Among the top five most expensive companies, four are technology monopolies. Unlike Aramco, these companies have become so expensive due to their monopolistic situation in the accumulation of technology ideas. The success of Microsoft, Apple, Tesla, Toshiba, Alphabet, Amazon, Facebook, and many more are distilled from technology monopoly. As reported in WSJ, “Intangible assets accounted for more than 80% of the total $25 trillion in assets of S&P 500 companies as of 2018.” But through IP asset accumulation, how do companies attain Monopolistic market power?

Despite the growing market, why does the number of competing firms keep falling? For example, in the hard disk market, there were 85 makers in 1984—but they fell to six in 2009. Similarly, Microsoft Word became the sole survivor in the competition war of more than 30 word processor makers in the 1980s. The number of firms in the competition race for 3D NAND flash memory has fallen from 20+ in the 1990s to six in 2022. But what are the forces in succeeding as technology monopolies? Does it happen all of a sudden, or is there a systematic pattern in gaining the market power to emerge as a technology monopoly?

Key takeaways of technology monopoly

- Technology monopoly–technology monopoly is the underlying success factor of a growing number of highly expensive and profitable companies like Apple, Amazon, and Google.

- Technology affects monopolistic market power accumulation–unlike conventional means like collusion, technology monopoly is the outcome of an Innovation race in offering higher quality at less cost, resulting in creating technological Economies of Scale, scope, positive externalities, and common application platforms.

- Process of the emergence of technology monopoly–the race of generating and leveraging ideas out of technology possibilities for saving material, energy, time and labor, creating positive externalities, generating Economies of Scope effect through a common platform, and increasing willingness to pay leads to the emergence of a winner–technology monopoly.

- Software and connectivity powering growing technology monopoly–due to the zero cost of copying software and the Network effect of connectivity, the growing role of software and connectivity in products and processes has been intensifying market power accumulation, leading to growing technology monopolies.

- AI adds new momentum to technology monopoly–the possibility of replacing humans’ cognitive role in making and using products with software and connectivity-centric artificial intelligence(AI), technology monopoly will likely intensify.

- Examples of technology monopoly–Here are a few examples and the underlying technological reasons:

- Microsoft--operating system as vertical foreclosure asset and scale effect of software innovations like Microsoft Office Suit.

- Spotify and Netflix–the zero cost of copying digital products like music and video and positive externalities of Internet and devices like smartphones and smart television.

- Apple–high perceived value for ideas implemented through software and 3rd party software applications.

- Google and Facebook—high positive externalities through network effect and leveraging of the platform as vertical foreclosure assets.

Table of contents

- Defining technology monopoly

- How can technology affect monopoly?

- Examples of technology monopoly

- Limitations of Antitrust Laws in dealing with technology monopolies

- Examples of the disruption of technology monopolies

- How to overcome technology monopolies

Defining technology monopoly

Technology monopoly refers to outperforming the competition in the innovation race by offering higher quality at less cost through leveraging technological economies of scale, scope, positive externalities, and vertical foreclosure assets. Let’s look into these underlying factors further:

- Scale–high R&D cost of generating ideas for improving the quality and saving material, energy, time and labor, increasing implementation of those ideas through software, and zero or negligible cost of replicating ideas in serving each customer, technology possibilities create economies of scale effect.

- Scope–due to the commonality and negligible cost of replication, the rescue of intellectual assets–notably in software form– between products leads to creating economies of scope effect out of technology

- Positive externalities–the growing role of software and connectivity powers ideas for increasing the perceived value of products with the growth of the user base.

- Platform as vertical foreclosure strategy asset–the development of a platform out of technology possibilities–such as OS, search engine or could platform–to power a family of products could be leveraged to deny or limit access to both upstream and downstream players.

Technology monopolies are not like conventional ones, which grow due to collusion and regulation as rent seekers. Instead, technology monopoly is the outcome of the competition of winning the innovation race for offering better quality at less cost through a Flow of Ideas, resulting in winner-takes-all. Due to the zero cost of copying software and the network effect of connectivity-centric innovation, modern technology cores powering the Reinvention of existing goods and services have been expediting the technology monopoly effect in a growing number of industries.

In an industry or sector, if a single seller or producer assumes a dominant position, we call it a monopoly. In the Market Economy, it is discouraged as monopoly stifles competition and prevents the sustaining and emergence of substitutes. Hence, monopoly is considered as harmful. Hence, regulators have come up with antitrust laws to limit the market power of a single firm. But is technology monopoly harmful? Are conventional measures of Antitrust laws like preventing mergers or acquisitions and breaking monopolies into smaller businesses beneficial to leveraging increasing benefits from technology possibilities?

How can technology affect monopoly?

