At the core of the Market Economy’s success is Innovation. It’s about offering successive better versions of existing products and innovating new ones to get jobs done better at less cost. At the root of it is Carl Marx’s observation of reoccurring notes in ancient philosophical writings. It’s about human beings’ inherent urge to pursue ideas for recreating existing means and finding new ways to get purposes served increasingly better. The market economy focuses on tapping into this intrinsic human ability, which is known as praxis. As economic incentives drive human beings, the market economy offers the freedom to profit from the journey of taking ideas to market. However, the mission of profiting from ideas is far more complicated than being a creative genius. Therefore, there is a need for managing innovation in the market economy.

The competition of profiting from ideas often makes the process unpredictable and also messy. Often, entrepreneurs suffer loss, and they also get caught in inescapable loss traps. The creative force of successive Waves of Innovation also causes instability in the market. On the other hand, offering prosperity also creates transformational pain for society as a whole. In retrospect, the market economy’s innovation swath is littered with deaths of start-ups, job loss, carcasses of once-dominant firms, deserted towns, and exhausted nations. In this swath of destruction, we also witness the uprising of new firms, even countries.

On the other hand, innovation is the only window for increasing Wealth from depleting resources to meet the growing consumption of fellow human beings. However, we need a less messy journey to leverage ideas for driving prosperity. Here are some characteristics or principles we should pay attention to managing innovation in the market economy. By the way, there have been many attempts to state innovation principles.

Defining objectives

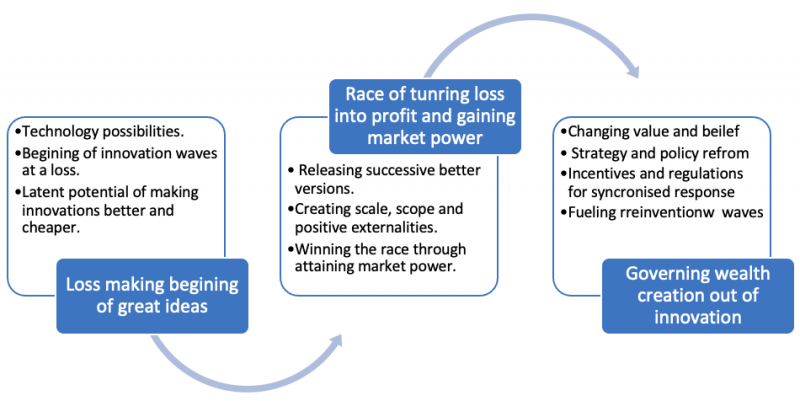

Often, we believe that innovation success is the magical outcome of heroic personalities. However, innovation is too important to be left with non non-transparent heroic outcome. Fortunately, there have been reoccurring patterns beneath the successes and failures of innovations. Such insights offer us a set of principles to manage innovations for maximizing wealth creation from technology possibilities and creativity. Hence, managing innovation in the market economy refers to turning loss-making beginning into profit and sustaining it and dealing with conflicting outcomes for maximizing wealth creation out of ideas by leveraging technology possibilities through the market forces.

Principle 1: Innovation opens an endless frontier of wealth creation

We mix ingredients with ideas to produce economic output. The value of outputs depends not only on the quality of inputs but also on the idea of mixing them. To offer a proper place to the idea, Prof. Paul Romer has articulated economic output as a function of ideas and objects. Objects include natural resources, labor, energy, land, factory building, and many more. All these objects are mixed with ideas. Due to natural limitations, our ability to increase the supply of objects is limited. On the other hand, we have a growing need of consumers. We should also lower the adverse effect of economic output production on soil, water, and air. The idea is our tool to address this conflicting situation.

Unlike objects, ideas do not face supply limitations. In fact, better ideas lead to redesigning existing products and innovating new ones to get our job done better while consuming fewer resources and causing less harm to the environment. Therefore, innovation offers the opportunity of opening an endless frontier of wealth creation, driving our continued prosperity.

