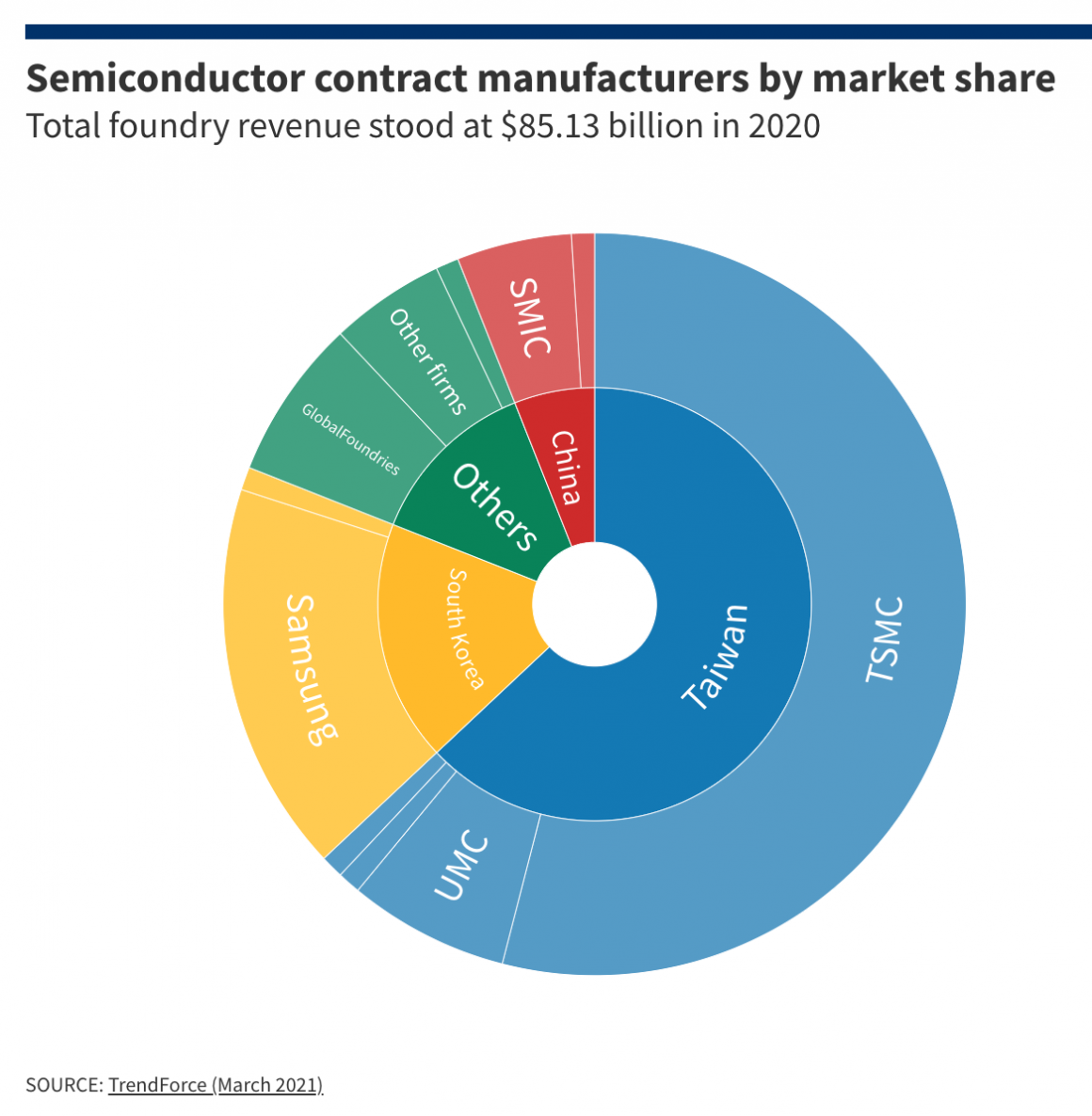

More than sixty percent of global Foundry output is from Taiwan. Besides, TSMC alone has a 54 percent global Foundry market share. These two numbers are good enough to show the gravity of Taiwan’s semiconductor monopoly- fueling the Chip War. Apple, Nvidia, QUALCOMM, and many other fabless companies depend on the foundry services of TSMC. Fabless companies send their designs to Foundries to print them on silicon wafers. Just more than 30 years ago, this model of chip-making with the 3rd party foundry service emerged—to serve small pockets of the market. But it has emerged now as the most preferred option, destroying the integrated device manufacturing (IDM) model.

