Due to Creative Destruction, we have automobiles, word processors, and e-mails as alternatives to horse wagons, typewriters, and postal service. Consequentially, our quality of living standard has gone up. Creative destruction has been at the core of the rise of economies. Due to this human race has been succeeding in finding better means of Getting jobs done. As a result, we have been deriving increasing economic value from the same amount of materials, energy, and labor.

There has been an increasing emphasis on Innovation for driving economic growth. In the discussion of innovation, there have been two competing phrases. They are ‘disruptive innovation’ and ‘creative destruction’. And there is a third term. That is a disruptive technology. They also create debates raising key questions. Is it essential that Disruptive technologies drive creative destruction? Does creative destruction happen in the absence of disruptive technology? What is a disruptive technology, and what is its growth behavior? And how does it transform innovation and industries? Why does this process destroy jobs, firms, and industries? Instead of a painful, messy transformation, why cannot it drive a seamless transition? All these questions are worth investigating. Moreover, contrary to common perception, disruptive technologies do not emerge in a strong form. It’s not matured technology, either. Suc reality often causes confusion, though.

The paradoxical theory of creative destruction:

In pursuit of explaining the free market’s messy way of delivering progress, Joseph Schumpeter used the term “creative destruction”. Austrian economist’s this phrase sounds paradoxical. Destruction out of creativity to drive growth sounds absurd and opposing. Why is it an innate characteristic of the free market? More interesting, this theory has become the centerpiece for modern thinking on how economies evolve.

In a mere six-page chapter, he presented “The Process of Creative Destruction.” He made the case that Capitalism behaves as “the perennial gale of creative destruction.” He abstracted this aspect of capitalism from the economic thinking of Karl Marx. Marxian economic theory observed the accumulation and annihilation of Wealth under capitalism. But is there any role technology in it? Due to it, why would firms, individuals, and counties experience the cyclic nature of wealth possession?

The history of capitalism is ridden with lost jobs, ruined companies, and vanishing industries. There are many examples of creative destruction. It is an inherent part of the growth system. This turmoil produces new and better products, shorter workweeks, better jobs, and higher living standards. History tells societies that allow creative destruction to unfold grow more productive and richer. But does it happen itself, because people are free to pursue ideas? If yes, why don’t all countries pursuing the Market Economy are not equally prosperous? Or, is there a capacity gap among nations to let disruptive technologies drive creative destruction?

Praxis underpins creative destruction:

Philosophers like Plato, Aristotle, and Socrates observed a reoccurring pattern in human behavior. Human beings have an inborn creative urge to generate ideas for finding better means of getting jobs done. Through observation, imagination, and controlled experiments, they gather knowledge. And they use that knowledge to produce ideas for innovating better mechanisms or tools. In philosophical writings, this behavior is mentioned as praxis. This praxis appears to be the core fuel propelling creative destruction.

Ideas meet conflicting incentives:

Human beings are driven by economic incentives. Consumers are looking for better products at lower prices. And producers are looking for profit-making opportunities. All producers source inputs like materials and labor by paying more or less the same price. On top of consumers’ desires, suppliers are also asking for a higher price. Moreover, the quality of natural input is often falling as we keep depleting the resource stock. And people providing labor want higher pay to increase purchasing power. Upon meeting such conflicting expectations, how can producers make an increasing profit?

The pursuit of profit-making self-interest of the producers ignites the creative process of producing increasing value from ideas that makes others better off.

Ideas and Objects:

Ideas paly a vital role. The perceived value or Utility of the product depends not only on inputs like materials and labor. But most importantly, it hangs on ideas. As Prof. Paul Romer has articulated, the value of economic output depends on ideas and objects. In his theory, other than ideas, all other production inputs are objects. It’s true that producers are looking for a cheaper source of labor and materials for increasing revenue and profit. For this reason, multinationals are setting up factories in developing countries. But companies can also increase profit through better ideas for mixing objects. For example, some producers are using the idea of a robot for cutting fish so that more meat can be extracted. Similarly, the idea of sending more bits using the same amount of electromagnetic spectrum is increasing the quality and reducing the cost of wireless communication.

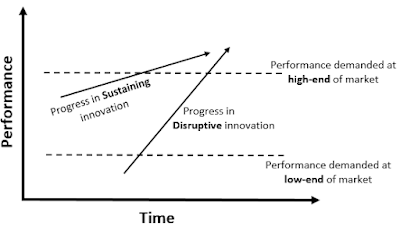

Incremental innovation does not drive creative destruction:

Some of the ideas are for improving existing products. These ideas make incremental progress in products, and processes. For example, such ideas are being added to gasoline engines and automobiles to improve fuel efficiency. Well, such a role of ideas for improving the underlying technology, consequentially products, does not kill jobs, firms, and industries. This has been a migration from a good to a great outcome. Rather an incremental improvement of products due to the continued progression of technology expands the demand for the product. For this reason, employment in many industries has been growing. Then, where is the disruptive effect of creativity?

