place. If you like the article, you may encourage us by sharing it through social media to enlighten others.