Furthermore, nobody else can process silicon better than TSMC. Hence, while Intel keeps struggling to upgrade to 7nm fabs, TSMC has a virtual monopoly in the 5nm segment of chip making. For this reason, companies innovating the best chips are waiting for TSMC to print their designs. But how has Taiwan, TSMC in particular, attained this unparalleled excellence?

As we know, semiconductor or silicon chip-making is a very complex process. It requires more than a thousand steps to process silicon wafers to print the designs. Among many performance indicators (KPIs), three are significant ones: device size, yield related to defect density, and Economies of Scale of ever-growing expensive fabs or processing plants. Taiwan has attained a virtual monopoly due to its unbeatable performance in these three KPIs. But being a late entrant, how Taiwan’s crown TSMC achieved this excellence is intriguing. Has it just happened out of bad or good luck as magic? Or, there have been underlying patterns. Due to the critical importance of semiconductors, we should look at a deeper level than what appears on the surface so that people can make better choices.

Economies of scale-out of sharing gave birth to foundry: seeding Taiwan’s semiconductor monopoly

At the root of success are the economies of scale resulting from sharing a highly expensive foundry resource that no single client can attain. Upfront capital expenditure for the fab is very high, in the billions of dollars range. Hence, no single fabless company could attain the minimum efficient scale to serve its demand. On the other hand, fabless companies could not collectively set up fab due to IP issues. Besides, fabless companies also needed processed silicon chip testing and packaging services. Hence, it has turned into a typical example of Innovation evolution leading to revolution through consistent incremental advancement and cluster formation for taking advantage of economies of scale, scope, and positive externalities.

Key takeaways of the semiconductor monopoly of Taiwan

- Taiwan semiconductor monopoly examples–

- Taiwan’s market share in the world’s semiconductors is 60% and over 90% of the most advanced ones belong to Taiwan.

- Taiwan Semiconductor Manufacturing Company (TSMC) has 90 percent global market share of of high-end microchip production.

- In 2022, TSMC recorded a market share of 56.4 percent in the global semiconductor foundry market, and TSMC foundry market share increased further, reaching 56.4% in the second quarter of 2023.

- In outsourced assembly and test (OSAT) – the downstream part of the industry’s supply chain–Taiwan had 51 percent global market share in 2022.

- Taiwan’s MediaTek had a 33 percent share in the global smartphone application processor market.

- Creating the flywheel effect out of idea flow–instead of offering labor and/or capital-centric service to the global value chain of semiconductors, Taiwan focused on offering value from the production of knowledge and ideas about yield optimization and microchip design–creating a flywheel effect.

- Leveraging the fabless model–increasing economic attractiveness of the fabless model due to the need for growing capital foundry expenditure has been fueling the rise of Taiwan’s semiconductor industry to a monopoly state.

- Forming a cluster effect–the focus on the formation of the clutter of firms for serving an increasing number of semiconductor value chain nodes has created synergy, resulting in market power accumulation.

- Riding the smartphone wave- the rising smartphone wave, which gives volume and profit-making opportunities in moving to increasingly complex process nodes, has played an instrumental role in the rise of Taiwan’s semiconductor industry monopoly.

The inferior beginning leads to being a superior performer: historical notes

In the early 1980s, small companies with chip design and marketing capacity started to emerge. But they could not afford fabs to process silicon to produce chips as per design. IDMs like Intel, IBM, TI, or Motorola had fabs—requiring high capital expenditure. Hence, those semiconductor companies without having fabs, later known as fabless companies, used to rely on IDMs for fab services. However, IDMs were not finding them to be lucrative clients due to their small volume and low margin. Hence, there was a growing demand for common fabs, or 3rd party fabs, to serve those little demands of small fabless companies. Therefore, TSMC emerged in 1987 to address this unmet demand.

The fab technology that TSMC had in those days was behind than IDMs. Even after 20 years of birth, TSMC was behind IDMs. For example, in 2007, IDMs like Intel were using 65nm technology. Furthermore, Intel’s introduction of strained silicon technology significantly boosted Transistor performance. Being behind by more than an entire generation (2–3 years), TSMC and other foundries were grappling with Intel’s transistor advances.

