As high as 90 percent of Startups fail. Does it mean that you need a Flow of Ideas to keep experimenting to fund the diamond? Besides, why did Amazon take so long to reach profitability, and will Uber be a failure? What it takes for startups’ success is a question indeed. Startups are on the journey of ideas around emerging technologies for offering better substitutions. The proposition is to cause disruption to incumbent products and firms. For example, Karl Benz’s internal combustion engine-driven automobile was for offering substitution to horse-pulled wagons.

However, it emerged in a primitive form. Its production and sale could have generated loss. Hence, he focused on its refinement and consistent diffusion. And legendary Edison was no exception. Like Karl and Edison, the founders of Kodak, Xerox, or Sony followed the same path of refinement. But are Uber and many others pursuing digital transformation following such a path? Are loss-accumulating unicorns inappropriate indicators of success? Are the success factors of digital startups different?

Lesson from most startup success stories:

Should startups in pursuing digital ideas draw lesson from them?

Kodak, Boeing, Xerox, Intel, Sony, HP, Apple, and Microsoft among others followed the same approach–focusing on R&D for producing a flow of knowledge for making a great idea powerful enough to cause disruption at profit.

There is no denying that startups pursuing digital transformation have unique characteristics. For example, as opposed to hardware, data, software, and connectivity form the core of the value proposition in digital ideas. Some of the startup success stories out of hardware-centric ideas are Kodak, Boeing, Xerox, Intel, Sony, and Apple. But unlike these well-known startup success stories, digital startups are after subsidies to sell their primitive products. Even software-centric startups like Apple and Microsoft were not after huge investors’ funds.

Defining startups’ success

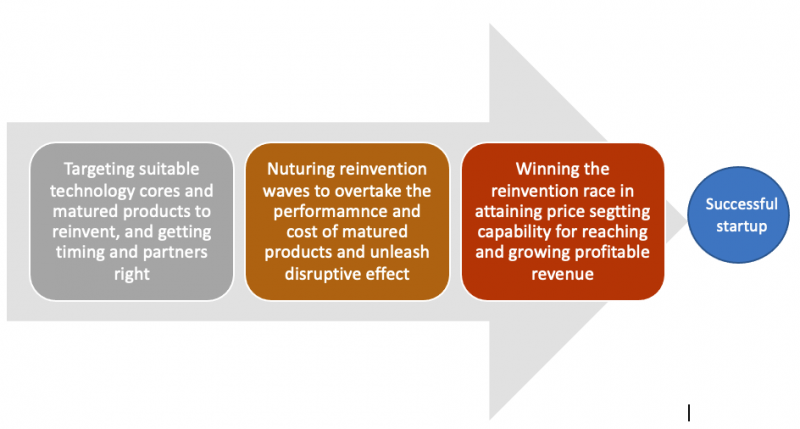

Startups refer to new ventures that begin the journey in embryonic form for pursuing reinvention of matured products by changing the old technology core with emerging ones and fueling reinvention waves as Creative waves of destruction, unleashing disruptive innovation effects. Due to the primitive emergence of reinvention, invariably, all startups begin the journey at a loss. Their success depends on the growth of reinvention waves through a flow of ideas to improve the quality and reduce the cost. Besides, reinvention waves must cross the threshold of matured products. Furthermore, as many startups pursue a single reinvention wave, winning the race is a must for creating success. Hence, startup success refers to nurturing the reinvention waves to overtake the performance and cost of matured products, unleashing disruptive effects, and winning the race to attain market power in turning loss-making revenue into profit and sustaining it.

Subsidy centric digital startup thesis:

As opposed to refinement and gradual diffusion, startups in pursuing digital transformation are after buying customers for their primitive products. Hence, they burn billions in subsidies to inflate valuation to be unicorns. Among these two approaches, what is one more appropriate for startups’ success? But after burning billions, many of the digital startups like Uber or WeWork are failing to reach profit. Hence, counting unicorns, like 44 of them in India in 2021, from buying customers may be a misleading indicator. In retrospect, startups’ success demands a flow of ideas for the refinement of a great idea to succeed.

