What has caused a semiconductor monopoly? Often, we think that government license, ownership of resources, political decision, vertical integration, invention patent, and collusion are factors for creating a monopoly. But none of them has caused semiconductor monopoly. Is it price-fixing collusion for compelling customers to buy the same quality products at a higher price? Perhaps no. Instead, a race of offering higher quality at decreasing cost out of ideas has led to a semiconductor monopoly. Interestingly, no single company has control over the value chain. Ironically, vertically integrated firms, called integrated device makers (IDMs), are tumbling due to rising monopolies.

As opposed to concentration, the Semiconductor value chain is a globally distributed ecosystem. On average, a semiconductor component travels across international borders 70+ times. Although as many as 25 countries are involved in the direct supply chain and 23 countries support market functions, this industry has a monopoly in all major value chain segments. Segments having a very high monopoly are (i) Wafer, (ii) Process, (iii) Lithography, (iv) EDA Tools, (iv) IP Cores, and (v) Fine Chemicals.

The underlying core technology of semiconductors or semiconductor components is Transistor. In 1947, three Scientists at the Bell Labs invented it. Interestingly, instead of possessing this vital patent for creating a monopoly, Bell Labs made it open through licensing. Soon after its invention, in 1952, 40 companies, upon paying a meager $25,000, got the license for the production and refinement of the Transistor. The objective of licensing was to benefit from its continued advancement—making it better and cheaper.

Furthermore, to facilitate technology transfer, Bell Labs organized a nine-day Transistor Technology Symposium for 100 representatives of those patent license receiving 40 companies. Besides, organizers published a compendium of Transistor knowledge– “Ma Bell’s Cookbook.” Despite it, why has the semiconductor industry ended up in monopoly?

Race of ideas for improving the quality and reducing the Cost:

For the same reason, Bell Labs transferred the transistor technology to as many as 40 companies, the semiconductor has got monopolized. Like many other great inventions, Transistor also emerged in primitive form. It was noisy, and it could handle only a little power. Furthermore, it was bulky, energy-hungry, and highly costly to manufacture compared to today’s transistor. Hence, Bell Labs management paid heed to the advocacy of sharing this transistor technology with other researchers and companies to benefit from advances made elsewhere. So, it sponsored gatherings welcoming other scientists and engineers to visit Bell Labs to learn the new semiconductor technology. It began with military users and applications in 1951, leading to licensing Transistor to 40 companies in 1952.

Among the subsequent developments, two nodes started showing remarkable progress. The first one was in California, and the other one was in Japan. The chain reaction of competition in advancing transistors in California began with Fairchild semiconductors’ invention of integrated circuits (IC). This is about the formation of multiple transistors on the same silicon substrate. Besides, Sony was under intense pressure to make transistors cheaper and less noisy and have more amplification capability to expand the transistor radio market.

Hence, the race started forming an idea base to make transistors increasingly better and cheaper. This possibility started rapidly expanding the market, increasing profit, and most importantly, inviting new entrants to profit from the untapped opportunity. So, it became a new gold rush.

Furthermore, expanding business opportunities encouraged disintegration, new firms’ formation, and specialization. For example, some companies focused on refining silicon. Others focused on the design of ICs, and fabrication plants. As a result, the value chain started getting disintegrated and distributed. The underlying driver has been a Flow of Ideas for making this device smaller, better, and cheaper.