On the other hand, IDMs like Intel were avoiding the growing processing service demand for fabless companies. Hence, upon rejection from Intel, Apple had to choose Samsung’s 90nm to produce the core chip of iPhone 1—a full generation behind Intel’s 65nm at that time (2007). In those days, fabless companies like Qualcomm, Broadcom, NXP, and many others used to rely on older technologies of Foundries like TSMC.

But the situation started changing rapidly as fabless companies kept demanding smaller transistor sizes in meeting the ever-growing demand for performance and energy efficiency. In addition to growing volume, they started showing greater willingness to pay. Hence, Foundries like TSMC became aggressive in capital expenditure and R&D for lowering transistor size and increasing yield.

Rising fabless companies and availability of IP-core:

At the root of the uprising of Taiwan’s semiconductor monopoly is the growth of fabless chip companies. They are the clients of TSMC and many other Taiwanese companies. Several factors contributed to the development of fabless companies. Among them are the growing availability of IP-core from ARM in easing design complexity, 3rd party Electronic Design Automation (EDA) tools, and the ever-increasing demand for application-specific integrated circuits (ASICs). Low entry barriers and growing demand contributed to the rapid growth of fabless companies. Furthermore, the need for increasingly complex ASICs also kept demanding better fab maturity in producing smaller transistors. Consequentially, a virtuous cycle of keep gaining market power started to gathering momentum-a typical example of flywheel effect reaching monopilies final moment—winner takes all.

Smartphones demanding ever-growing chip density and IDM’s failure to tap into it led to the rise of Taiwan’s semiconductor monopoly:

It’s well understood that the personal computer (PC) was the driver of IDM’s icon Intel’s and Motorola’s growth. In the 1970s, Intel used to produce commodity memory chips. Its fallout in developing an ASIC for Japanese calculator company Busicom led to Intel 4004 led to updating to the famous 8080 microprocessor. Its next version, 8088, became the choice of designers in making IBM PC. The growth of popularity of PC and the ever-growing demand for processing power by Microsoft’s OS and applications kept fueling the demand for higher processor chip density.

Hence, Intel faced the challenge of reducing transistor size for capitalizing on the opportunity of selling increasing units of better-performing chips. Thus, Intel found the proliferation of IBM PC as a profit-making opportunity by increasing R&D investment for growing chip density. Therefore, Intel kept attaining an edge in production process superiority. Furthermore, growing PC demand kept Intel and other IDMs busy.

Among other digital devices, smartphones started growing as a disruptive force in the early 2000s. Due to the small market size and high-cost sensitivity, like many other IDMs, Intel also avoided them. But it was an excellent fit for fabless companies like QUALCOMM and Nvidia. On the other hand, Apple’s iPhone needed very high computational power that off-the-shelf smartphone processors could not support. Hence, Apple embarked on designing it around ARM IP core. Unfortunately, Intel rejected Apple’s offer to make the chip for iPhone 1, as it was not financially attractive. Hence, Apple had to choose inferior process technology (90nm instead of Intel’s 65nm) from Samsung.

Smartphone has been a game-changer for TSMC:

With the ever-growing smartphone’s demand for processing power and TSMC’s sole dedication to serving fabless companies, TSMC started getting increasing demand for upgrading process technology. Hence, TSMC found it a highly profitable investment opportunity for increasing chip density. Therefore, TSMC discovered the opportunity in smartphone growth, as Intel did in PC, for profitably reducing transistor size through in-house R&D, innovation partnership, and sourcing of high-end process technologies.

Growing capital expenditure for fabs kept keeping fabless companies fabless:

In addition to the entry of new fabless companies, Qualcomm, Nvidia, and a few others became very large. For example, Qualcomm’s revenue in 2021 was above $33b. The question could be, why could not some of those fabless companies set up their own fabs and become IDMs? Firstly, the fab cost has exponentially increased, leading to $15b for 5nm fab. The next challenge is that investment should be recovered within 05 years, before the arrival of the next generation, making it obsolete. Moreover, it demands instiutional capacity for driving growth out of the generation of knowledge and IPs and linking them with the productionprocess, dirving the yield and reducing lead time.

It seems that no fabless company finds it a profitable investment opportunity to meet only its own demand. On the other hand, IP issues discourage coalition between fabless companies from going together. Furthermore, there is a strong R&D, IP portfolio, and skill base to optimize yield and move to the next generation fab before anyone does. Hence, due to its proprietary IP base, strong R&D capacity, and in-house yield optimization skill base, TSMC does not find fabless companies as rivals.