In this article, we will be addressing the following topics and questions:

Table of Contents:

- What are start success factors? Are commonly known five factors good enough?

- Startup success and failure statistics. How is India doing in startups and unicorns?

- Underlying factors of digital startup rush

- Is the thesis of creating startup success stories out of subsidies wrong? Why is Uber failing?

- What is the secret of Amazon’s success? What does it take to replicate it?

- Startup success factors for digital entrepreneurship

- Should we draw lessons from old-age startups?

Startup success factors:

The high rate of startup failure has drawn significant research to find underlying causes. The list of factors is, often, very long. But, Bill Gross has identified five startup success factors such as (i) ideas, (ii) the team, (iii) the Business model, (iv) funding, and (v) timing. According to him, among them, timing is the most important. That makes sense due to the fact that startups’ success demand synchronized response from multiple stakeholders, contributing to the network Externality Effect. But for leveraging timing, startups should systematically leverage ideas for creating the Network effect.

Furthermore, irrespective of the greatness of the idea, the team should be competent enough to pursue consistent incremental advancement for creating technological Economies of Scale effect. Besides, creating a family of products around a great idea is important. It generates Economies of Scope effect out of reuse of core assets among family members. Hence, technology and innovation management capability for systematic idea generation is critical for startups’ success.

Startups’ successes and failures:

- According to Investopedia, 90 percent of startups fail. Along with the age, the failure rate starts increasing. For example, the percentage of failure increases from 21% in the first year to 70% in the 10th year. Among other causes, running out of money is the number one cause of startup failure. That makes sense, as every startup begins the journey at a loss with the poor value proposition of their substitution offering. In retrospect, it is quite natural. As opposed to expanding the customer base and staying afloat with growing subsidies, the focus should be on improving the offering with additional ideas.

- As per CB INSIGHTS, there are 1000 unicorns all around the world at the beginning of 2022. A unicorn startup is a privately held company with more than $1 billion valuations. This number is rapidly growing. For example, in 2021 alone, India added 44 new unicorns, and the US and China added 487 and 301 unicorns, respectively.

- The downside of this staggering number is that the cumulative loss of a growing number of unicorns has been increasing with no sign of a turnaround. The underlying cause has been in the strategy of expanding the customer base of primitive offerings with subsidies, as it inflates valuation.

- Unlike in the past, the growth of startups in India, China, and many other developing countries is very high. But according to a study of IBM, as high as 80-90% of startups in India fail within the first five years due to a lack of focus on research to improve their offerings. As opposed to innovation, Indian startups are predominantly imitating foreign ideas.

Digital technologies are powering a rush of digital startups:

At the dawn of the 21st century, a new technology core emerged. It comprises the ubiquitous deployment of cellular networks, the adoption of smartphones, rapid mobile internet penetration, and commoditization of software development (also data analytics and AI) skills. It has been powering many ideas. Starting from ride-sharing to food delivery, the list of ideas is endless. And many of these ideas are called AI startups, as they have software-based computational intelligence.

Despite having the potential to cause disruption, each of those ideas invariably starts the journey of offering primitive products, generating loss-making revenue. Unlike in the past, start-ups are now focusing on mobilizing tons of money to sustain loss-making operations and to practice predatory pricing to monopolize the market. And some investors are pumping money hoping to be owners of repetition of past start-up successes. Such a practice of startups in taking ideas to make is a cause of concern for investors’ Wealth annihilation. Particularly, data-supporting AI startups run the risk of misguiding us.

Startups’ success out of subsidies for the primitive product: is the thesis wrong?