Disruptive technologies drive creative destruction:

Unlike for incremental progress of existing technologies, and thereby products, some ideas are for developing alternative technology core. For example, Carl Benz looked upon the internal combustion engine as an alternative to the horse to power wagons. Bell laboratory scientists got the idea of a solid-state switch as a replacement for electromechanical ones. Similarly, Sony took the idea of an electronic image sensor from the Bell Labs to make cameras. And Steve Jobs adopted the idea of a graphical user interface. By following the footsteps of creative genius, Elon Mask looked upon electric batteries to power automobiles. Some of these alternative technology cores grow as disruptive technologies, and they keep driving creative destruction. By the way, a set of technologies may be fused to form a disruptive technology core. For example, the education industry runs the possibility of experiencing creative destruction from a disruptive technology core, which is basically a fusion.

Primitive emergence of disruptive technologies:

In the beginning, alternative technology cores emerge in embryonic form. But among them, the disruptive one rapidly grew to surpass the incumbent one, as shown in the following figure. They show very weak potential to power substitutes for incumbents. They look very primitive in comparison to existing ones. For instance, in the 1880s, the internal combustion engine was producing little power. Consequentially, Carl Benz’s automobile was far slower as well as weaker than horse-driven wagons. Similarly, the digital camera was quite inferior to Kodak’s film cameras in the early 1980s. And Sony’s Transistor pocked radio was not comparable to vacuum tube-based radios. As a result, people often ignore these technologies in the early days. Moreover, those early primitive products around infant alternative technology cores invariably produce loss-making revenue.

Decision-making Dilemma and risk aversion:

The primitive emergence of them also creates decision-making a challenge to incumbent firms. On the one hand, they are perceived as a threat. On the other hand, the reallocation of capital from profit-making products to produce primitive alternatives produces a loss. Moreover, they also require different types of competence, production processes, marketing, and sales channels. On top of it, there is an issue of risk. Will it at all succeed? Therefore, often incumbent high-performing firms producing better products around matured technology core ignore them. In the early stage, the loss-making journey of offering primitive products poses challenges in making decisions for allocating scarce resources more productive.

They remain busy in allocating resources to incumbent products as workers, inputs, and financial capital seek their highest returns. In doing so they keep overlooking the unfolding transformation. Once they start experiencing an erosion of revenue and profit, it’s too late for them to reallocate resources from declining sectors to those rising from the below. As a matter of fact, upon adhering to best management pieces of advice, they often fail to respond on time to switch to the next wave.

New entrants and Startups leverage disruptive technologies:

But for new entrants, this is an opportunity. In mature industries, there is a high entry barrier. Patents, complementary assets, production facilities, and incumbent firms’ brand value are often insurmountable barriers. For aspiring new entrants, often, infant alternative technology core becomes a target for innovating substitutions. But they emerge in primitive form. For example, in the 1960s, Sony wanted to be in the camera business. But the entry barrier was extremely high.

Sony looked upon electronic image sensors as an alternative technology core to innovative cameras. The initial image sensor producing 8×8 black and white, noisy images was no way closer to film cameras. However, Sony believed that they had to take steps to let disruptive technologies drive creative destruction. To address it, Sony focused on R&D to nurture the technology core to make successive versions better as well as less costly. To many entrants like Sony, it has been great by choice for pursuing disruptive technologies.

But unfortunately, in recent times, startups are overlooking the fact that disruptive technologies drive creative destruction. Rather, they are practicing predatory pricing.