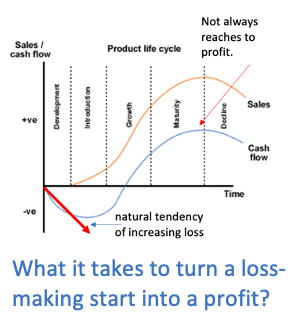

Principle 2: Innovation has a natural tendency of starting the journey with loss-making revenue

Irrespective of the greatness and strength of the underlying technology core, ideas often emerge in primitive form. Ideas at the nascent stage need further improvement to succeed in creating a willingness to pay among the target customers. Often they require intensive R&D over several years to make the idea strong enough to release products. Even after succeeding in generating sales, often, the revenue in the early days produces a loss. For example, the idea of an electric vehicle is a great one. Despite its greatness, still to date, it produces loss-making revenue. Turning this loss-making revenue into a profitable one is a daunting challenge. Moreover, all ideas do not have the potential to reach profit.

Due to inherent limitations and also because of competition situations, often time, entrepreneurs get caught in loss-making traps. Sometimes, they are inescapable. This is one of the root causes of the high mortality rate of start-ups. As high as 90 percent of start-ups, even in Silicon Valley, fail due to it. Hence, there is a need for management practices for assessing the progress of ideas. How far development needs to be made to reach profitability is often uncertain. Most importantly, to figure out whether the journey of taking ideas to market is caught in an inescapable loss trap is daunting.

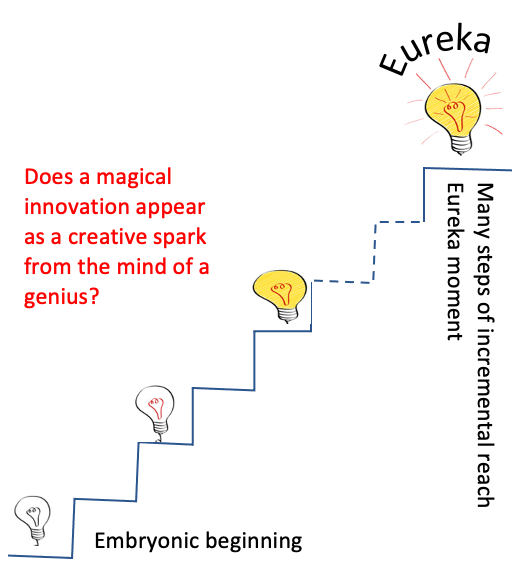

Principle 3: More than an Eureka moment– an incremental progression of both product and process is the key

As explained before, invariably, ideas enter the market to generate loss-making revenue. Of course, there is a need for a subsidy to remain afloat. But subsidy alone does not turn loss-making revenue into profit. The core challenge has been to keep increasing the quality and reducing the cost of innovative products. Hence, there is a need to keep producing ideas. These ideas should be used to add new features, improve existing features, and enhance the production process. The key challenge is to keep increasing the willingness to pay and reducing costs to increase revenue and reduce loss. As a result, the Eureka moment ends up in a relentless journey of continued product and process enhancements.

This journey may last over 10, 20, 50, and even 100 years. For example, since Carl Benz’s patent was issued in 1887, Automobile has been going through a series of incremental innovations. Moreover, along the way, there might be a need to change the technology core to keep driving the progression. For example, innovators changed the technology core of the light bulb three times over the last 100 years. They changed it from carbon or bamboo filament to tungsten wire, which was replaced by fluorescence leading to the next change with LED. However, technology core change also creates discontinuity. Sometimes, this discontinuity opens the door for new entrants, often causing a disruptive effect.