The most important force is the option of getting ideas for making products incrementally better and cheaper–simultaneously. Upon leveraging this option, firms producing and trading even conventional products can succeed in monopolizing the market. For example, Rockefeller succeeded in monopolizing America’s oil business. He set up an R&D center for producing ideas and implementing them in exploring, producing, and refining oil. He succeeded in having a flow of ideas for increasing the success of finding oil reservoirs, producing more oil than before from the same reservoirs, and improving the quality of the refined oil.

Technological innovations, irrespective of their greatness, begin the journey in primitive form, producing no or loss-making revenue. Starting from Phonograph and hard disks to word processors and smartphones, this is true. Hence, technology monopoly does not emerge with the debut of inventions and innovations. By the way, it’s also true that often, a single company triggers the emergence of technological innovations but generates a loss-making revenue.

For sure, we are not concerned about such a monopoly. For example, IBM was the first to release a hard disk in 1957 and a smartphone in 1994. But the customer base for 5MB hard disk, weighing 1 ton, was a handful—producing paltry revenue. Similarly, being the first to release the smartphone Simon, IBM suffered a loss and retracted from the market. Instead of being solo loss-making producers, we are concerned about monopolizing large technology innovation businesses, like the way Microsoft has done in a word processor or Apple has done in a high-end smartphone.

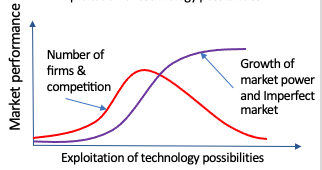

As opposed to sudden appearance due to collusion, inventions, or regulatory interventions, technology monopoly appears slowly along with the growth of innovations. It takes place due to the leveraging of ideas in the form of scale, scope, externality, and vertical foreclosure effects.

Scale, scope, externality, and vertical foreclosure power technology monopoly

Although a single producer releases a technological innovation, a growing number of firms start entering the market to make a profit from growth potential. As ideas offer the opportunity to make products better and cheaper, a race starts picking up among the competing firms. In making products better and cheaper, scale advantage keeps growing. As a result, some of the firms start showing better performance than others, forcing poorer-performing firms to leave the market.

Technology progression keeps empowering innovating a family of products, creating the scope advantage. For leveraging, innovators keep performing commonality and variation analysis and forming the core asset for reusing among family members. However, not all competing firms keep taking advantage of the scope equally. Hence, better-performing firms keep gaining market power out of scope advantage. For example, unlike Apple, Nokia had to confront dozens of OS for smartphones; Apple developed the same core OS for its diverse products, like iPod, iMac, MacBook, and iPhone. As a result, Nokia took a long, unpredictable time to respond to Apple’s iPhone debut, leading to its departure from the competition race.

The next attribute contributing to gaining market power for monopolization is positive externality effects, including the network effect. Smart innovators focused on designing their products to support the growth of 3rd party component plugins. By leveraging technology progression, they also start focusing on creating a network effect—a positive Externality Effect with the growth of customers. Hence, by showing better performance in creating a positive externality effect, smarter firms place competing firms in a disadvantageous position.

The last one is creating and leveraging platforms as a vertical foreclosure asset. By applying a vertical foreclosure strategy, platform-owning companies place competing firms in a weaker position. Hence, smarter firms keep leveraging technology progression in creating scale, scope, and externality effects and applying vertical foreclosure strategy to form a technology monopoly.

Examples of technology monopoly

Among the examples of technology monopolies, Microsoft, Apple, Spotify, Google, Amazon, Toshiba, and Facebook are notable. Here is a bit of clarification about monopolies in personal computers, smartphones and the Internet.

- Personal computer monopoly--By applying a vertical foreclosure strategy around the Windows Operating system and adding numerous features to the Office suite, Microsoft emerged as a poster child of technology monopoly. As the cost of copying software is zero, Microsoft keeps adding all conceivable features to its Office suite—leaving no pockets for the competing firms. Furthermore, it took advantage of the Windows operating system to leverage the platform benefits. Hence, even upon being a late entrant, Microsoft emerged as a technology in the monopoly PC-based office computing market.

- Smartphone monopoly–The second poster child is Apple. Upon converting mobile handsets from electronic gadgets to software-intensive devices, Apple embarked on adding numerous software features. Furthermore, it also focused on creating positive externality effects by opting for component plugins for iPhone—through the App Store. As a result, Apple has succeeded in monopolizing the high-end smartphone market, forcing even market leader Nokia out of the mobile handset business.

- Internet monopolies–Google and Facebook are recent emergences of technology monopolies. Both of them have been leveraging the network externality effects—bigger is better and cheaper. Furthermore, their three-party business model innovation has contributed to leveraging the network effect. Besides, software-based implementation of ideas has created immense supply side scale and scope effects in turning them into technology monopolies.

Limitations of Antitrust Laws in dealing with technology monopolies

Antitrust laws in the USA encompass a broad group of state and federal laws designed to regulate businesses to ensure fair competition. These laws limit the market power of any particular firm. They do so by restricting the market power, concentrating mergers and acquisitions as well as breaking up firms having monopolistic market power. They prevent firms from colluding or cartel formation so that they cannot limit competition and charge unjust prices to customers through price fixing.