Disruptive technologies must be amenable to rapid growth

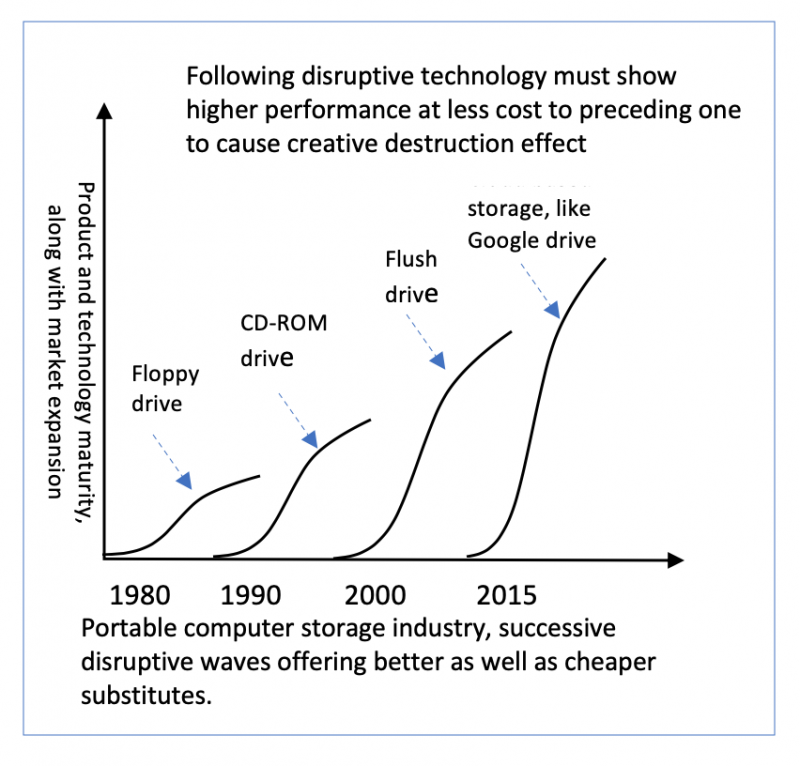

Some of the emerging technology cores are found to be highly amenable to growth. This growth is vital for making successive versions of innovations around the new technology core increasingly better and cheaper. This race should continue until and unless the innovation around alternative technology core successes to be better as well as less costly. The following graph shows an example of the computer storage industry. Once this substitution reaches that level, existing customers start replacing their products with the substitution. And incumbent firms also start finding fewer and fewer new customers for their products.

But why does it kill jobs and incumbent firms? Why cannot incumbent firms switch to the next wave?

As explained before, due to the aversive response of the incumbent, this journey of nurturing and offering substitution is often pursued by new entrants. Some of the new entrants are even startups. Once substitution around alternative technology core starts taking away customers, incumbents start suffering erosion. It’s too late for them to penetrate the new industry. Starting from patents to unfamiliar business models, they face many barriers. As a result, often, once highly successful firms are compelled to lay off people, close production factories, and even file bankruptcy. This reality of pursuing alternative technology core by new entrants is at the core of the destructive effect of creative persuasion of offering better products at a lower cost. This effect makes the transformation for a better tomorrow painful.

Accumulation and annihilation of wealth:

During the maturity of industries, driven by incumbent technology core, firms, shareholders, and even countries accumulate wealth. But due to the uprising of alternative technology core, they suffer the loss. The availability of better-quality products at a lower cost around alternative technology core takes away the jobs and the market value of incumbent firms’ shares. For example, due to the uprising of digital cameras, Kodak’s employees and shareholders suffered from loss of wealth. This phenomenon has been at the core for the Marxian economic theory of accumulation and annihilation of wealth under capitalism. It’s quite ironic that upon succeeding with wealth accumulation while disruptive technologies drive creative description, they often keep losing with the uprising of the next wave.

Not all alternative technologies are disruptive:

In the absence of an uprising of alternative technology core, there appears to be no peacetime reason of creative destruction. But are all alternative technologies disruptive? Unfortunately, the answer is no. On the one hand, technology should be amenable to growth. On the other hand, there should be sufficient effort to grow it to reach a situation when innovated products around it become better as well as less costly substitutes. For example, the fuel cell is an alternative technology core to a gasoline engine. But it came out not sufficiently amenable to growth. On the other hand, the electronic image sensor was disruptive as it was amenable to keep growing for causing disruption to the film-based camera industry.

Spotting and nurturing disruptive technologies:

Spotting the growth potential of underlying technologies to support innovation to cause disruption has been a major challenge. For example, AI-based autonomous vehicle technology was perceived to be an attractive candidate to cause disruption in the car ownership model. However, upon spending above $80 billion in R&D, innovators are finding that technology has reached saturation before succeeding in delivering autonomous vehicles. By the way, often, a technology takes decades to grow into disruptive power innovation. For example, LED took more than 100 years to cause disruption to the lighting industry. Due to such uncertainty and often the need for a long journey, the startup mortality rate appears to be high.

Profit-making competition is key:

For offering better quality living standards, the free market economy is powered by creative destruction. And the creative destruction is fueled by disruptive technologies. These disruptive technologies emerge in embryonic forms. They need to be nurtured through a flow of knowledge and ideas. Moreover, the role of new entrants is vital. In many cases, they are startups. Neither Governments nor incumbent firms pursue creative destruction. This is the beauty of the free market for leveraging praxis to drive economic growth. Henceforth, it’s paramount to patronize freedom of creativity and the race to make a profit from ideas.

To benefit from this creative destruction, how to empower new entrants and startups through a Flow of Ideas and fair competition has been a burning issue to keep benefiting from the market economy. The disparity appears to be the cause of inequality among competing nations. By the way, the uprising of new entrants with disruptive potential is also vital to reign growing monopolies, often powered by technological ideas too. Unfortunately, startups showing disruptive potential are being acquired by the incumbent. Such practice has been slowing down or blocking disruptive waves and wealth creation out of creative destruction. However, for the sake of job loss, some segments of society are often tempted to block the process of creative destruction, implementing policies to resist economic dynamism. To see continued prosperity, we should rather let disruptive technologies drive creative destruction.