The network Externality Effect has been at the core of the success of Facebook, Google search engine, and many others. On the other hand, it has been a seemingly insurmountable barrier for many new entrants. In Innovation diffusion or technology adoption, network externality is a phenomenon explaining the benefit influenced by the number of users of the same or compatible products. It could be both negative and positive. In recent times, the rapid diffusion of software and connectivity-centric products has benefited significantly from positive network externality effects. Due to this effect, in many software and connectivity-centric innovations, the perceived value of products keeps increasing with the growth of the user base. As a result, a bigger user base offering better value leads to keep attaining Monopolistic market power.

Network externality is a powerful force affecting innovation, creating exponential adoption patterns. Intelligent leveraging of it leads to the increasing popularity of products without the need for further involvement of the innovators. For example, if you are the only subscriber of a social networking site, perceived value is zero, irrespective of the great design. You keep finding it more beneficial as many others start joining. The perceived value may increase exponentially as additional users’ adoption of the product may open exponentially growing Utility extraction channels.

Innovations’ value dimensions: autarky and synchronization

a new value dimension

In addition to autarky value, the value generated by a product to its users as if there are no other users, network externality creates another value dimension. It’s the synchronization value, the additional value derived from being able to interact with other users of the product. This latter value is the essence of network effects. Synchronization value created by network externality could be negative too. For instance, if you are subscribing to internet service through a shared channel, the quality of services faces exponential decay with the growth of the subscriber base.

Network externality examples:

The origin of the network effects appears to be in telephone service, as perceived value is strongly related to the number of subscribers. Due to it, although there were 4,000 local and regional telephone exchanges in the USA in 1908, all of them merged with Bell System, giving the rise of monopoly. In the post-patent era, network externality was at the core of the strategy of Theodore Vail for making Bell Telephony the monopoly. Subsequently, among others, Robert Metcalfe popularized it for creating the market of computer networking devices.

One of the prevalent contemporary examples has been cryptocurrency. The perceived value of it is directly linked with the number of people or sellers who have been accepting it for a transaction. Similarly, different payment products over digital platforms fall in this category.

Network benefits may also emerge without the presence of a physical network. For example, the Network effect in software and many other innovative products distills from the opinions of existing users. Besides, the 3rd party plugins, such as the option of downloading Apps, contribute to value from the network externality. For example, iPhone’s perceived value has been greatly benefiting from the growing number of apps at the App Store. Among others, the fermium version is also a contributing factor for creating the tipping effect through the concentration building.

Startup strategy by leveraging externality effects:

Contemporary Startups are after leveraging High-tech innovation possibilities. Due to high reliance on software and connectivity, most of these innovations have a latent potential to benefit from the network externality effect. However, they also run the risk of facing barriers due to it. For example, if market tips to specific products, competing innovations will face serious obstacles to diffuse in the market. For instance, in the 1980s, there were more than 30 popular word processors. But in the end, all of them, except Microsoft Word, disappeared due to get tipping effect caused by the network externality effect.

