Why did great companies like Kodak, Nokia, DEC, PALM, or RCA suffer from destruction? Is it because they did not have great ideas, competent R&D teams, complementary facilities, client base, or risk capital? They had all of them. But they suffered from severe destructions. Some of them even became bankrupt. The underlying cause has been innovators’ Dilemma — the predicament managers face in switching to the next wave of Reinvention and reinnovation. But why do competent managers face such a quandary? What are the underlying causes? Surprisingly, the lesson for being high-caliber managers itself is a barrier to overcoming this impasse. Besides, technology uncertainty makes it worse.

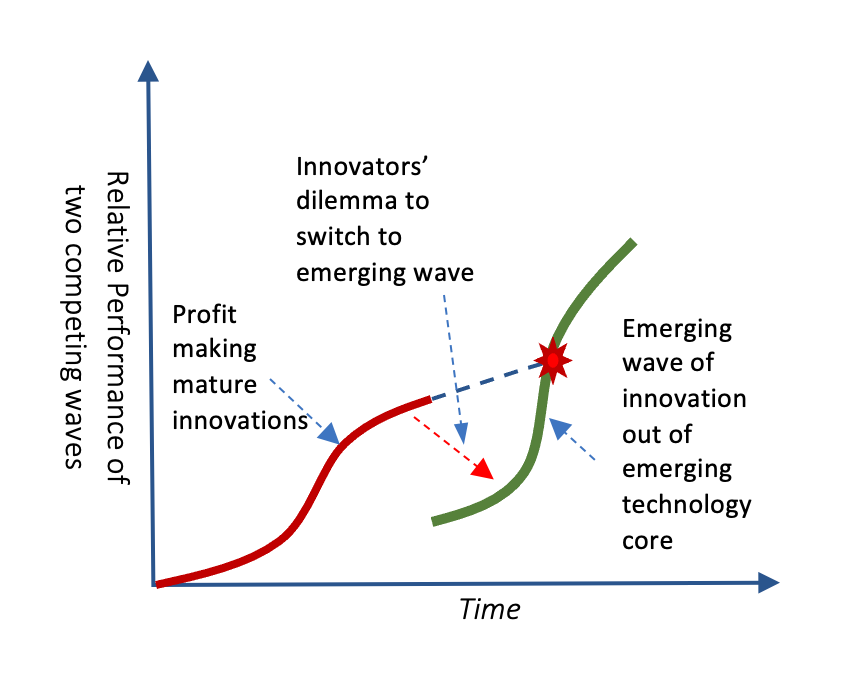

The life cycle of inventions, driving innovations, takes an episodic form. They neither emerge in matured form nor do they keep growing linearly. Irrespective of the greatness, every invention goes through reinvention due to emerging technology core. Subsequently, the reinnovation wave begins, often, by new entrants. Due to primitive beginning and mature forms of existing products, managers of incumbent firms often experience a decision impasse in switching to the next wave—giving birth to innovators’ dilemma. Hence, at the inflection point, products around mature technology core start losing demand to the innovations around new technology core. As a result, due to innovators’ dilemma, once-dominant firms having a solid market share in mature products suffer from destruction.

Reinvention and Reinnovation: primitive emergence of a creative wave of destruction

The invention of a technology core and its subsequent advancement trigger Product Innovation. If this emerging technology core has the potential to be a better alternative to existing ones, reinnovation of mature products also starts—often, by new entrants. For example, the invention of the electronic image sensor, a charge-coupled device (CCD), showed the potential to be a better alternative to film to capture images. Similarly, the light-emitting diode (LED) invention showed the potential to be better than filament to produce light from electricity. Point and click and multitouch technologies emerged with the prospect of being a better alternative to the keyboard-centric design of the human-machine interface. There have been many such examples. But in most situations, incumbent firms shied away from being the drivers of new waves around emerging technologies. Consequentially, once-powerful firms suffer from disruptive effects.

But upon understanding its nature, many new entrants grow as high-performing firms. Even, existing firms recreate themselves. One of the notable examples has been Apple’s magical success out of recreation of existing products by changing the technology core.