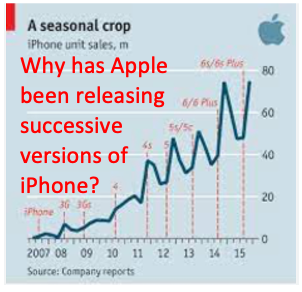

Principle 4: Competitive market force releasing demands successive better versions and attaining market power

In the market economy, the willingness to pay for an innovative product is not static. It does not depend only on the benefits or Utility the product offers. Most importantly, it depends on a set of variables, which keep changing. Hence, willingness to pay for innovation is a function of time. The underlying variables fall into two main categories. The first category is the competition. It comprises of competitors’ responses in the form of i. replication, ii. imitation, iii. innovation, and iv. substitution. Once the product enters the market, the competition force keeps drifting the willingness to pay (WtoP) downward. On the other hand, the WtoP also keeps benefiting from the externality effects. The effects of i. complementary goods and services, ii. network Externality Effect, iii. reduction of information and experience gap, and iv. advancement of infrastructure and standards keeps driving WtoP up.

However, the resultant force of externality and competition keeps pushing the willingness to pay for the innovative product downward. Even the magical iPhone could not escape from this reality. To counter it, innovators are compelled to keep releasing successive better versions, consequentially pushing up the WtoP. The challenge is to keep raising the WtoP in the midst of the effect of these eight and other variables. Such reality demands a serious focus on managing innovation in the market economy.

Besides, in releasing successive better versions, managing innovation in market economy must focus on creating the scale, scope, and positive network effects for attaining market power for extracting profitable market value.

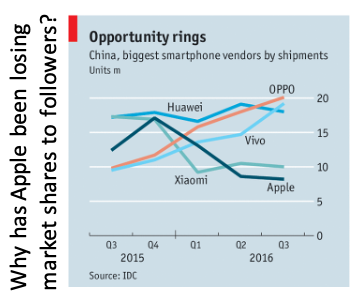

Principle 5: Newly formed wealth creation territory is invaded and expanded by followers

Irrespective of the greatness of the idea, followers will enter to take a piece of the profit-making opportunity. Possible entry opportunities are through i. replication, ii. imitation, iii. innovation, and iv. substitution. Some of the followers will replicate, offering the clone. Often, some governments condone intellectual property rights issues to encourage such cloning of foreign products by their local firms. A few of them will also imitate similar products by imitating either certain features or the whole product. Often, imitators also grow as innovators. For example, the iPhone triggered an imitation response from Samsung. Upon predicting the bright prospect of the iPhone, Samsung started imitating multitouch features in its mobile handsets line. Subsequently, Samsung has succeeded in innovating certain features on its own.

However, followers like Oppo or Vivo imitated the whole iPhone, as opposed to selective components. On the other hand, Apple entered the smartphone business by following a component-level substitution strategy. It replaced once-dominant keyboard designs and stylus with a multitouch-based user interface. This component-level substitution effect plummeted the WtoP of keyboard-based smartphone designs of Nokia. Due to the slow response, Nokia suffered a catastrophic consequence.

Principle 6: Successive waves of disruptive innovations keep emerging

As opposed to experiencing substitution effect at the component level, substitution often shows up at the whole product level. Alternatives show up around a new technology core. In the beginning, they emerge in a very primitive form, creating very little or no willingness to pay to users of incumbent products. This primitive emergence often communicates misleading signals, particularly to incumbent firms. Primitive appearance, creating loss-making revenue, places managers of incumbent firms in a decision Dilemma. In fact, the potential remains hidden in the technology core. Innovators pursuing substitution accelerate R&D investment in advancing the technology core, leading to subsequent better versions and decreasing costs.

Over time, primitive substitution grows as a creative wave of destruction to incumbent products. This is known as Schumpeter’s Creative Destruction. Furthermore, the decision Dilemma of switching to an emerging technology core often leads to disruption of firms. Prof. Clayton Christensen termed this effect of an emerging wave as Disruptive innovation. There are plenty of examples around us. Starting from a digital camera, PC to iPhone, the list is endless.

Principle 7: Innovation is not benign–causes stress, pain and destruction

Innovation is at the core of the market economy for offering us increasing prosperity and quality of living standards. But it delivers such promises through a messy process. It begins with the suffering of millions of creative youths pursuing start-ups. The potential of profiting from ideas takes them on the journey of start-ups. They invest their time and money from the pockets of their family, friends, and outside investors. Unfortunately, more than 90 percent of these start-ups do not reach profitable revenue. Subsequently, they fold up, due to suffering loss from multiple dimensions.