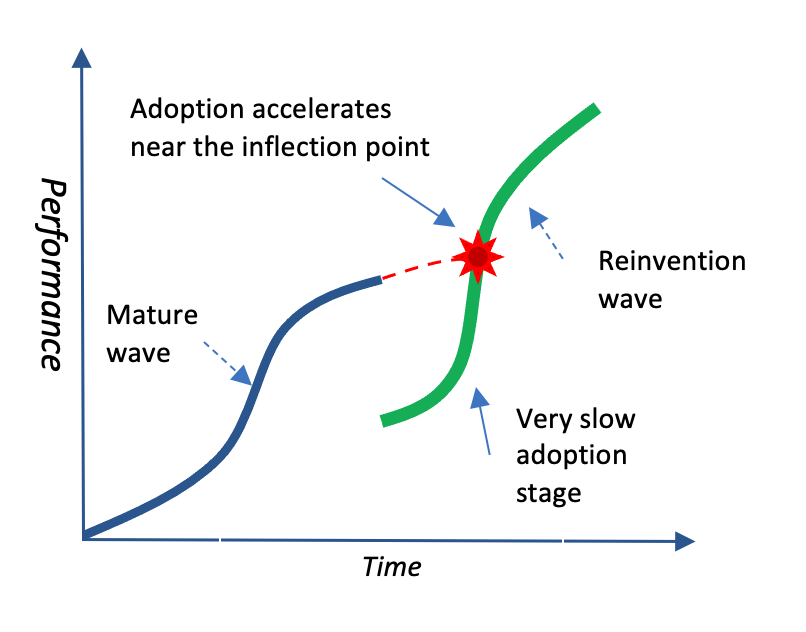

In the early stage of adoption, the network effect is shallow. Once a critical mass adopts particular technological innovation, network effects become significant enough to influence the competition. Subsequently, market tips and dominant firms stand out from the crowd, subsequently creating the effect of winners take all. Hence, startups face two challenges with respect to network externalities. First of all, from the very beginning, they should focus on ideas in creating value for their innovations from the network externality effect. But, certainly, not all the competing startups will stand out. Hence, they must be vigilant to detect the market tipping point out of network externality effects, as that may be the strong indication of getting caught in an inescapable loss trap. Therefore, network externalities should form a core part of firms winning strategy and folding.

Network externalities fuel the Natural tendency of monopoly: triggering a regulatory response

As network effects fuel the bigger-is-better concept, upon the development of a critical mass of customers, the market of the target products gathers sufficient momentum of tipping. As network effects tend to incentivize users to coordinate their adoption of a single product, tipping can naturally happen. Hence, market concentration in products that display network effects naturally gives rise to dominant firms having monopolistic market power. However, the autarky value derived from the network effect must exceed the differentiation value to reach the tipping effect. Furthermore, there should also be sufficient switching cost or loss of value for moving away from the concentration.

The leveraging of the network externality effect has led to the growth of dominant firms. For example, as opposed to collusion or other unlawful acts, Microsoft, Facebook, Google, and many others have established dominant positions in some of their products. To deal with it, policymakers have been after antitrust regulatory action. Often, for finding the remedy, regulators look for is limiting the freedom of benefiting from the network externality effect. But such an action leads to causing harm to users’ benefit extraction options. As the network externality effect is a robust growing means of creating consumers’ value, it undoubtedly weakens competition. Hence, what could be the remedy without throttling innovation is a fundamental question.

Disruptive innovation for overtaking network externality barrier:

Once markets tip and give rise to dominant firms, both regulators and losers are after antitrust laws. Although legal measures clip the wings of top performers, does it offer a solution? Perhaps, No. For example, Netscape relied on antitrust rulings to weaken the dominant position of Microsoft’s Internet explorer for creating a profitable path for its Netscape browser. In the end, Netscape has become extinct. On the other hand, relatively silent, late comer Chrome has taken away the dominant position in the browser market. It appears that disruptive innovation out of the creative wave of destruction is a very effective strategy to counter the dominant position.

In a nutshell, the value from network externality is real, and it has been growing as a powerful competition force. Unlike the past, along with the Telcom service, all kinds of innovations are now candidates to experience network externality effects. Notably, the growing role of network and software are accentuating the role of network externalities. For many innovative products, it has a vital positive role in diffusion. But once a dominant innovation stands out, all other competing innovations, in the same category, suffer from a diffusion barrier. Hence, network externality effects should be at the core of the winning strategy of innovators. Furthermore, in addition to regulations, we should intensely focus on empowering the creative wave of destruction to create disruptive innovation effects to diffuse market power, gathered from network externality effects.

...welcome to join us. We are on a mission to develop an enlightened community by sharing the insights of Wealth creation out of technology possibilities as reoccuring patters. If you like the article, you may encourage us by sharing it through social media to enlighten others.