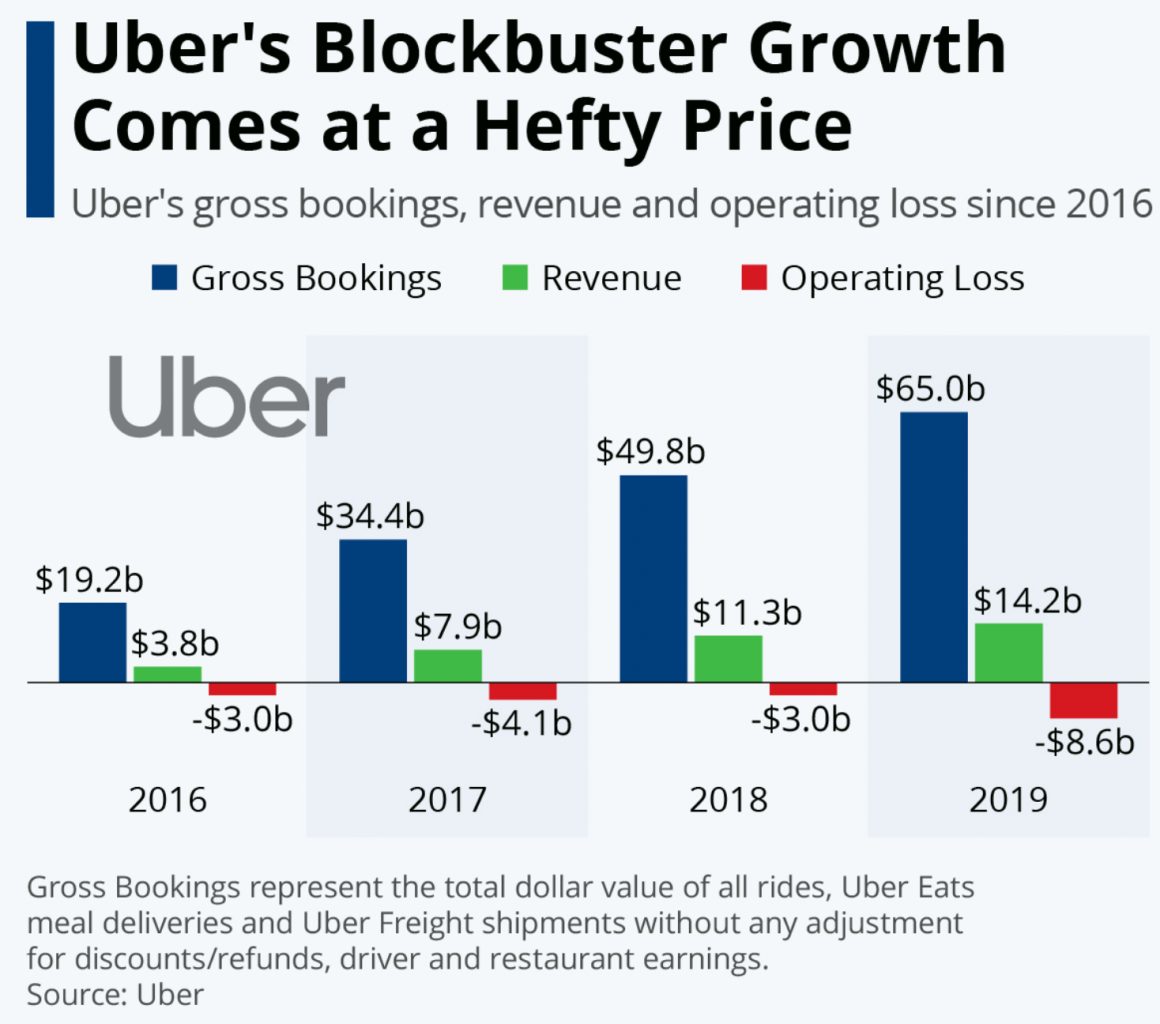

One of the role models of digital startups is Uber. Along with revenue, Uber’s loss is also growing. Uber’s basic idea is to replace human drivers with robot taxis to cause destruction to taxi services and car ownership. However, its debut with an app-based ride-sharing service has not reached profit as it has been competing with taxi services without having robotaxi.

Uber has been failing due to the fact that without robotaxi it cannot offer higher value at less cost. Despite having invested in autonomous vehicles, Uber is caught in a chasm due to technology uncertainty. However, this chasm created by the technology is different from Geoory Moores’ understanding of chasm.

Hence, it has been after subsidies to expand its revenue. Although such success contributed to the valuation for raising more funds, it has failed to offer a profitable exit path to the investors.