Overview of the semiconductor value chain and globally distributed ecosystem:

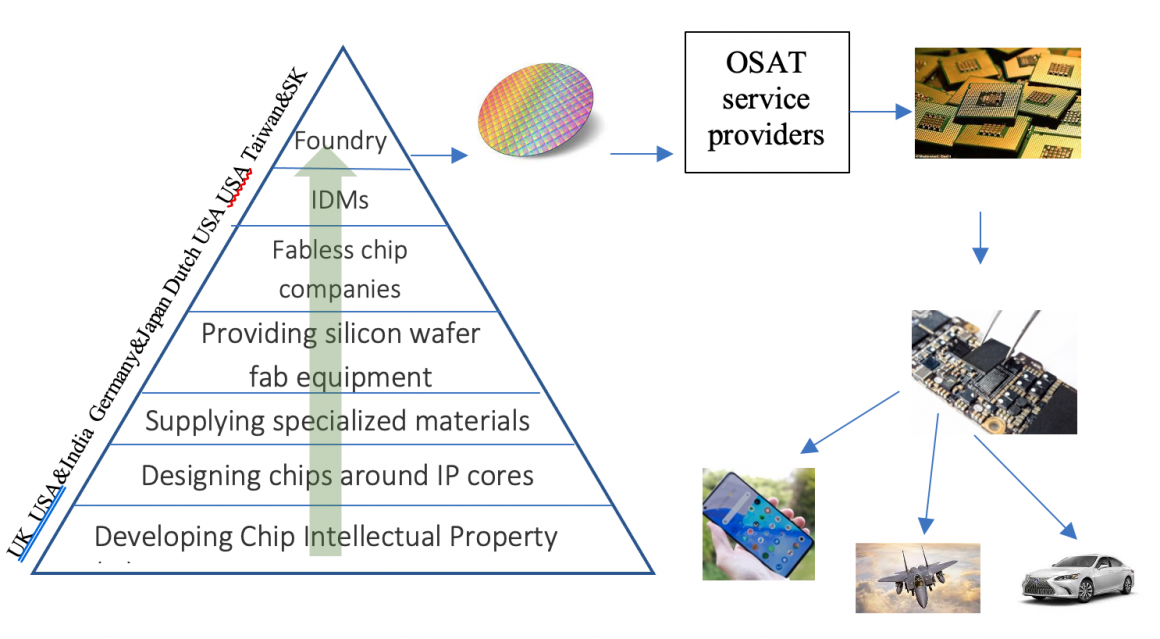

The globally distributed value chain of the semiconductor industry has eight significant layers. The first layer is the first step of having semiconductor components—reusable design cores or IP cores. On top of it is the designing of the chips around those IP cores. For transferring design into a device, we need specialized materials and chemicals. It begins with a silicon wafer that forms the substrate to create components in layers. The fourth layer is the fabrication plants or fabs and equipment to make the plant. One of the prominent pieces of equipment is a photolithography machine that projects designs on silicon wafers.

Residing at higher levels in the value chain pyramid, two types of companies use those five layers. The first one the fabless companies. To print designs on the wafer, they engage the 3rd party fabrication service providers—called Foundries. And the other one is integrated device makers having both design and fabs inhouse. These companies are called IDMs or integrated device manufacturers. On the top of the IDM layer is Foundry. Upon going through all these layers, designs come out as processed silicon wafers. These wafers go through Outsourced Semiconductor Assembly and Test (OSAT) companies to get sliced, tested, and packaged.

There are many companies in each of those layers. There are thousands of them operating throughout the whole value chain. Furthermore, they are distributed all over the world. The underlying driver has been maximizing the benefit from Innovation, the cost advantage of labor, geographic location, and risk minimization. Despite it, there has a high-level monopoly in many segments, making the semiconductor industry a monopolistic competition.

Semiconductor monopoly in significant segments:

British firm ARM has more than 40 percent market share in IP cores. In 2020, with almost $2 billion revenue, ARM grew 17.4 percent to increase its market share to 41 percent. In the wafer segment and fine chemicals, Japan has a strong position. As high as 60 percent of chip-grade Silicon comes from Japan. For electronic design automation (EDA) tools, the USA with Cadence, Synopsis, and Mentor Graphics has a monopolistic position.

The photolithography machine is crucial for making transistors smaller, better, and cheaper. For making a 5nm chip, this bus-sized machine costs $150 million. For extreme ultra violet lithography machines, the global semiconductor ecosystem has only one supplier. This is Dutch ASML—Advanced Semiconductor Materials Lithography.