Despite the potential, innovations around budding technology cores emerge in primitive form. They are far inferior to comparable products around mature technology core. For example, in the early days, digital cameras were primitive. Carl Benz’s automobile in the 1980s was far weaker than horse wagons. Similarly, the printing quality of PC-based word processing software in the 1980s was highly poor.

Embarking on a loss-making uncertain journey creates innovators’ dilemma:

Over 100 years, Kodak perfected film-based camera and profit-making business around it. For sure, the first digital camera created by Kodak’s engineer Steven Sasson was a primitive alternative to the film camera. Virtually, there was no customer for a 100×100 resolution camera weighing 8 pounds and requiring 23 seconds to capture and record an image onto a cassette tape. Similarly, radio out of Transistor in the 1950s and PC-based word processing in the 1970s were highly primitive too. Hence, Kodak managers avoided and waited for suffering from disruptive effects. There are many such examples of primitive emergence of innovations around new technology core. Hence, such primitive emergence created innovators’ dilemma–whether to switch to emerging primitive waves or keep making far better-quality mature products.

In addition to the high cost of emerging products, invariably, there has been very little willingness to pay for inferior products among a tiny group of customers. Hence, irrespective of the greatness, the journey begins at a loss. How to justify the reallocation of resources from profit-making products to loss-making alternatives is at the core of innovators’ dilemma.

Marginal cost-benefit analysis based rational decision:

Managers have been educated to perform a marginal cost-benefit analysis in resource allocation. They have been taught to allocate resources to those activities which produce the highest additional benefits compared to the additional costs. Hence, what is the justification for reallocating resources from profit-making mature products to the activities about loss-making primitive emergence? Therefore, highly educated managers of incumbent firms experience a predicament to justify switching to the loss-making emerging wave from profit-making matured one.

But entrepreneurs pursuing innovations around emerging technology core do not face this innovators’ dilemma, as they do not have the option to allocate resources to incumbent mature products. Nurturing emerging primitive products is their only option of making entry into the business of existing products. Hence, while managers of incumbent firms keep suffering from innovators’ dilemma, new entrants keep accelerating the mission. They vigorously keep investing in R&D in producing ideas and patenting them, creating the supply chain, and developing the complementary capacity for improving the quality and reducing the cost.

Performance bonus and the misleading response of capital market:

There is another factor that underpins innovators’ dilemma faced by managers. This is about the performance bonus. Often, performance bonus is linked to revenue and profit growth. Hence, as reinnovated products around emerging technology core start the journey in producing loss, bonus maximization agenda lives little or no justification to managers of incumbent firms to allocate resources for primitive alternatives.

There could be a question about linking bonuses to the appreciation of the share price of incumbent firms. But the capital market does not show a positive response in the early days of the rise of the emerging wave. For example, although the electric vehicle has been delivering a high promise, for almost over a decade the share price of Tesla did not experience appreciation. Hence, the performance bonus maximization agenda keeps encouraging resource allocation toward mature products until it’s too late.

Innovators’ dilemma: resource allocation predicament

At the core of innovators’ dilemma is resource reallocation from profit-making activities to loss-making alternatives. Certainly, marginal cost-benefit analysis based on rational decision-making thesis does not support it. Besides, pervasive uncertainties about the growth of the infant technology core aggravate the decision-making challenge. On the other hand, there is a need for developing additional complementary capacities and new supply chains. Hence, there has been an apparent reason for managers of incumbent firms to face challenges to switch to the emerging wave. For this reason, even being the first to work on emerging technology core and reinnovating around it, managers of RCA, Kodak, and many other high-performing firms shied away from switching to the emerging wave in the early days.

To overcome Wealth annihilation due to innovators’ dilemma, there should be a change in corporate governance. There should be incentives for managers for pursuing loss-making primitive emergence of alternative. To avoid conflict of interest, the policy could be to have independent business units directly reporting to the board. Performance measurement framework and incentives for this business unit, perusing emerging waves, should be conducive to the unique nature of the mission.

...welcome to join us. We are on a mission to develop an enlightened community by sharing the insights of wealth creation out of technology possibilities as reoccuring patters. If you like the article, you may encourage us by sharing it through social media to enlighten others.