For example, Uber raised $14 billion before it went public, and its loss has been growing. Similarly, Lift, the second-biggest IPO in 2019 at Nasdaq, raised $5 billion before its IPO and another $2.3 billion in its public offering. Like them, there are many unicorns that have raised billions from investors and have never seen profit.

Like Uber, burning investors’ money to sustain loss-making operations has been a new formula for startups. However, the capital market has not been giving profitable exit opportunities for the late-stage investors. Contrary to the expectation of the proponents of loss-making startups, these two and other similar startups have been losing market value.

The secret of Amazon’s success out of prolonged loss accumulation:

To justify the loss accumulation of startups, we refer to Amazon. There is no denying that Amazon is America’s most famous money loser. It kept losing money until the 10th year, and on its 16th birthday, it covered its accumulated $3 billion loss. But does it mean that, like Amazon, all startups will reach profit upon losing money over decades?

Could any amount of subsidies have turned book retailing into profit if Amazon did not pursue the innovation of turning physical books into eBooks? Like reinventing books, Amazon focused on ideas in fine-tuning many of the initial money-losing great ideas to turn them into profit. The focus on R&D for turning loss into profit out of the flow of ideas is Amazon’s success secret. It inflated Amazon’s patent portfolio, placing it among the top ten patent recipients at USPTO. Hence, the secret of Amazon’s success is in its research in producing ideas for creating increasing economies of scale, scope, and network externality effects.

Amazon’s uniqueness has been in creating scale effect through making offerings better and less costly. For example, the reinvention of books has made eBooks a better and cheaper option in many cases. Its focus on robotics in warehouses and packing has contributed to scale. The next one is deriving economies of scope effect.

For example, Amazon’s cloud service has been for creating the scope effect out of the reuse of huge computing infrastructure. The next one is leveraging of natural network externality effect of the e-commerce platform. The adoption of robotic process automation (RPA) has been one of the underlying secrets of Amazon in deriving these benefits. Hence, intelligent exploitation of scale, scope, and network externality–the secret sauce of digital startup success–is the underlying cause of making Amazon so big.

Startups’ success for digital entrepreneurship:

Often, it’s quite easy for the idea of startups to take ideas around digital technologies to market. As there is ample opportunity to turn them into disruptive innovation, the valuation game out of customer acquisition begins. Hence, startups get into the race to expand the customer base of their primitive products. But the challenge of turning them into a success demands a flow of ideas for creating economies of scale, scope, and network externality effect.

Even upon monopolizing funds, will such an approach lead to developing a profitable business by causing disruption? Is it time to change the focus? Instead of the flow of money, should we focus more on the flow of knowledge and ideas? In fact, such ideas are vital for making start-ups’ products better as well as less costly to produce. Progress along this line is critical for nurturing a profitable disruption force. In the absence of it, how can startups succeed in offering better alternatives to consumers at a lower cost and generating an attractive return on investment for the investors?

Should digital startups’ success draw lessons from the past?

Like in the hardware era, digital ideas also emerge in primitive form. Whether that is online food delivery or autonomous vehicles, they surface as inferior alternatives. Yes, subsidies create the market of those primitive alternatives, increasing the number of customers and market shares. But that does not lead to generating profit. Turning the loss into profit demands quality improvement and cost reduction out of ideas. Hence, every start-up needs a flow of ideas for offering increasing quality at decreasing cost. Unless they attain this vital capability, no way they will succeed in increasing the customer base and turning the loss into profit.

Hence, irrespective of the greatness of the ideas, startups’ success should focus on a flow of ideas for quality advancement and cost reduction. Like Television or light bulbs, the journey of startups should focus on evolving their great ideas so that quality keeps rising and the cost keeps falling–the recipe for turning loss into profit. Furthermore, the ability to harness the latent natural tendency of the monopoly of digital transformation is a critical factor for startups’ success. Hence, what makes startups successful is creating scale, scope, and network externality effects out of ideas. Hence, the most successful factor for startups is the ability to manage a flow of ideas for consistently increasing diffusion and attaining price-setting capability–by offering the best quality at the least cost.

You may find these articles relevant:

Flow of Ideas–misleading business metric?

Winning idea — how to generate, detect, and pursue?

Big Ideas are Getting Harder to Find- how to overcome?