Fabs develop a highly optimized process for processing silicon wafers with the help of fine chemicals and many other materials supplied from many nodes. In addition to photolithography machines, it needs machines from many different suppliers. But integrating those machines and getting supplies from hundreds of companies is not good enough. There is a need for process optimization ideas. In this race, Taiwan’s TSMC has come up at the top. In the foundry segment, its market share is more than 50 percent—making TSMC the largest chip maker.

Furthermore, although IDMs like Intel and US Foundries like GlobalFoundry make 4 to 5 percent profit, profit margins of companies having a monopolistic position in their respective sectors make far greater. For example, the net profit of TSMC in 2020 was around 28 percent. Similarly, ASML’s gross profit was as high as 52 percent in 2020.

Semiconductor monopoly is value chain segment-specific:

Although no single company owns the whole value chain, once we look through the value chain, we observe that the semiconductor industry has high monopolistic competition. Hence, there is no denying that Taiwan has attained a strong monopoly in the Foundry segment. Similarly, the USA has a monopolistic situation in fabless chipmakers and EDA tools. On the other hand, Japan is a semiconductor monopoly in wafers and fine chemicals. And Dutch company ASML is a monopoly in extreme ultraviolet lithography machines. Furthermore, in addition to Foundry, Taiwan has gained a monopoly position in the semiconductor industry due to its strong position in OSAT and growing strength in the Fabless segment.

Due to the global distribution of the ecosystem, although many countries have been making microchips, no single country has the whole value chain. Similarly, although China or even newly entering countries can make chips, they need to depend on the supply from other countries. Furthermore, having fabs in making chips is not always a good decision. Hence, China imports chips from many countries, from the USA, Taiwan, Japan, and many others, to meet the single largest global demand. By the way, although making the photolithography and many other supplies needed for chip-making is doable for China and many others. But that is not sufficient. The challenge is to make them state-of-the-art—requiring idea and skill base.

Underlying factors of semiconductor monopoly: disintegration and specialization

The fuel of the race of making transistors better and cheaper is ideas. Hence, the competition took advantage of vertically disintegrating and focusing on specialization to profit from ideas. Thus, although no one owns the whole value chain, there are highly specialized producers in several layers. The race of specialization has led to offering the highest quality at the least cost or the best value for money. Yes, that has created the price-setting capability for highly specialized producers. But, unlike conventional reason, it has distilled from the race of leveraging ideas for offering increasing quality at decreasing cost. Hence, the semiconductor monopoly is an example of how the market tills to monopoly due to the profit-making race out of the idea of serving customers better. Hence, the semiconductor monopoly appears to be a typical example of the economics of technology out of ideas.

With the given high-level segmentation and global distribution of the ecosystem, conventional antitrust interventions appear to be ineffective for dealing with semiconductor monopolies. There is no bundling or vertical foreclosure strategy. Instead, it has occurred due to segment-specific specialization. Despite it, the market is failing to function due to growing market power in the hands of a few. Without throttling innovation, how to weaken the semiconductor monopoly is a challenge indeed–as semiconductor new oil drives the wheel of the modern economy.

...welcome to join us. We are on a mission to develop an enlightened community by sharing the insights of Wealth creation out of technology possibilities as reoccuring patters. If you like the article, you may encourage us by sharing it through social media to enlighten others.

Related Articles:

- Semiconductor Value Chain–globally distributed ecosystem

- Semiconductor Monopoly Due to Winning Race of Ideas

- Intel Falling Due to PC and Mobile Waves

- ASML Lithography Monopoly from Sustaining Innovation

- Taiwan’s Semiconductor Monopoly – How did it arise?

- ASML TSMC Nexus Fuels Semiconductor Monopoly

- ASML Monopoly in Semiconductor — where is magic?