Are not great ideas, heroic character, and risk capital good enough for startup success? Startups are pursuing creative waves out of great innovative ideas for Disruptive Innovation. For succeeding, is the heroic art of the entrepreneurs undefinable? Are there underlying reoccurring patterns in the uprising of Apple, Microsoft, Google, Intel, or Facebook? Despite the heroic role of creative genius, there appear to be three underlying patterns in startup strategy. Interestingly, these patterns are not their magical secret, known to many for ages. They are distilled from the solid foundation of innovation economics. They are age-old Economies of Scale, scope, and network externalities. By the way, technological economies of scale significantly differ from conventional economies of scale definition given by economics literature. On the other hand, due to a weak base in these three areas, high-flying startups like Uber, Google’s Waymo, and many others are yet to unleash magical disruptive performance.

Startups are after ideas around emerging technology cores for offering substitutes. This is not a new concept. In the preindustrial age, creative entrepreneurial minds were also after startups. Upon inventing or having access to technologies, like shaping or sharpening metal, they also innovated products. They also got into entrepreneurial activities to profit from them, giving birth to firms. However, in the preindustrial age, none of those startups did grow as large corporations. But there have been deviations in the startup journey of Thomas Alva Edison, Carl Benz, John Deere, and many more. Further deviation we observed in startups forming Boston Route 128 and Silicon Valley. At present, we have been witnessing a new rush of startups. They are after creative waves out of smartphones, mobile internets, cloud computing, sensors, data analytics, and AI. Still to date, timeless factors such as scale, scope, and network externality determine their fate.

Fundamental challenges of startup strategy: Growing loss-making beginning

Among many startups in the 19th century, John Deere’s one is notable. His Reinvention of the plow as a self-scouring steel plow in 1837 immediately started producing revenue for him. However, unlike him, Edison could not find customers for generating profitable revenue for his magical phonograph invention. Even for his lightbulb invention, in getting good revenue, he had to wait for the systematic R&D of increment advancement of filament life to make some headway. On the other hand, Tesla has been burning billions over almost two decades for generating profitable revenue. Similarly, upon consuming as high as $80 billion, an autonomous vehicle is yet to roll out. It seems that successive generations of startups have been starting an increasingly deeper loss-making journey.

But the mission to empower these loss-making startups to reach profit and scale up into large corporations is a great challenge. It seems that heroic art is not good enough. In retrospect, they need to succeed in three dimensions. Furthermore, as opposed to multiple startups succeeding in generating profitable revenue in a market segment, invariably, each segment is facing a monopoly threat.