It’s being learned that this stressful process creates significant mental pressure, sometimes leading to ill mental health, problems in personal lives and financial chaos. In some instances, it leads to suicide and jail terms. On the other hand, the unfolding of a creative wave of destruction leads to the loss of jobs, firms, industries, and wealth annihilation. Such a painful experience is demanding better insights for managing innovation in a market economy.

Principle 8: Fuels Monopolistic market power accumulation and also expands trade

Although innovation is the core strength of the market economy, it also weakens the invisible hand to govern competition. By leveraging innovation, monopolistic firms emerge with price-setting capability. To counter it, frequently, Governments get busy with the application of antitrust laws. On the one hand, price-setting market power weakens the competition force to pursue innovation. On the other hand, the application of antitrust laws runs the risk of throttling innovation. The alternative could be to increase public funding for university-based R&D to increase the supply of ideas to fuel the next wave of start-ups and innovation. However, innovation increases trade. Therefore, managing innovation in the market economy should take into consideration of the effects of innovation on monopolization, weakening competition, and expansion of trade.

Principle 9: Necessitates the dealing with conflicting outcomes

Innovation in the market economy often runs the risk of directional failure. For example, innovative features for creating an addictive association with smartphone increases screen time. Due to an advertisement-based revenue model, it’s an attractive option for the innovators, but at the cost of the overall benefit of society. Hence, managing innovation in the market economy is often challenging.

In a broad sense, we are facing the challenge of meeting these 10 objectives simultaneously: 1. better products at lower cost serving more consumers, 2. more jobs are created than lost, 3. less harm is done to the environment and natural resource stock, 4. higher pay for all segments of the employment pyramid, 5. growing profit, 6. a greater opportunity for Inclusive and equitable participation in wealth creation, 7. more tax revenue for the government, 8. increasing security and collective well-being, 9. intensifying competition, and 10. Often, these variables are conflicting in nature. For example, innovation has a natural tendency to cause labor-saving effects, resulting in job loss. How to pursue innovation to address all these variables poses significant management, policy, and regulatory challenges.

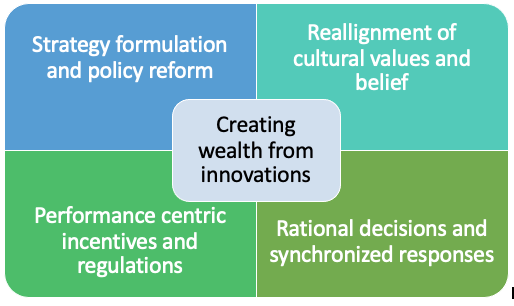

Principle 10: Demands policy reform, realignment of cultural values, and rational decisions

Ideas are fed to the growth of innovation. Of course, we need creative minds to generate ideas. The process of idea generation also demands the advancement of knowledge. Moreover, a single great idea needs the support of flow ideas, often lasting for decades, to succeed. To ensure this flow, we need institutional capacity, which often demands S&T policy reform. On the other hand, local demand should be created for emerging ideas. Policy support is required to create the initial demand for innovative products, particularly at the early stage. For example, the US government’s defense technology policy is vital for creating the demand for early-stage innovations. Similarly, economic and industry policies play a vital role in stimulating demand.

In addition to it, culture also plays an important role. Invariably, ideas demand a Craftsmanship spirit for pursuing the relentless journey of refinement, often lasting for decades. Moreover, this craftsmanship spirit should have a linkage with scientific discoveries and technological inventions. For example, the Japanese have shown a high success rate by blending craftsmanship spirit with the institutional approach of scientific discoveries and invention. Due to this unique capability, Sony grew from the ash of World War to disrupt American and European technology icons, while one of the R&D team members won the Nobel prize. Similar successes are in lithium-ion batteries and also in the LED light bulb.