Increasing sourcing opportunities of specialized materials and equipment from the ecosystem:

Over the decades, the semiconductor industry has been vertically disintegrated. More or less, in every layer, there are specialized actors. But none of them, including IDMs, specializes across the value chain. Hence, Foundry finds it a feasible option to source the best innovation from every layer and fuse them with proprietary process IPs and an in-house skill base to offer the best fab service. Furthermore, it exploits growing economies of scale advantage. Therefore, the Foundry model has favored TSMC and Taiwan to attain a semiconductor monopoly.

Fab excellence through proprietary process technologies and high-end skill is at the core of Taiwan’s semiconductor monopoly:

TSMC focused on developing proprietary process optimization IP and skill base from the very beginning. Instead of just buying equipment and relying on outside consulting services for integration, TSMC focused on learning through research and converting it into higher yield. This is a fundamental difference between TSMC and many other manufacturing service providers. For example, despite being a substantial contract manufacturer, Canada’s Magna intranational has not taken over the edge of IDM automobile makers. Similarly, Bangladesh’s ready-made garments manufacturers or Indonesia’s contract shoemakers have not succeeded in developing an edge to outshine brands.

Cluster effect, due to the availability of testing and packaging services, contributed to Taiwan Semiconductor monopoly:

The cluster effect has also played a vital role in creating Taiwan’s semiconductor monopoly. For example, fabless companies want wafers to cut into individual chips upon processing. They also want to test and package those chips as chips we know of. Hence, to cater to this after-fab service demand, Taiwan has developed many OSAT companies; they are Outsourced Semiconductor Assembling and Testing (OSAT) service providers. Among several of Taiwan’s OSAT companies, ASE is the global leader. There are also companies in the area of PCB making and populating PCBs. Further, there is a strong linkage between Taiwan’s semiconductor industry and academic institutions supporting R&D and human resource needs.

The growing fabless segment in Taiwan:

Although the media outlets have referred to TSMC as the cause of Taiwan’s semiconductor monopoly, homegrown fabless companies have also contributed. Notable Taiwan’s fabless companies are MediaTek Inc. and Novatek Microelectronics Corp. Already, Taiwan’s No. 1 fabless company Mediatek joined the list of the world’s top 10 semiconductor companies by revenue in 2021 from the 16th position in 2020. These Taiwanese fabless companies are now selling chips to the ever-growing demand of Chinese smartphone and TV makers. Furthermore, Taiwan’s fabless companies are highly profitable. For example, Taiwan’s top five fabless companies posted an average of 47.5% in gross profit margin ratio in 2020—far higher than 26% for South Korea’s top five fabless firms.

Growing merit of the Foundry model, TSMC’s unbeatable edge in fabs, a strong linkage between R&D and fab performance, and the cluster effect are the underlying causes of Taiwan’s Semiconductor monopoly. TSMC’s fifty-four percent market share in Foundry, Taiwan’s overall share of 63% in global foundry output, and TSMC’s sole capability in the high-end silicon processing segment are strong indicators in favor of Taiwan’s semiconductor monopoly.

Interestingly, there have been underlying patterns in creating this competitive advantage for a late entrant small island economy in a highly distributed global value chain. Already the foundry model led by Taiwan has risen as a Creative Destruction force, partially unfolding disruptive effects on IDMs like Intel. But will it unleash full Disruptive innovation effect, causing massive destruction to IDMs like Intel? Does it mean that America cannot regain the edge as TSMC’s Morris Chang has reportedly claimed? Does it mean that Chip War, for the USA, has already been permanently lost?

...welcome to join us. We are on a mission to develop an enlightened community by sharing the insights of Wealth creation out of technology possibilities as reoccuring patters. If you like the article, you may encourage us by sharing it through social media to enlighten others.

Related Articles:

- Chip War

- Semiconductor Value Chain–globally distributed ecosystem

- Semiconductor Monopoly Due to Winning Race of Ideas

- Intel Falling Due to PC and Mobile Waves

- ASML Lithography Monopoly from Sustaining Innovation

- Taiwan’s Semiconductor Monopoly – How did it arise?

- ASML TSMC Nexus Fuels Semiconductor Monopoly

- ASML Monopoly in Semiconductor — where is magic?