Winning startup strategic dimensions: scale, scope, and externality

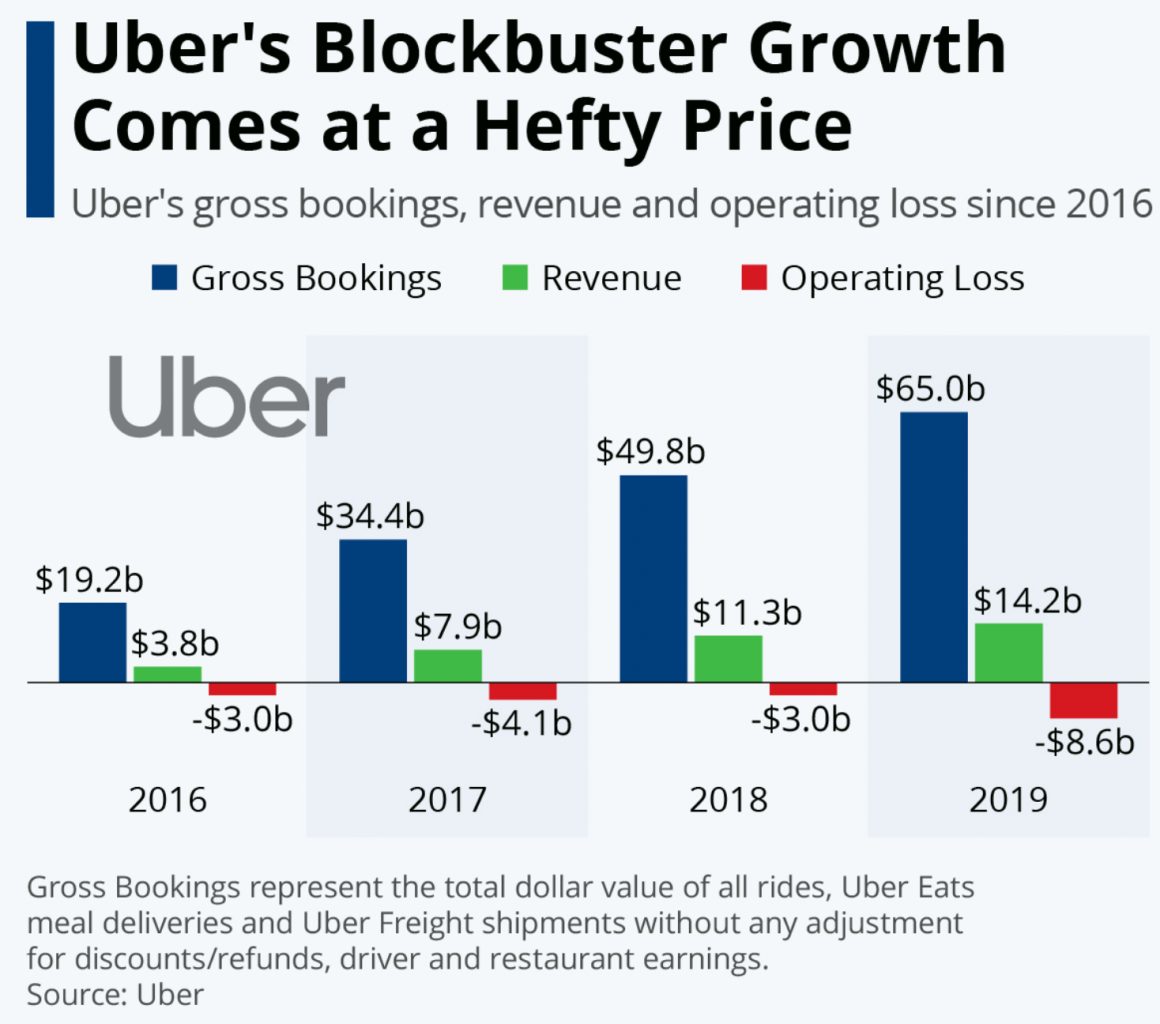

The first one is the economies of scale advantage. But if Tesla increases production, its loss goes up too. Similarly, Uber suffers from growing losses with the growth of revenue. For example, Uber’s revenue growth from $11.3 billion in 2018 to $14.2 billion in 2019 led to the loss from $3.03 to $8.6 billion. But interestingly, after years of losing, the profit of Tesla has been rising. On the other hand, before reaching profit, Amazon was at a loss for more than a decade.

Technological economies of scale:

In the given situation, by expanding the production, startups do not lead to economies of scale advantage for reducing the loss. Contrary to conventional economies scale, startup success demands technological economies of scale. No amount of subsidies and production capacity can substitute this vital requirement. This is about creating the scale effect out of the Flow of Ideas in improving the quality and reducing the cost.

Economies of Scope:

The next strategic dimension is about economies of scope. Instead of focusing on the scope advantage of operational facilities, startups need to focus on developing a family of products. They should divide growing R&D investment not only on the customers of a single innovation. The growing R&D investment demands spreading the expense of ideas on a family of products. Hence, the startup strategy should focus on product family architecture for reusing common assets among the family members. Notably, due to the growing role of software and the increasing cost of software-centric innovations, economies of scope have been growing as a critical success factor.

Leveraging network externality effects:

The third dimension of the startup strategy is the network Externality Effect. Although the network externality effect surfaced in the early part of the 20th century in the telecom industry, innovators can now distill it into many products. The growing role of software and connectivity has expanded the scope of benefiting from network externality effect in all kinds of innovations. Due to its increasing role as Monopolistic market power accumulation, no startup can afford to overlook this strategic dimension.

The growing Natural tendency of monopoly:

Unlike in the past, startups are facing dual challenges. First of all, they need to generate tons of ideas for turning the loss-making journey of great ideas into profit. The next one is to face the challenge of growing as a monopoly force for avoiding an inescapable loss trap.

It happens to be all these strategic dimensions presented here are recipes for attaining monopolistic market power for creating startup success stories. Of course, not many startups pursuing similar ideas will stand out and succeed in monopolizing the market. Unfortunately, the rest of the cohort will get caught in an escapable loss trap at the success of one, adding to start-up failure numbers. The game is simple. Either you blend these dimensions into a startup success strategy or be ready to face the consequences. It does not matter how great your idea is, how heroic character you are, and how much money you have to burn, to turn your loss-making journey into profit; perhaps, this is your only option—focus on age-old innovation economics.

...welcome to join us. We are on a mission to develop an enlightened community by sharing the insights of Wealth creation out of technology possibilities as reoccuring patters. If you like the article, you may encourage us by sharing it through social media to enlighten others.