As explained in the technology sector, the race to increase quality and reduce cost through a flow of ideas has a natural tendency to attain market power. Often, breaking tech firms or preventing mergers and acquisitions limit innovation ability. Hence, applying antitrust laws in dealing with technology monopolies risks causing more harm than good. In some cases, the rise of the next wave of reinvention plays a far more significant role than the applications of conventional antitrust interventions to serve the intended purpose. For example, the smartphone, foundry service, and fabless company wave has taken over Intel’s monopolistic market position.

Due to virtually infinite scale economies of software and data and increasing perceived value stemming from network effects, bigger is often better and cheaper in the technology industry. Hence, the temptation to separate Amazon’s retail and cloud computing businesses, breaking up Alphabet into search, email, Android, YouTube, and other companies should follow a cautious approach.

Policy vs Antitrust laws

As reinvention dynamics keep unfolding in the marketplace to fuel and destroy the market power, should we focus on strengthening the market or applying antitrust laws by the Department of Justice? As the application of US-style antitrust laws suffers from the debatable outcome of regulating competition in the US tech sector, there is a burning question: What specific policy interventions will do the most good and the least harm?

Examples of disruption of technology monopolies

Despite legal measures, in retrospect, the Creative Destruction effects of reinventions appear to be a frequent cause of the disappearance of technology monopolies. Here are 10 examples of the disruption of monopolies due to the rise of creative destruction waves out of reinvention:

- Nokia in mobile phone handsets–due to the aesthetically pleasant design and precision manufacturing, Nokia emerged as an unsinkable Titanic in mobile handset making. However, the rise of iPhone-like smartphones did not take long to erase Nokia’s monopolistic market power in the mobile handset business.

- Research in Motion (RIM) in smartphones–with the Blackberry model, RIM emerged as a monopoly in full-qwerty keyboard-based highly secured mobile communication handset business. Apple’s iPhone, as a reinvention wave of smartphones, destroyed RIM’s monopoly within a few years.

- Kodak in camera–Sony’s digital camera melted Kodak’s monopoly in film cameras like ice cream, creating the Kodak moment.

- DEC in minicomputer–rise of the PC wave crashed DEC’s monopolistic market power in the minicomputer business, forcing this high-performing technology company to file bankruptcy.

- Microsoft in Internet browser–The US Department of Justice applied several punitive measures to weaken Microsoft’s monopoly in the Internet browser market. However, the ultimate solution came from Google’s Chrome.

- Sony in portable music players–with Walkman, Sony emerged as a monopoly in portable music players. Apple’s iPod showed a magical performance to take away this monopoly from Sony.

- Apple in music distribution–Apple lost its monopolistic music distribution through iTunes and iPod to the rising smartphone-based streaming wave of Spotify.

- GE in lighting–the invention of the light bulb and continued market power through incremental advancement and complementary asset development led to GE’s monopolistic position in the lighting business. Unfortunately, GE lost it to tiny Nochia due to the rise of LED as a reinvention wave in lighting innovation.

- RCA in Radio and TV— American RCA was a pioneer in developing the Radio and Television business. However, Sony’s success of reinventing radio and television by changing the vacuum tube technology core destroyed the RCA’s monopolistic market power.

- Palm in PDA–Jeffry Hawkins’s magical innovation Palm Pilot lost its monopolistic position in the PDA market to smartphones as smartphones disrupted the PDA market.

How to overcome technology monopolies

Instead of collusion and regulatory measures, technology monopolies emerge due to the race to pursue ideas to keep increasing better value at a decreasing cost. Hence, the race to attain technology monopoly has been a blessing for consumers. But once the monopoly state is achieved, the winner is reluctant to invest in further enhancement. Particularly, monopolies prefer not to invest in high-risk reinvention, forming the creative destruction wave. But such investment is essential to keep opening the next path of growth. Hence, despite the beneficial effect of the monopoly race, society badly demands to destroy the monopoly of the mature wave by fueling the next wave of creative destruction. Hence, society should invest in basic research and foster innovation and Startups. Furthermore, measures should be taken to prevent the incumbent monopolies from buying startups pursuing the reinvention wave and burying them.

Specific recommendations for dealing with technology monopoly:

- Funding basic R&D--for powering reinvention waves, public funds should go for basic research to invent alternative technology cores.

- Focusing on technology dynamics and synchronized response–technology inventions are not good enough to fuel the next waves for unleashing Disruptive innovation effects on incumbent technology monopolies. Focusing on technology innovation dynamics plays a crucial role in a synchronized and timely response.

- Fostering startups--as incumbent monopolies are reluctant to pursue the next wave, startups should be fostered to drive new reinvention opportunities.

- Preventing buy and burry strategy— regulatory measures must prevent incumbent technology monopolies’ strategy from buying and burying startups pursuing the next waves.